Get the free Insurance: Primary:

Show details

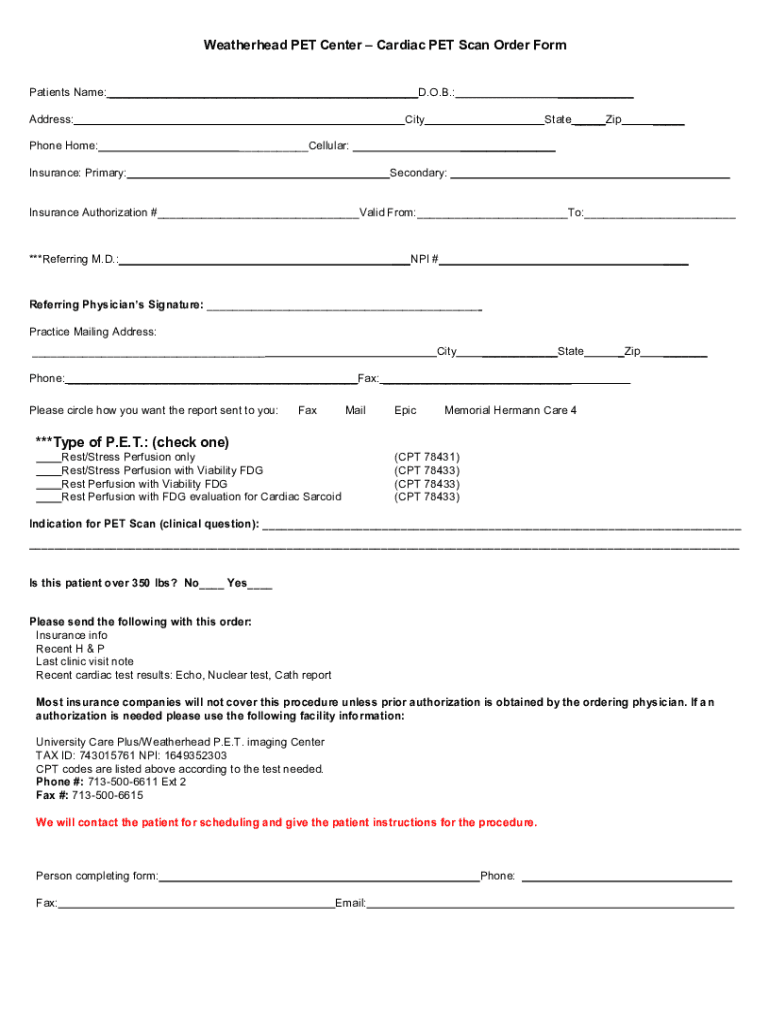

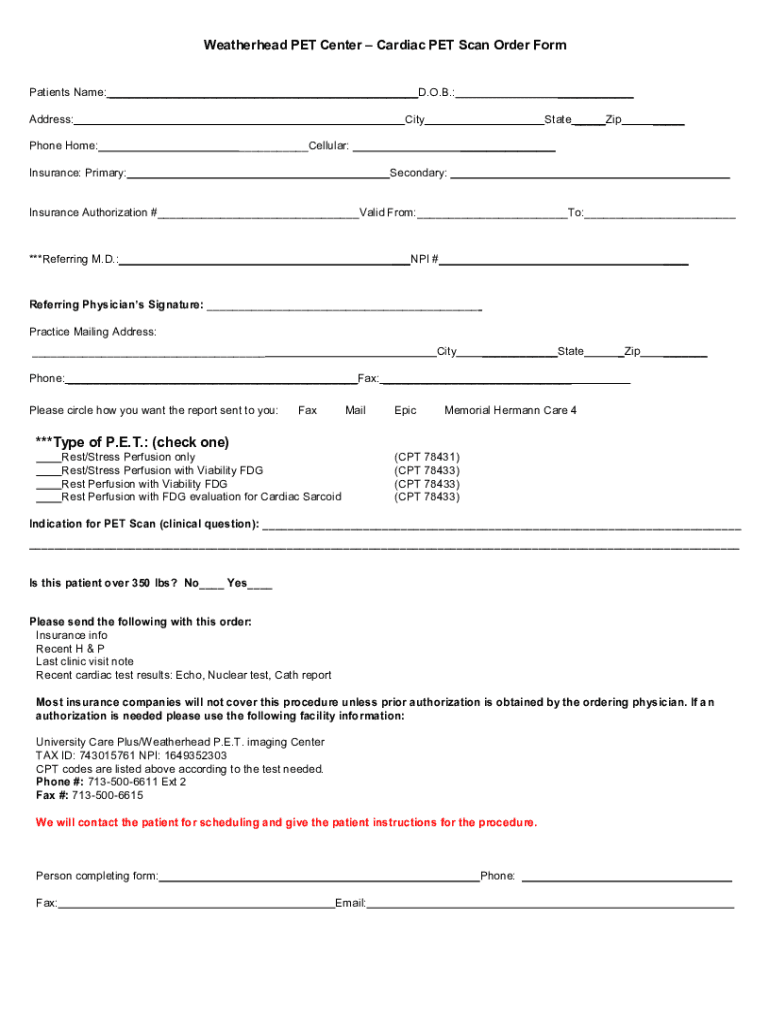

Weather head PET Center Cardiac PET Scan Order Form Patients Name: D.O.B.: Address: Phone Home: Cityscape Zip Cellular:Insurance: Primary: Secondary:Insurance Authorization # Valid From: To: ***Referring

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance primary

Edit your insurance primary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance primary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance primary online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance primary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance primary

How to fill out insurance primary

01

Step 1: Start by gathering all the necessary documents, such as your personal identification information, proof of residency, and any relevant healthcare information.

02

Step 2: Research and choose a primary insurance provider that best fits your needs and budget. Compare different policies and coverage options to make an informed decision.

03

Step 3: Contact the chosen insurance provider to inquire about their application process and obtain an application form. You may be able to do this online or by visiting their office in person.

04

Step 4: Carefully fill out the application form, providing accurate and detailed information about yourself and any dependents you wish to include in the primary insurance coverage.

05

Step 5: Attach all the required documents along with the completed application form. Double-check to ensure you have included everything requested by the insurance provider.

06

Step 6: Review and verify all the information provided in the application form to avoid any mistakes or omissions. It is crucial to provide accurate information to avoid potential issues.

07

Step 7: Submit the completed application form and supporting documents to the insurance provider by the specified method (online, in-person, or by mail). Keep copies of all the submitted documents for your records.

08

Step 8: Wait for the insurance provider to process your application. This may take some time, so it is important to be patient. You may receive updates or requests for additional information during this stage.

09

Step 9: Once your application is processed and approved, review the terms and conditions of the insurance policy provided by the primary insurance provider. Keep a copy of the policy for future reference.

10

Step 10: Begin utilizing the primary insurance coverage as per the terms outlined in the policy. Familiarize yourself with the coverage limits, deductibles, copayments, and any other relevant details to maximize its benefits.

Who needs insurance primary?

01

Anyone who wants to safeguard themselves against potential financial losses associated with medical expenses should consider obtaining primary insurance.

02

Individuals who do not have access to a secondary insurance policy or are not covered under any other healthcare plan may also need primary insurance for comprehensive coverage.

03

Employers often require their employees to have primary insurance for employee healthcare benefits.

04

Families with dependents who rely on their income and support may find primary insurance essential to ensure proper healthcare and financial protection.

05

Individuals who have higher risk factors, pre-existing medical conditions, or require regular medical treatments may greatly benefit from having primary insurance to manage their healthcare costs.

06

It is important to evaluate your personal circumstances, health needs, and financial capabilities to determine if primary insurance is necessary for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get insurance primary?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the insurance primary. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my insurance primary in Gmail?

Create your eSignature using pdfFiller and then eSign your insurance primary immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete insurance primary on an Android device?

Use the pdfFiller mobile app to complete your insurance primary on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is insurance primary?

Insurance primary is the main insurance policy that provides coverage for specific risks or events.

Who is required to file insurance primary?

Any individual or organization who holds an insurance policy and is seeking coverage for a particular risk or event is required to file insurance primary.

How to fill out insurance primary?

Insurance primary can be filled out by providing accurate and detailed information about the policyholder, the insured risks, coverage limits, and any other relevant details.

What is the purpose of insurance primary?

The purpose of insurance primary is to protect policyholders from financial losses due to unforeseen events or risks.

What information must be reported on insurance primary?

On insurance primary, information such as policyholder details, insured risks, coverage limits, and policy terms must be reported.

Fill out your insurance primary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Primary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.