Get the free 2021-2022 Income and Expenses Verification Form (Parent)

Show details

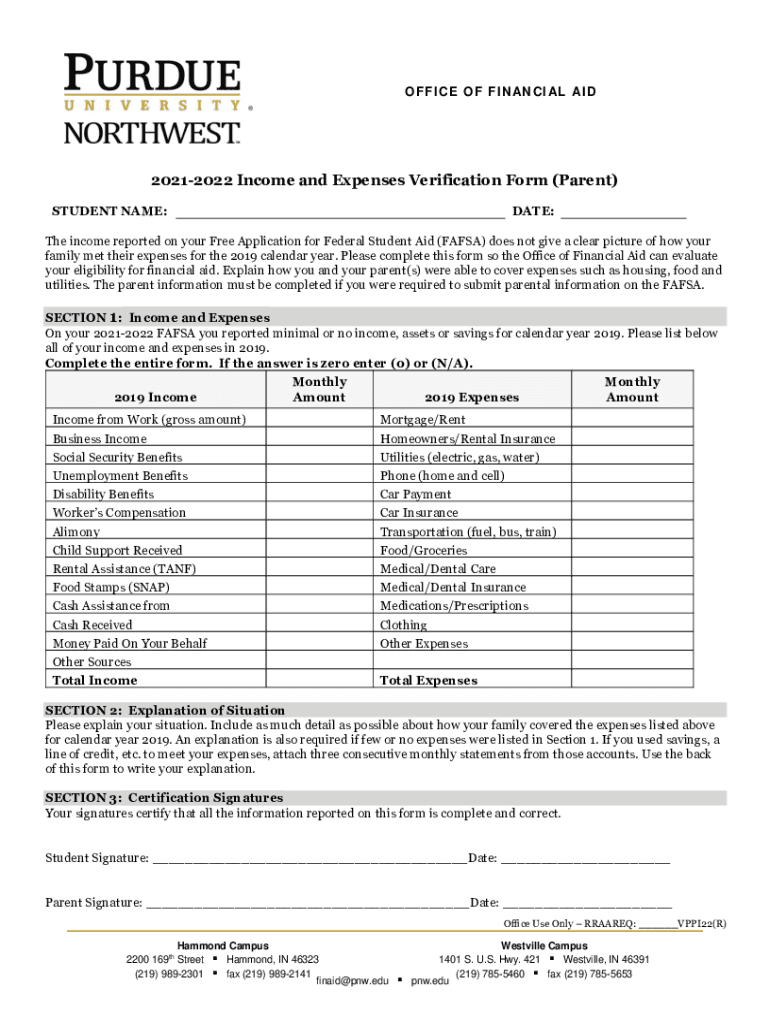

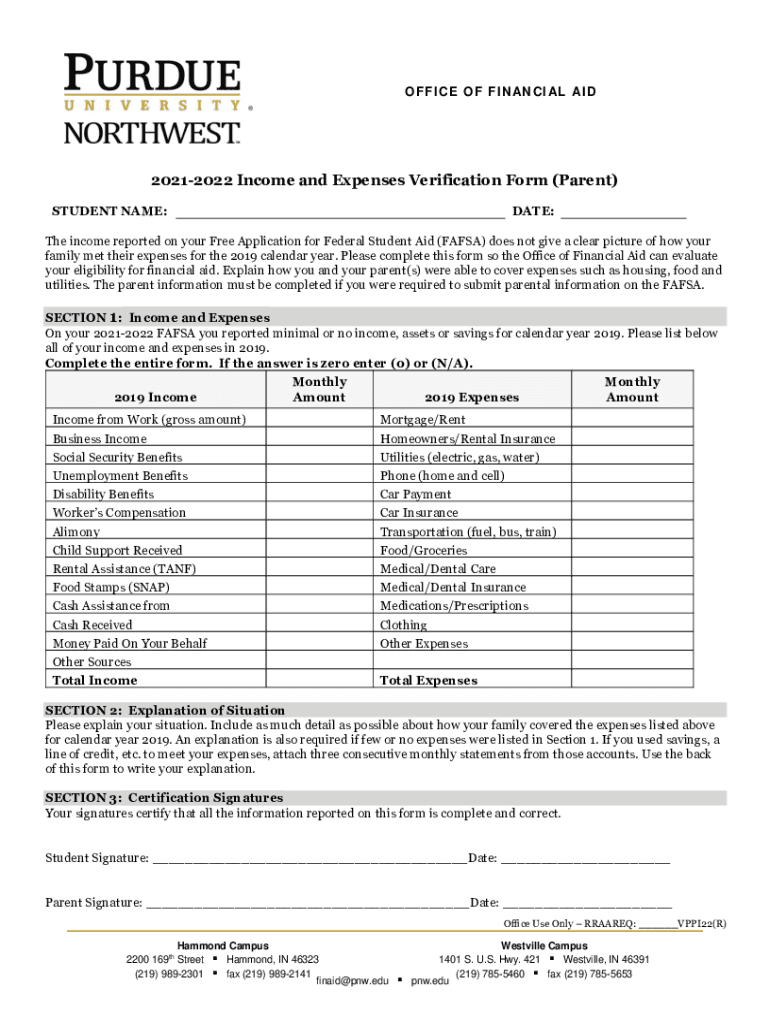

PURDUE F FI C E O F IN AN CI AL AID UNIVERSITY NORTHWEST 20212022 Income and Expenses Verification Form (Parent) STUDENT NAME:DATE:The income reported on your Free Application for Federal Student

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2021-2022 income and expenses

Edit your 2021-2022 income and expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2021-2022 income and expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2021-2022 income and expenses online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2021-2022 income and expenses. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2021-2022 income and expenses

How to fill out 2021-2022 income and expenses

01

To fill out the 2021-2022 income and expenses form, follow these steps:

02

Start by gathering all your financial documents, including bank statements, pay stubs, and receipts for any expenses you want to include.

03

Begin with the income section of the form. Enter your total income for the specified period, which typically covers a full year.

04

Break down your income into specific categories, such as salary, rental income, investment dividends, or any other sources of income you have.

05

Provide accurate details for each income source, including the amount received and any associated taxes.

06

Move on to the expenses section of the form. List all your expenses by category, such as housing, transportation, utilities, insurance, education, healthcare, and others.

07

Subdivide each category further to include specific expenses, such as rent, mortgage payments, car loans, gas and maintenance, electricity bills, insurance premiums, tuition fees, medical bills, etc.

08

For each expense item, provide the exact amount spent and any applicable deductions or tax benefits.

09

Double-check all the entries to ensure accuracy and completeness.

10

Sign and date the form, as required.

11

Make copies of the completed form for your records and submit the original to the appropriate authority or organization requesting the information.

12

Remember to keep all relevant supporting documents for future reference or verification purposes.

Who needs 2021-2022 income and expenses?

01

Various individuals and entities may require the 2021-2022 income and expenses information, including:

02

- Individuals filing their annual tax returns to accurately report their income and deductions.

03

- Self-employed individuals or business owners who need to report their earnings and expenses for proper accounting and tax purposes.

04

- Financial institutions or lenders who may request this information when assessing loan applications or determining creditworthiness.

05

- Government agencies that require this information for social welfare programs, grant applications, or any other purposes related to income-based benefits or assistance.

06

- Legal entities and organizations involved in auditing or conducting financial reviews, such as accountants, tax consultants, or financial advisors.

07

- Landlords or real estate agents who may seek income and expense details as part of rental or lease agreement agreements.

08

- Individuals or households interested in managing and planning their personal finances effectively.

09

Overall, anyone with financial responsibilities or obligations can benefit from having accurate income and expenses information for the specified period.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2021-2022 income and expenses for eSignature?

When your 2021-2022 income and expenses is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in 2021-2022 income and expenses without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2021-2022 income and expenses and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit 2021-2022 income and expenses straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2021-2022 income and expenses.

What is income and expenses verification?

Income and expenses verification is a process of confirming and documenting an individual or entity's sources of income and expenses.

Who is required to file income and expenses verification?

Individuals or entities who have income or expenses that need to be reported to a governing body are required to file income and expenses verification.

How to fill out income and expenses verification?

Income and expenses verification can typically be filled out by providing detailed information about sources of income, expenses incurred, and any supporting documentation.

What is the purpose of income and expenses verification?

The purpose of income and expenses verification is to ensure accuracy and transparency in reporting financial information to relevant authorities.

What information must be reported on income and expenses verification?

Information such as sources of income, types of expenses, amounts earned or spent, and any supporting documentation may need to be reported on income and expenses verification.

Fill out your 2021-2022 income and expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2021-2022 Income And Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.