Get the free Exchange-Traded Fund Shares - Cboe Global Markets

Show details

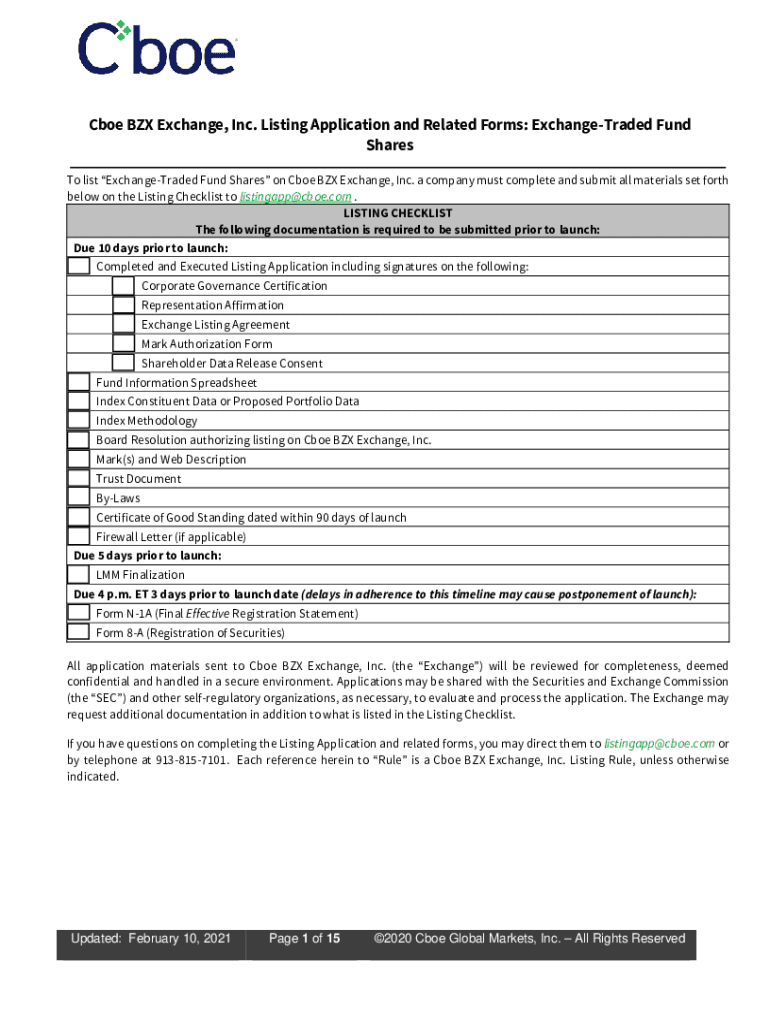

Oboe BOX Exchange, Inc. Listing Application and Related Forms: ExchangeTraded Fund Shares To list ExchangeTraded Fund Shares on Oboe BOX Exchange, Inc. a company must complete and submit all materials

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exchange-traded fund shares

Edit your exchange-traded fund shares form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exchange-traded fund shares form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing exchange-traded fund shares online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit exchange-traded fund shares. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out exchange-traded fund shares

How to fill out exchange-traded fund shares

01

To fill out exchange-traded fund shares, follow these steps:

02

Obtain a brokerage account: To invest in ETF shares, you need a brokerage account. Choose a reputable brokerage firm and complete the application process.

03

Research and select an ETF: Determine your investment goals, risk tolerance, and desired asset allocation. Conduct research to identify suitable ETFs that align with your investment objectives.

04

Place a trade order: Once you have chosen the ETF, log in to your brokerage account and navigate to the trading platform. Enter the ticker symbol of the ETF and select the order type (market order, limit order, or stop order). Specify the quantity of shares you want to purchase and review the order details.

05

Verify trade details: Before finalizing the trade, carefully review the order details, including the price, fees, and any additional terms. Ensure everything is accurate and meet your investment criteria.

06

Submit the trade order: If you are satisfied with the trade details, submit the order. The brokerage will execute the trade on your behalf at the next available opportunity.

07

Monitor your investment: Keep track of your ETF investment. Monitor its performance, review any changes in the market or economy that may impact the ETF's value, and consider rebalancing your portfolio periodically.

08

Sell or hold your shares: When you decide to sell your ETF shares, follow a similar process. Enter a sell order instead of a buy order, specifying the quantity and order details. If you prefer to hold the shares, manage your investment portfolio accordingly.

Who needs exchange-traded fund shares?

01

Exchange-traded fund shares are suitable for various individuals and entities, including:

02

- Individual investors: ETFs provide a convenient way for individual investors to diversify their portfolios, gain exposure to specific sectors or asset classes, or implement investment strategies. They may be appealing to both novice and experienced investors.

03

- Institutional investors: Institutional investors, such as pension funds, endowments, and insurance companies, may utilize ETFs to efficiently allocate assets, manage risk, and achieve diversification. ETFs offer flexibility and cost-effectiveness for large-scale investments.

04

- Passive investors: Investors who prefer a passive investment approach, where the goal is to match or track specific market indexes, may find ETFs suitable. These individuals aim to achieve market returns rather than outperforming the market.

05

- Active traders: ETFs can be traded throughout the trading day, making them attractive to active traders who seek frequent buying and selling opportunities. They can be used for short-term trading strategies or to hedge existing positions.

06

- Tax-conscious investors: ETFs are structured in a way that often minimizes capital gains distributions, making them tax-efficient compared to other investment vehicles. Investors looking to reduce their tax liabilities may find ETFs beneficial.

07

- Risk-averse investors: Some ETFs focus on low-risk investments, such as government bonds or dividend-paying stocks. Risk-averse investors who prioritize capital preservation may choose such ETFs for their portfolios.

08

- Investors seeking international exposure: ETFs provide access to global markets and specific regions/countries. Investors interested in diversifying their investments beyond domestic markets can utilize international ETFs.

09

- Financial advisors: Financial advisors may recommend ETFs to their clients based on their financial goals, risk tolerance, and investment preferences. ETFs offer a wide range of options that align with different investment strategies.

10

- Speculators: Speculative investors who aim to capitalize on short-term price movements in the market may use ETFs as a trading instrument. These individuals may take advantage of volatility or specific sector trends.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my exchange-traded fund shares in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your exchange-traded fund shares and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find exchange-traded fund shares?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific exchange-traded fund shares and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit exchange-traded fund shares straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing exchange-traded fund shares.

What is exchange-traded fund shares?

Exchange-traded fund shares are a type of investment fund and securities that track an index, commodity, bonds, or a basket of assets like an index fund, but trade like a stock on an exchange.

Who is required to file exchange-traded fund shares?

Individuals or entities who have invested in exchange-traded fund shares are required to file them with the appropriate regulatory authorities.

How to fill out exchange-traded fund shares?

To fill out exchange-traded fund shares, investors need to provide information about the fund, their investment amount, and any relevant financial details.

What is the purpose of exchange-traded fund shares?

The purpose of exchange-traded fund shares is to provide investors with a way to diversify their portfolios and gain exposure to a wide range of assets in a cost-effective and efficient manner.

What information must be reported on exchange-traded fund shares?

Information such as the fund's name, ticker symbol, investment strategy, holdings, performance, expenses, and any relevant tax information must be reported on exchange-traded fund shares.

Fill out your exchange-traded fund shares online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exchange-Traded Fund Shares is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.