Get the free PREVENTION OF MONEY LAUNDERING QUESTIONNAIRE

Show details

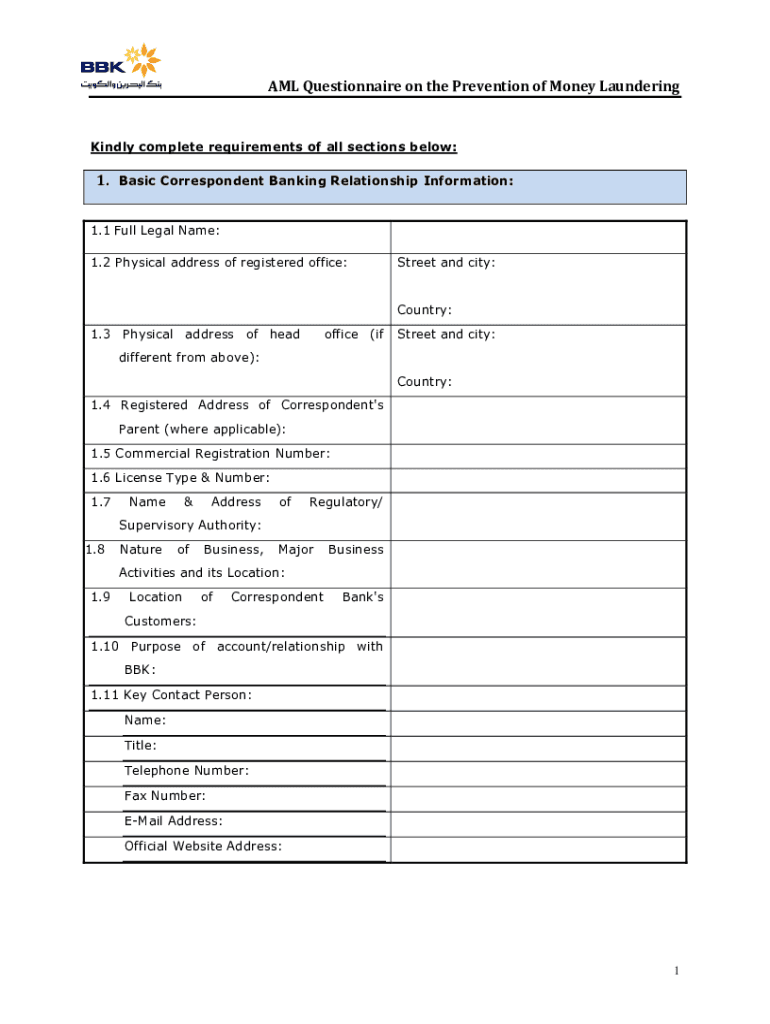

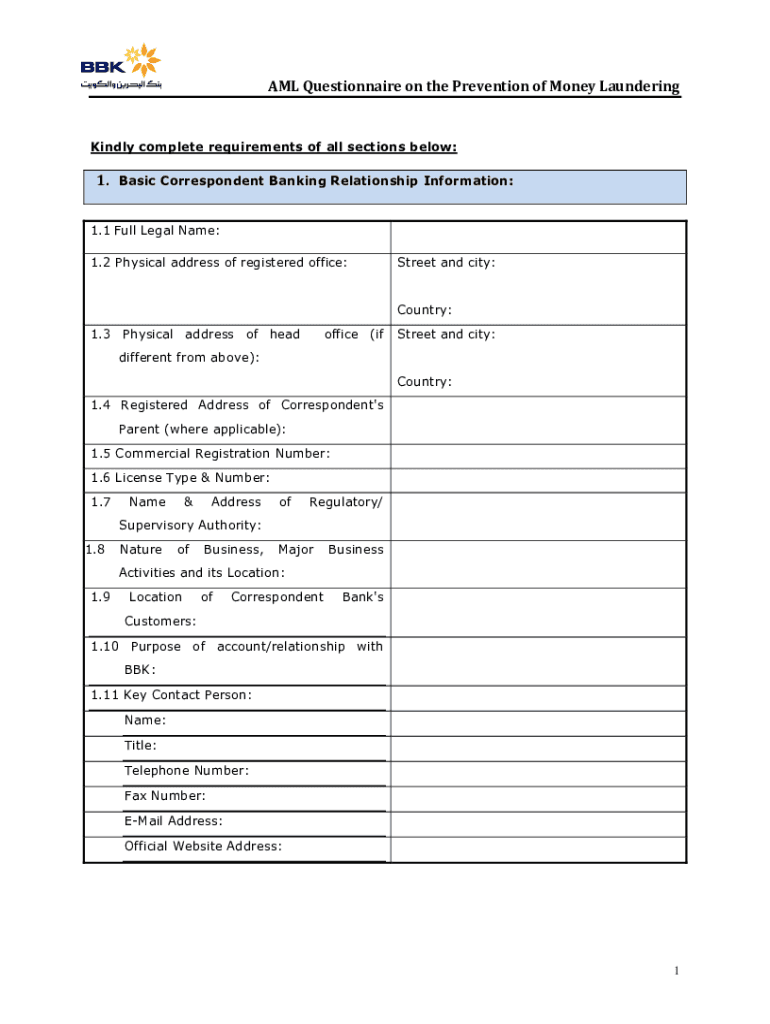

AML Questionnaire on the Prevention of Money LaunderingKindly complete requirements of all sections below:1. Basic Correspondent Banking Relationship Information: 1.1 Full Legal Name: 1.2 Physical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign prevention of money laundering

Edit your prevention of money laundering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prevention of money laundering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing prevention of money laundering online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit prevention of money laundering. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prevention of money laundering

How to fill out prevention of money laundering

01

To fill out prevention of money laundering, follow these steps:

02

Start by gathering all the necessary information and documentation relating to the individuals or entities involved in the transaction.

03

Identify and verify the identity of the customers or clients by requesting valid identification documents such as passports or driver's licenses.

04

Conduct a risk assessment to determine the level of risk associated with each customer or transaction.

05

Implement appropriate customer due diligence measures to ensure that you have a clear understanding of the purpose and intended nature of the relationship.

06

Establish and maintain an internal control system to detect and prevent money laundering activities.

07

Educate your staff on the importance of prevention of money laundering and provide them with training on how to identify and report suspicious transactions.

08

Monitor and review transactions and activities on an ongoing basis to effectively detect and report any suspicious activities.

09

Keep comprehensive records of all transactions and customer information for a specified period of time as required by law.

10

Regularly update and review your prevention of money laundering policies and procedures to ensure compliance with the latest regulations and best practices.

11

Lastly, if you suspect any suspicious activity, report it to the relevant authorities and cooperate fully with any investigations.

Who needs prevention of money laundering?

01

Prevention of money laundering is necessary for various entities and individuals, including:

02

- Financial institutions such as banks, credit unions, and insurance companies

03

- Investment firms and securities brokers

04

- Money service businesses such as currency exchanges and remittance companies

05

- Gaming and gambling establishments

06

- Real estate agents and brokers involved in high-value transactions

07

- Lawyers, accountants, and other professionals who handle client funds

08

- Non-profit organizations that receive and distribute large sums of money

09

- Governments and regulatory authorities responsible for overseeing financial transactions

10

Essentially, anyone involved in financial transactions or dealing with large sums of money should have prevention of money laundering measures in place to ensure the integrity of the financial system and prevent illicit activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in prevention of money laundering without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your prevention of money laundering, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my prevention of money laundering in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your prevention of money laundering directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the prevention of money laundering form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign prevention of money laundering and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is prevention of money laundering?

Prevention of money laundering refers to the set of laws, regulations, and procedures designed to stop the practice of generating income through illegal actions.

Who is required to file prevention of money laundering?

Financial institutions, including banks, credit unions, and money service businesses, are required to file prevention of money laundering reports.

How to fill out prevention of money laundering?

To fill out prevention of money laundering reports, financial institutions must gather and report information on suspicious transactions or activities.

What is the purpose of prevention of money laundering?

The purpose of prevention of money laundering is to detect and prevent illegal activities, such as terrorist financing and drug trafficking, by tracking and reporting suspicious financial transactions.

What information must be reported on prevention of money laundering?

Information such as customer identification, transaction details, and supporting documentation must be reported on prevention of money laundering reports.

Fill out your prevention of money laundering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prevention Of Money Laundering is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.