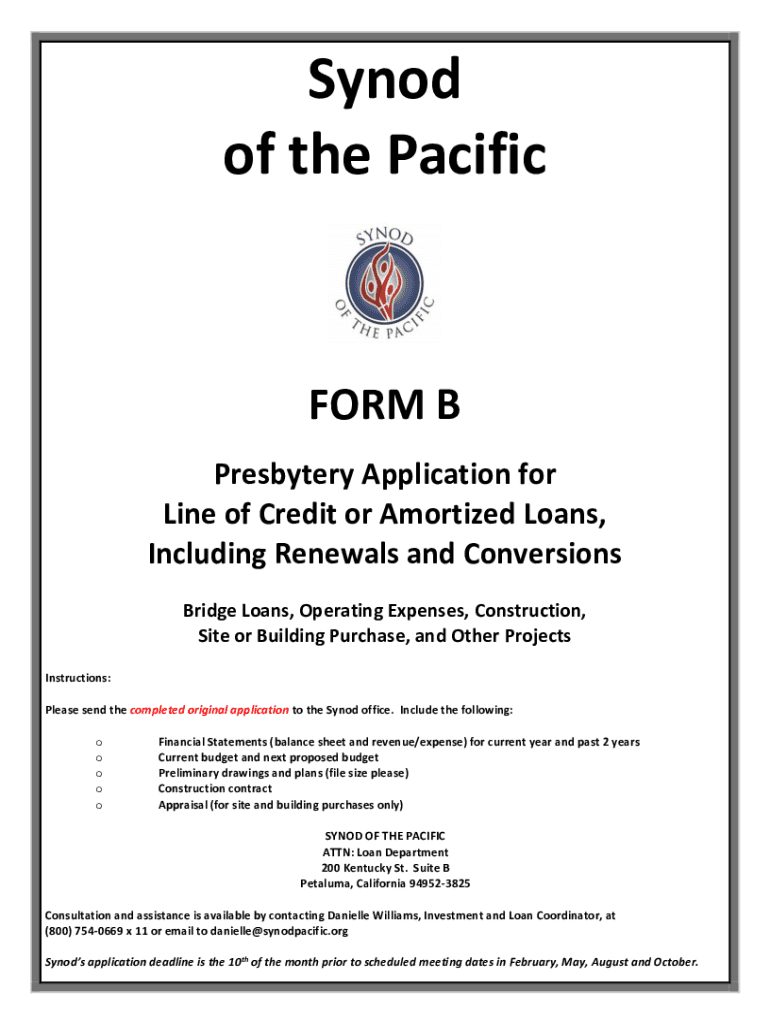

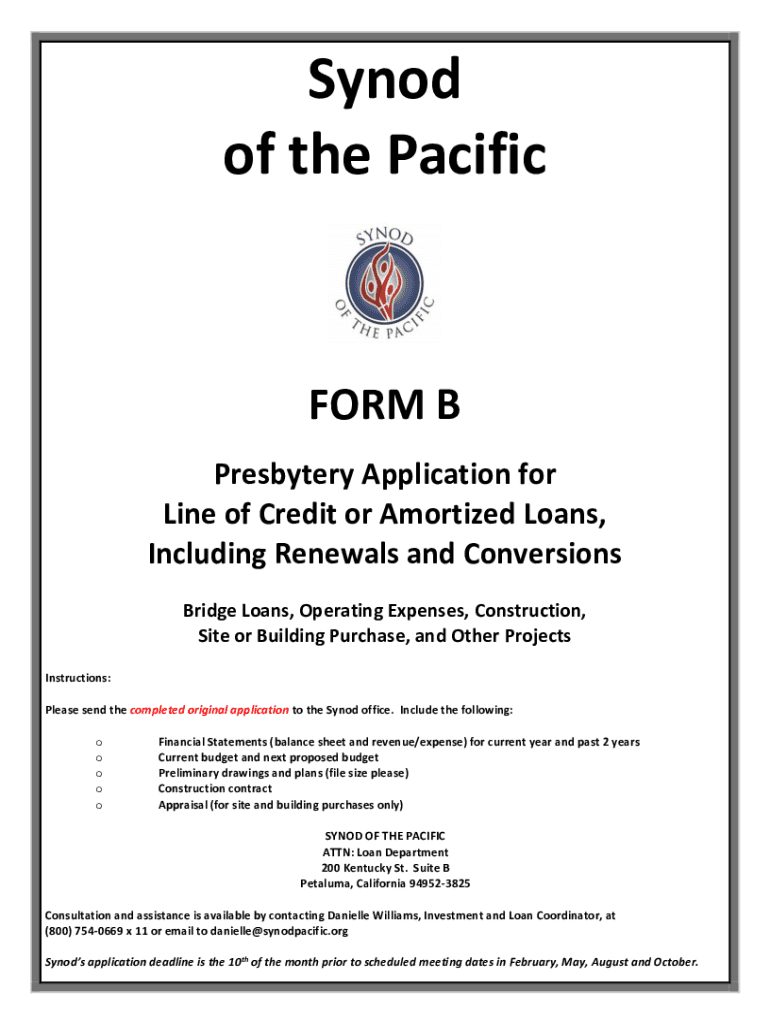

Get the free Line of Credit or Amortized Loans,

Show details

Synod of the PacifiCorp B Presbytery Application for Line of Credit or Amortized Loans, Including Renewals and Conversions Bridge Loans, Operating Expenses, Construction, Site or Building Purchase,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign line of credit or

Edit your line of credit or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your line of credit or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit line of credit or online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit line of credit or. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out line of credit or

How to fill out line of credit or

01

To fill out a line of credit, follow these steps:

02

Gather all the necessary documents and information. This may include your personal identification, financial statements, and proof of income.

03

Research different lenders and compare their terms and interest rates. Choose the one that best fits your needs.

04

Visit the lender's website or branch and fill out the line of credit application form. Make sure to provide accurate information.

05

Attach any supporting documents required by the lender, such as bank statements or tax returns.

06

Submit the completed application along with the supporting documents to the lender.

07

Wait for the lender to review your application. This may take some time depending on their processing time.

08

If approved, carefully read and understand the terms and conditions of the line of credit agreement.

09

Sign the agreement and return it to the lender.

10

Once the line of credit is activated, you can start using it as per your needs.

11

Make sure to repay the borrowed funds on time and manage the line of credit responsibly.

12

Remember to consult with a financial advisor if you are unsure about any step.

Who needs line of credit or?

01

Line of credit can be beneficial for various individuals or organizations, including:

02

- Small business owners who need access to funds for managing cash flow, purchasing inventory, or investing in growth.

03

- Homeowners who want a flexible source of funds for home improvements, emergency repairs, or other expenses.

04

- Individuals who want to consolidate debts and have a single, lower-interest borrowing option.

05

- Freelancers and self-employed professionals who may experience irregular income and need a financial safety net.

06

- Students who require additional funds for education-related expenses.

07

These are just a few examples, and there can be many other situations where a line of credit can be useful. It is important to evaluate your financial needs and consult with a financial advisor before deciding if a line of credit is suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit line of credit or from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including line of credit or, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find line of credit or?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the line of credit or. Open it immediately and start altering it with sophisticated capabilities.

How do I complete line of credit or on an Android device?

Use the pdfFiller mobile app to complete your line of credit or on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is line of credit?

A line of credit is a preset borrowing limit that can be used at any time.

Who is required to file line of credit?

Individuals or businesses who have applied for and received a line of credit are required to file.

How to fill out line of credit?

To fill out a line of credit, you need to provide information about your financial situation, borrowing needs, and repayment ability.

What is the purpose of line of credit?

The purpose of a line of credit is to provide flexibility in borrowing money as needed.

What information must be reported on line of credit?

Information such as the total credit limit, outstanding balance, and payment history need to be reported on a line of credit.

Fill out your line of credit or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Line Of Credit Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.