Get the free S&P Underlying Rating: "AA"

Show details

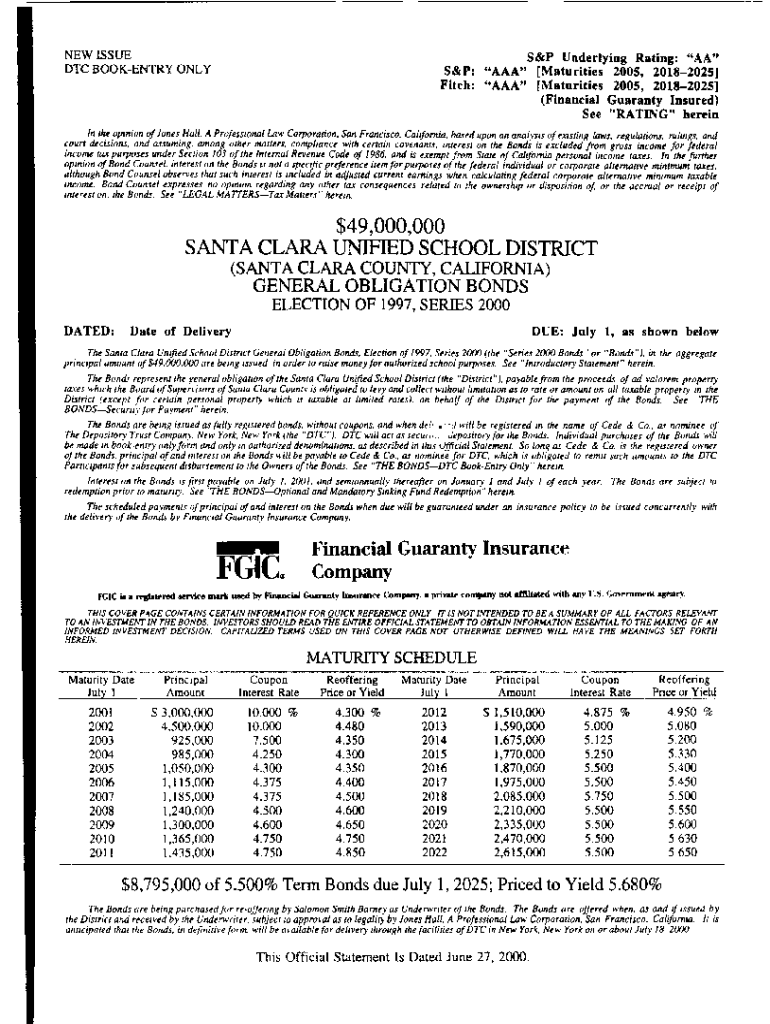

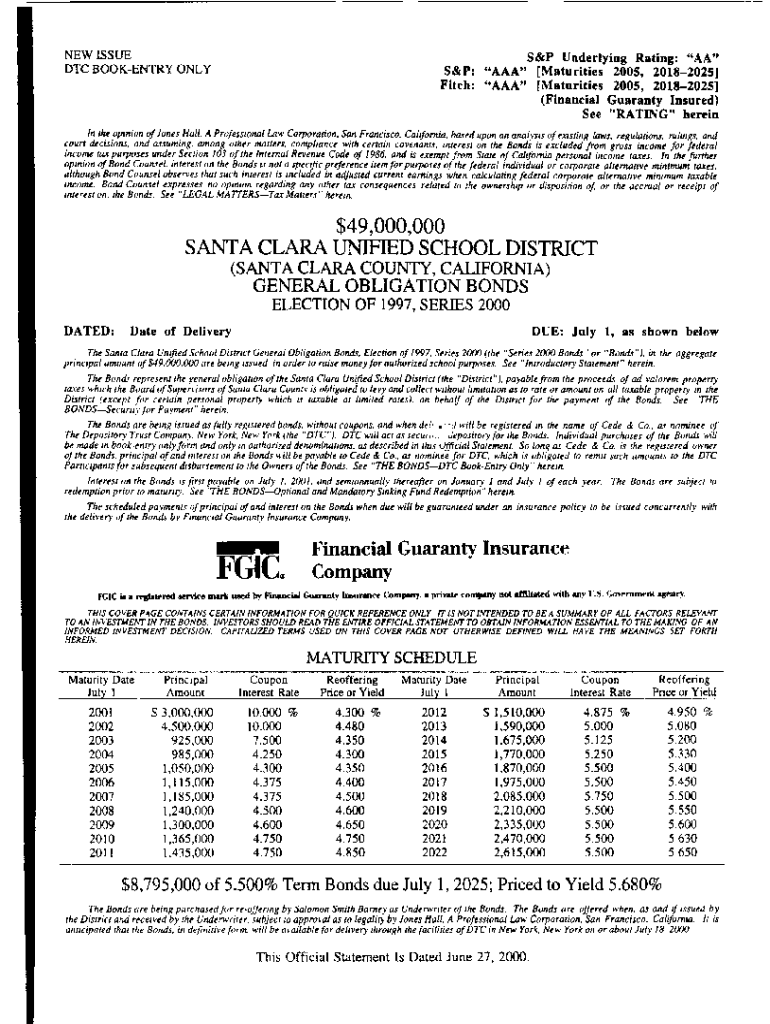

NEW ISSUES Underlying Rating: “AA S&P: “AAA Maturities 2005, 20182025 Fitch: “AAA Maturities 2005, 20182025 (Financial Guaranty Insured) See “RATING herein DTC COVENTRY ONLY In TH.e.opinion

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sampp underlying rating quotaaquot

Edit your sampp underlying rating quotaaquot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sampp underlying rating quotaaquot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sampp underlying rating quotaaquot online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sampp underlying rating quotaaquot. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sampp underlying rating quotaaquot

How to fill out sampp underlying rating quotaaquot

01

To fill out the sampp underlying rating quotaaquot, you need to follow these steps:

02

Begin by gathering all relevant information such as the company's financial statements, market data, and credit history.

03

Evaluate the company's financial performance by analyzing key financial ratios, liquidity, profitability, and cash flow.

04

Assess the company's market position, industry competition, and growth prospects.

05

Consider the company's management qualifications, experience, and ability to navigate market challenges.

06

Analyze any potential risks or vulnerabilities that may affect the company's creditworthiness.

07

Assign a rating score based on the evaluation of these factors.

08

Provide a written report detailing the rationale behind the assigned rating.

09

Review and finalize the rating before submitting it as the sampp underlying rating quotaaquot.

Who needs sampp underlying rating quotaaquot?

01

Various entities may need the sampp underlying rating quotaaquot, including:

02

- Investors who want to assess the creditworthiness and risk profile of a company before making investment decisions.

03

- Financial institutions that rely on ratings to determine the terms and interest rates for loans or credit facilities.

04

- Credit rating agencies that provide independent evaluations of companies' creditworthiness for informational purposes.

05

- Governments or regulatory bodies that use ratings to monitor the financial stability of companies or sectors.

06

- Insurance companies that use ratings for underwriting policies and calculating premiums.

07

- Companies themselves that may require a rating for benchmarking purposes or to attract potential investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sampp underlying rating quotaaquot without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including sampp underlying rating quotaaquot, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get sampp underlying rating quotaaquot?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific sampp underlying rating quotaaquot and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my sampp underlying rating quotaaquot in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sampp underlying rating quotaaquot right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is sampp underlying rating 'aa'?

S&P underlying rating 'aa' refers to a high-quality credit rating assigned by Standard & Poor's, indicating that the entity has a strong capacity to meet its financial commitments.

Who is required to file sampp underlying rating 'aa'?

Entities such as corporations, financial institutions, and governments that issue securities and are rated by S&P are required to file the S&P underlying rating 'aa'.

How to fill out sampp underlying rating 'aa'?

To fill out the S&P underlying rating 'aa', one needs to provide detailed information regarding the issuer's financial condition, creditworthiness, and relevant supporting documents as required by S&P.

What is the purpose of sampp underlying rating 'aa'?

The purpose of the S&P underlying rating 'aa' is to provide investors with an assessment of the credit quality of the issuer, which helps them make informed investment decisions.

What information must be reported on sampp underlying rating 'aa'?

Information to be reported includes the issuer's financial statements, credit metrics, market position, and any relevant economic factors impacting the issuer's creditworthiness.

Fill out your sampp underlying rating quotaaquot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sampp Underlying Rating Quotaaquot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.