Get the free DRmt of Pa T

Show details

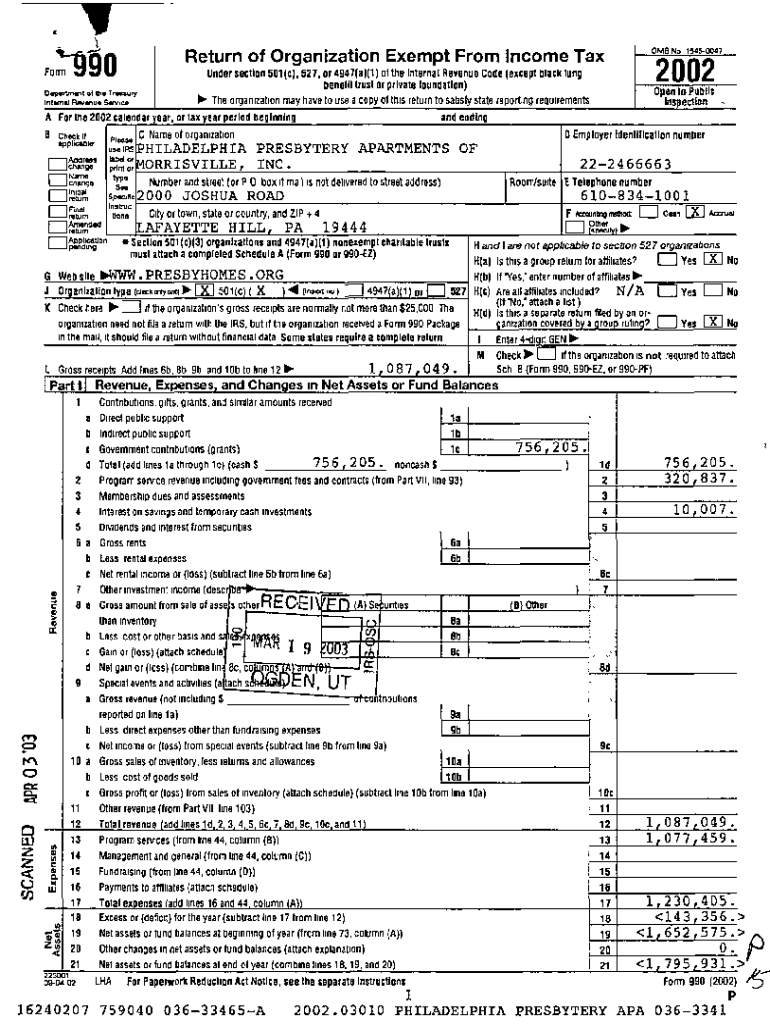

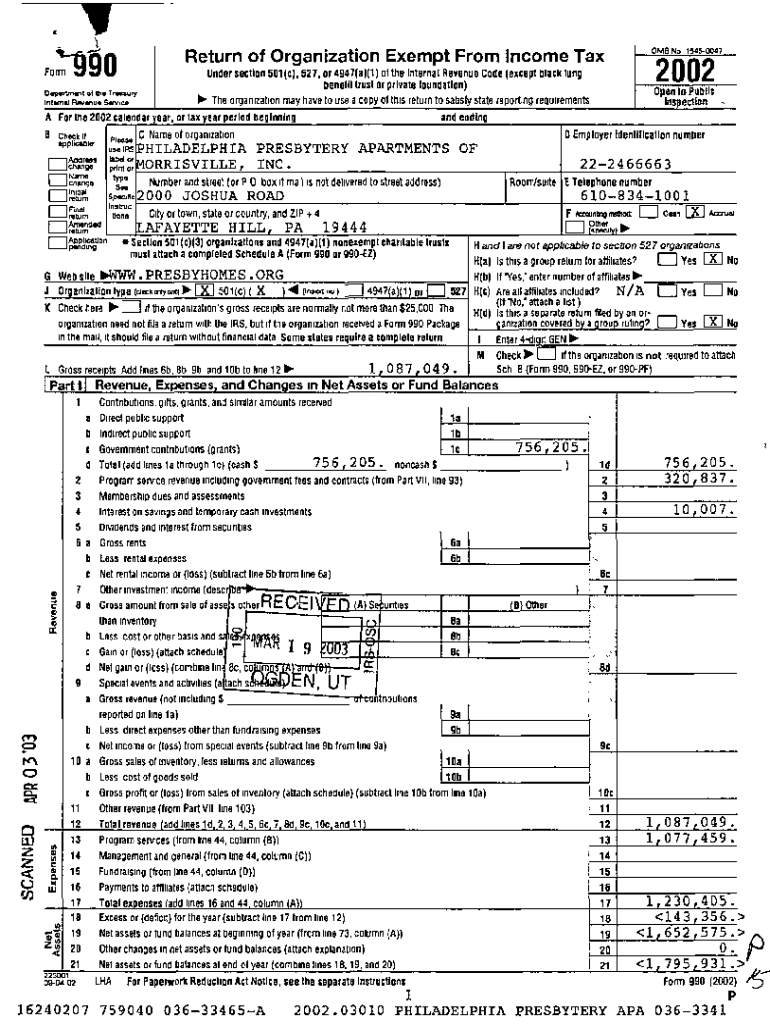

Form J90Return of Organization Exempt From Income Tandem of Pa T .URY intern Rev .due Sara, c. Under section 501(c), 527, or 49a7(a)(t) all the Internal Revenue Code (except black lung benefit trust

We are not affiliated with any brand or entity on this form

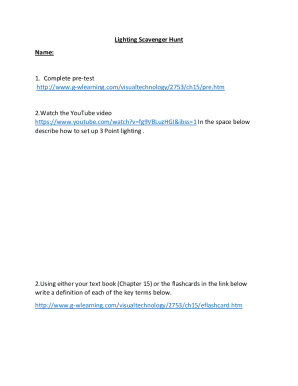

Get, Create, Make and Sign drmt of pa t

Edit your drmt of pa t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your drmt of pa t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing drmt of pa t online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit drmt of pa t. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

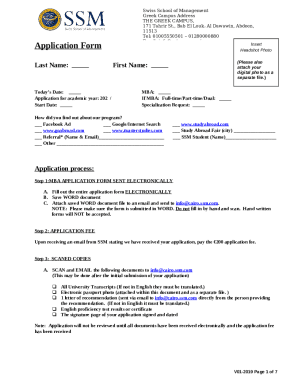

How to fill out drmt of pa t

How to fill out drmt of pa t

01

To fill out the DRMT of PA T, follow these steps:

02

Begin by obtaining a copy of the DRMT of PA T form.

03

Read through the instructions provided with the form to familiarize yourself with the requirements and guidelines.

04

Input your personal information accurately in the designated fields, including your name, address, contact details, and any other relevant information requested.

05

Fill in the details of the specific PA T you are referring to, including the title, date, and any other required information.

06

Use concise and clear language to provide a detailed description of the content of the PA T in the provided section.

07

Include any additional information or attachments that may be necessary or requested, such as supporting documents or references.

08

Review the filled-out form for accuracy and completeness, ensuring that all required fields are properly filled and any applicable signatures are obtained.

09

Finally, submit the completed DRMT of PA T form according to the provided instructions, such as by mail, fax, or online submission.

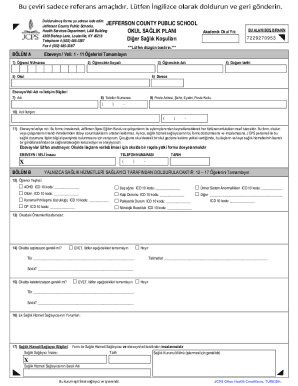

Who needs drmt of pa t?

01

The DRMT of PA T is needed by individuals or organizations who are involved in the process of creating or managing PA Ts.

02

This may include:

03

- Authors or creators of creative works who wish to protect their intellectual property rights through a PA T.

04

- Organizations or businesses who develop new products or technologies and want to secure exclusive rights and legal protection for their innovations.

05

- Experts in intellectual property rights who require a comprehensive understanding of the PA T process for consulting or advising purposes.

06

- Legal professionals who specialize in intellectual property law and assist clients in filing and managing PA Ts.

07

- Government agencies or entities responsible for enforcing intellectual property rights and evaluating the validity of PA Ts.

08

In summary, anyone seeking legal protection and exclusivity for their creative or innovative works may need to fill out a DRMT of PA T.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send drmt of pa t for eSignature?

Once your drmt of pa t is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in drmt of pa t?

The editing procedure is simple with pdfFiller. Open your drmt of pa t in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit drmt of pa t in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your drmt of pa t, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

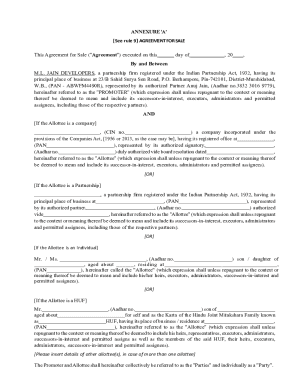

What is drmt of pa t?

The acronym DRMT of PA T stands for Declaration of Partnership Tax.

Who is required to file drmt of pa t?

Partnerships are required to file the Declaration of Partnership Tax.

How to fill out drmt of pa t?

The Declaration of Partnership Tax can be filled out online or in paper form, following the instructions provided by the tax authority.

What is the purpose of drmt of pa t?

The purpose of the Declaration of Partnership Tax is to report the income, deductions, and credits of a partnership for tax purposes.

What information must be reported on drmt of pa t?

The Declaration of Partnership Tax must include details of the partnership's income, expenses, credits, and any other relevant tax information.

Fill out your drmt of pa t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Drmt Of Pa T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.