AZ UB-106-A-FF 2021 free printable template

Show details

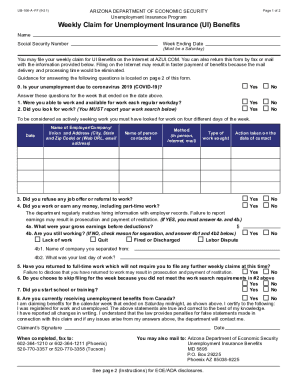

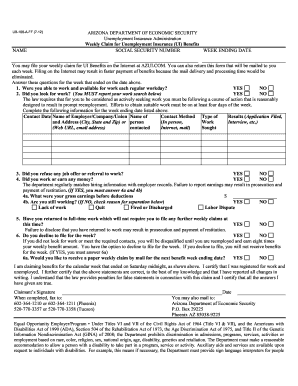

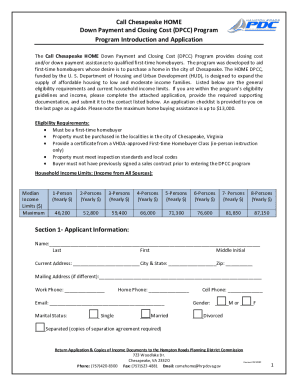

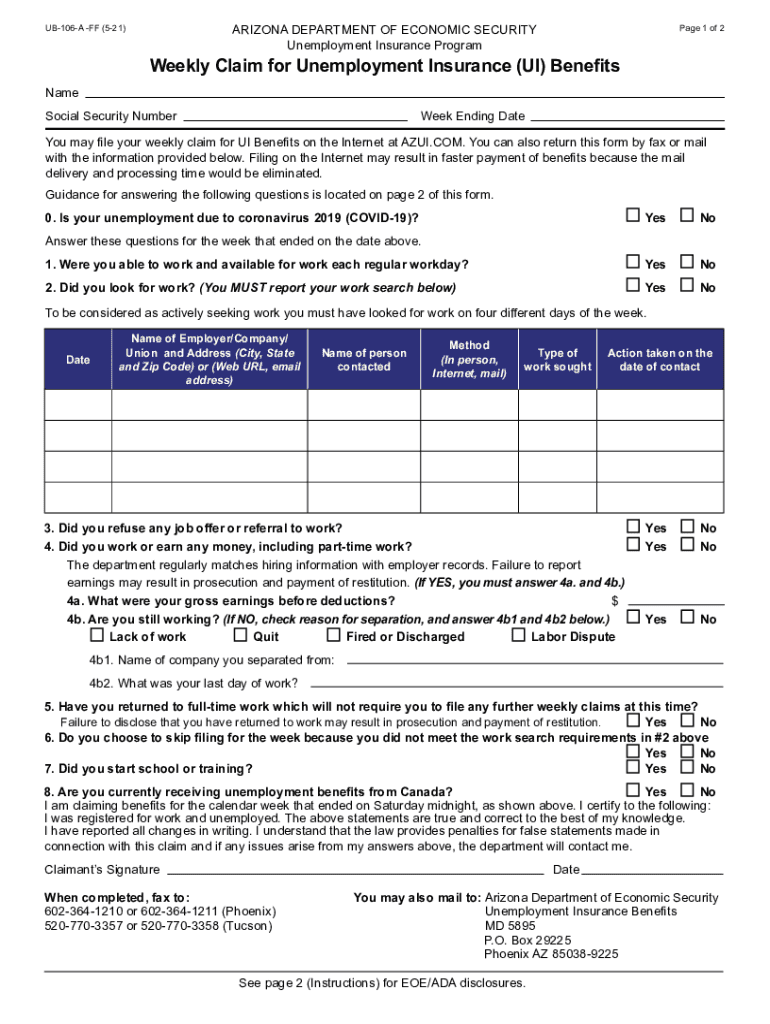

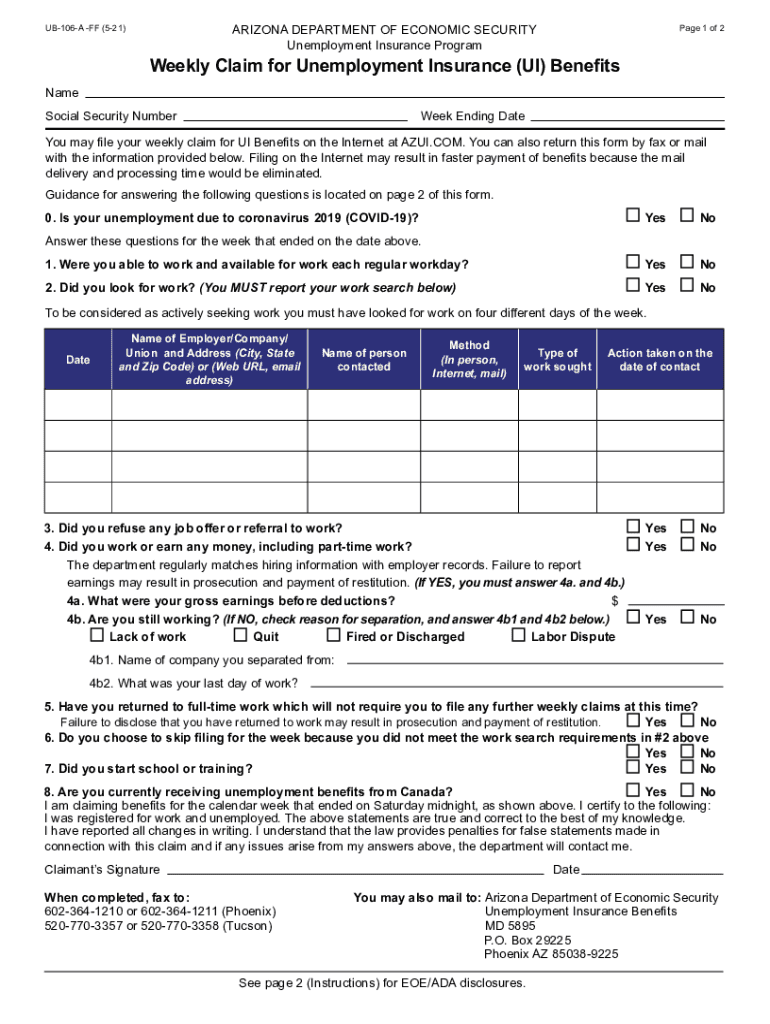

UB-106-A -FF 9-21 ARIZONA DEPARTMENT OF ECONOMIC SECURITY Unemployment Insurance Program Page 1 of 2 Weekly Claim for Unemployment Insurance UI Benefits Name Social Security Number Week Ending Date Must be a Saturday You may file your weekly claim for UI Benefits on the Internet at AZUI. COM. You can also return this form by fax or mail with the information provided below. Filing on the Internet may result in faster payment of benefits because the mail delivery and processing time would be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona unemployment

Edit your arizona unemployment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona unemployment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona unemployment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arizona unemployment. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ UB-106-A-FF Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona unemployment

How to fill out AZ UB-106-A-FF

01

Start by obtaining the AZ UB-106-A-FF form from the appropriate state agency or website.

02

Fill out the 'Personal Information' section with your name, address, and contact details.

03

Provide the necessary identification information, such as your Social Security number or Tax ID.

04

Complete the 'Income Information' section, detailing your income sources and amounts.

05

Fill out the 'Household Information' section with details on all household members and their income.

06

Attach any required supporting documentation, such as pay stubs or tax returns.

07

Review your form for accuracy and completeness to avoid processing delays.

08

Sign and date the form at the designated areas.

09

Submit the completed form to the appropriate office via mail or in-person, as directed.

Who needs AZ UB-106-A-FF?

01

Individuals and families applying for unemployment benefits in Arizona.

02

Workers who have been laid off or lost their jobs due to no fault of their own.

03

People seeking financial assistance during unemployment periods.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my 1099-G from unemployment Arizona?

Unemployment Insurance Benefits Tax Form 1099-G DES has mailed 1099-G tax forms to claimants who received unemployment benefits in 2022. To request 1099-G tax forms for years prior to 2022, send your name, Social Security Number and which tax year you need in your request.

How do I apply for unemployment benefits?

How Do I Apply? You should contact your state's unemployment insurance program as soon as possible after becoming unemployed. Generally, you should file your claim with the state where you worked. When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.

How much is Kansas unemployment per week?

People who are eligible for unemployment in Kansas will receive a weekly payment amount between $125 and $503. The maximum length of Kansas unemployment benefits is 16 weeks.

What disqualifies you for unemployment in Kansas?

You worked in any other state than Kansas in the past 18 months. You filed an unemployment claim with another state in the past 12 months. You were in the military service or were a federal employee in the past 18 months.

What is a UC 018 form?

Businesses determined liable to provide unemployment insurance coverage for their workers are required to. submit Unemployment Tax and Wage Reports (UC-018) for each quarter they are covered, even for quarters during which no wages were paid, and. to pay taxes each quarter taxable wages were paid.

What are excess wages in Arizona?

(Excess Wages are wages in excess of the taxable wage amount, which is the first $8,000 ($7,000 before January 1, 2023) paid to each employee each calendar year.) If you did not file such prior quarters via TWS, the system automatically “knows” this and prompts you to provide the Excess Wages amount yourself.

How do I get an unemployment tax form in Arizona?

Beginning February 1, 2023, if you received UI benefits in the calendar year 2022, you can log in to the Weekly Claims portal and view and print your 1099-G information in the "View Benefits Paid 1099" tab.

How to apply for ubi Arizona?

To start an application for one or more programs, apply online using this website, Health-e-Arizona PLUS, or call toll-free 1-855-HEA-PLUS, Monday through Friday, 7:00 am to 6:00 pm. Please visit the Cash Assistance information page for resources including: Frequently Asked Questions (FAQs)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit arizona unemployment online?

The editing procedure is simple with pdfFiller. Open your arizona unemployment in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit arizona unemployment on an iOS device?

You certainly can. You can quickly edit, distribute, and sign arizona unemployment on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete arizona unemployment on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your arizona unemployment. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is AZ UB-106-A-FF?

AZ UB-106-A-FF is a specific form used in Arizona for reporting certain financial information for businesses.

Who is required to file AZ UB-106-A-FF?

Businesses operating in Arizona that meet specific financial criteria are required to file AZ UB-106-A-FF.

How to fill out AZ UB-106-A-FF?

To fill out AZ UB-106-A-FF, businesses should gather the required financial information and follow the instructions provided on the form, ensuring all sections are completed accurately.

What is the purpose of AZ UB-106-A-FF?

The purpose of AZ UB-106-A-FF is to collect financial data from businesses for compliance and statistical analysis by state authorities.

What information must be reported on AZ UB-106-A-FF?

The information that must be reported includes details about income, expenses, taxes paid, and any other relevant financial data as specified in the form guidelines.

Fill out your arizona unemployment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Unemployment is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.