SSRCx Small Business Self-Certification Form free printable template

Show details

Small Business Self-Certification Form

SMITH BECKMAN REID, INC. / SSR

Company Name: Street: City: Phone Number: Cage Code: DUNS Number: Business Size: (Please check all that apply) Small Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business certification form

Edit your self certification statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba small business self certification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business self certification statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit disadvantaged certified gender form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssrcx self online form

How to fill out SSRCx Small Business Self-Certification Form

01

Obtain the SSRCx Small Business Self-Certification Form from the relevant agency or website.

02

Read the instructions carefully to understand the requirements.

03

Fill out the business information section with accurate details including your business name, address, and contact information.

04

Specify the ownership structure of the business (e.g., sole proprietorship, partnership, corporation).

05

Provide details regarding the number of employees and business revenue.

06

Self-certify by signing and dating the form to confirm all information provided is true and accurate.

07

Submit the completed form as instructed, which may include online submission or mailing it to a designated office.

Who needs SSRCx Small Business Self-Certification Form?

01

Small business owners seeking to qualify for certain government programs or contracts.

02

Businesses looking to leverage benefits associated with being recognized as a self-certified small business.

03

Entrepreneurs wanting to demonstrate compliance with small business regulations and guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Can I fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

What tax forms Cannot be electronically filed?

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Can I download and print tax forms?

Download Income Tax Forms You can e-file directly to the IRS and download or print a copy of your tax return. Federal tax filing is free for everyone with no limitations, and state filing is only $14.99.

What forms do I need to file my taxes 2022?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

Can you fill out tax forms digitally?

How does the e-signature option work? Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

How can I file my taxes fast?

File electronically and choose Direct Deposit for your tax refund – it's the fastest and safest way to receive your money. Electronically filed tax returns are received within 24 hours, and paper tax returns take weeks.

What is the easiest way to do your own taxes?

The IRS recommends using tax preparation software to e-file for the easiest and most accurate returns. Determine if you are taking the standard deduction or itemizing your return. If you owe money, learn how to make a tax payment, including applying for a payment plan.

Is it OK to submit your taxes online?

IRS e-file is a fast, safe and proven way to get your tax return to the IRS. the fastest way to get your refund. IRS issues nine out of 10 refunds in less than 21 days. technology to protect tax returns.

Can I just do my taxes online?

IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to you. Those who don't qualify can still use Free File Fillable Forms.

How do I do my own personal tax return?

Steps to File a Tax Return Gather your paperwork, including: Choose your filing status. Decide how you want to file your taxes. Determine if you are taking the standard deduction or itemizing your return. If you owe money, learn how to make a tax payment, including applying for a payment plan.

How do I file my Income Tax Return online?

Select 'Assessment Year' Select 'ITR Form Number' Select 'Filing Type' as 'Original/Revised Return' Select 'Submission Mode' as 'Prepare and Submit Online'Choose any one of the following option to verify the Income Tax Return: I would like to e-Verify. I would like to e-Verify later within 120 days from date of filing.

How can I fill my own Income Tax Return?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute small owned veteran form online?

Easy online small owned veteran form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the small owned veteran form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your small owned veteran form in seconds.

How do I fill out the small owned veteran form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign small owned veteran form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

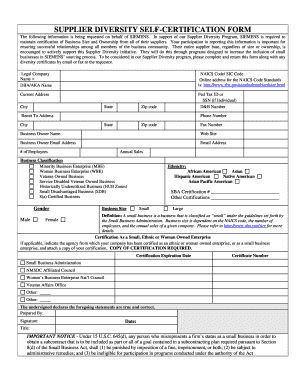

What is SSRCx Small Business Self-Certification Form?

The SSRCx Small Business Self-Certification Form is a document that allows small businesses to self-identify their status as small entities for various programs and procurement opportunities.

Who is required to file SSRCx Small Business Self-Certification Form?

Businesses seeking to participate in certain government contracts, grants, or programs that require verification of small business status are required to file the SSRCx Small Business Self-Certification Form.

How to fill out SSRCx Small Business Self-Certification Form?

To fill out the SSRCx Small Business Self-Certification Form, individuals must provide detailed information about their business size, ownership, and operations according to the form’s guidelines and instructions.

What is the purpose of SSRCx Small Business Self-Certification Form?

The purpose of the SSRCx Small Business Self-Certification Form is to verify the eligibility of small businesses for specific assistance programs, bidding opportunities, and to promote small business participation in governmental and private sector contracting.

What information must be reported on SSRCx Small Business Self-Certification Form?

The information that must be reported includes the business's name, address, size standards, ownership details, and any relevant financial data as required by the form.

Fill out your small owned veteran form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Owned Veteran Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.