Get the free diploma in taxation and law practice saurashtra university rajkot form - saurashtrau...

Show details

Syllabus 2006-2007 SYLLABUS POST GRADUATE DIPLOMA IN HARDWARE TECHNOLOGY AND APPLICATIONS. Syllabus 2006-2007 SEMESTER 01 PAPER-I ELECTRONICS FOR COMPUTER HARDWARE UNIT 01 PASSIVE COMPONENTS Resistors:

We are not affiliated with any brand or entity on this form

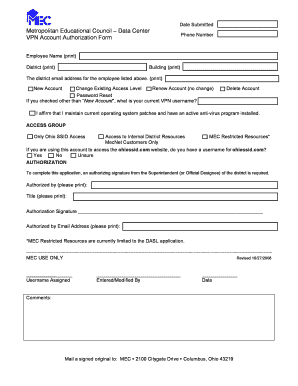

Get, Create, Make and Sign diploma in taxation and

Edit your diploma in taxation and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your diploma in taxation and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing diploma in taxation and online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit diploma in taxation and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out diploma in taxation and

How to fill out a diploma in taxation and:

01

Start by gathering all the necessary documents and information. This may include your educational transcripts, identification documents, and any relevant work experience or certifications.

02

Research the specific requirements and guidelines for the diploma program you are applying to. Each institution may have different application processes and deadlines, so make sure to thoroughly read and understand the instructions.

03

Fill out the application form for the diploma program. Provide accurate and complete information, including personal details, educational background, and employment history.

04

Prepare any additional documents or materials required by the institution. This may include a resume, statement of purpose, letters of recommendation, or a portfolio of your work.

05

Pay any application fees that may be required. Some institutions may have an application fee, which is usually non-refundable. Make sure to check the payment methods and deadlines.

06

Submit all the required documents and application materials. Double-check that you have included everything necessary and that all forms are filled out correctly.

Who needs a diploma in taxation and:

01

Individuals who are interested in pursuing a career in taxation or tax-related fields, such as tax accounting or tax consulting, would benefit from obtaining a diploma in taxation.

02

Professionals who are already working in fields related to taxation, such as accountants or financial advisors, may also benefit from gaining a diploma in taxation to enhance their knowledge and skills in this specific area.

03

Entrepreneurs or business owners who want to have a deeper understanding of tax laws and regulations, in order to manage their business finances and comply with tax obligations effectively.

04

Individuals who are considering a career change and are interested in exploring opportunities in taxation or tax-related roles can benefit from acquiring a diploma in taxation to gain the necessary knowledge and credentials.

05

Students who have completed a relevant undergraduate degree and wish to specialize in taxation can pursue a diploma in taxation as a stepping stone towards further education and professional certifications in the field.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send diploma in taxation and to be eSigned by others?

diploma in taxation and is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit diploma in taxation and straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing diploma in taxation and.

How do I complete diploma in taxation and on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your diploma in taxation and. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is diploma in taxation and?

Diploma in Taxation is a specialized program that provides individuals with in-depth knowledge and skills in the field of taxation. It focuses on various aspects of tax laws, procedures, and strategies.

Who is required to file diploma in taxation and?

Individuals who want to pursue a career in taxation, such as tax consultants, accountants, or tax advisors, are typically required to complete a diploma in taxation to enhance their expertise and credentials.

How to fill out diploma in taxation and?

The process of filling out a diploma in taxation typically involves enrolling in a recognized educational institution or online platform that offers the program, completing the required coursework, and meeting the assessment criteria outlined by the institution.

What is the purpose of diploma in taxation and?

The purpose of a diploma in taxation is to equip individuals with the necessary knowledge and skills to understand and navigate the complex field of taxation. It enables individuals to provide expert advice on tax-related matters and ensures compliance with tax laws and regulations.

What information must be reported on diploma in taxation and?

The information reported on a diploma in taxation may vary depending on the curriculum and institution. However, it typically includes topics such as tax planning, tax compliance, tax regulations, tax auditing, and tax research.

Fill out your diploma in taxation and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Diploma In Taxation And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.