Get the free Corporate Savings

Show details

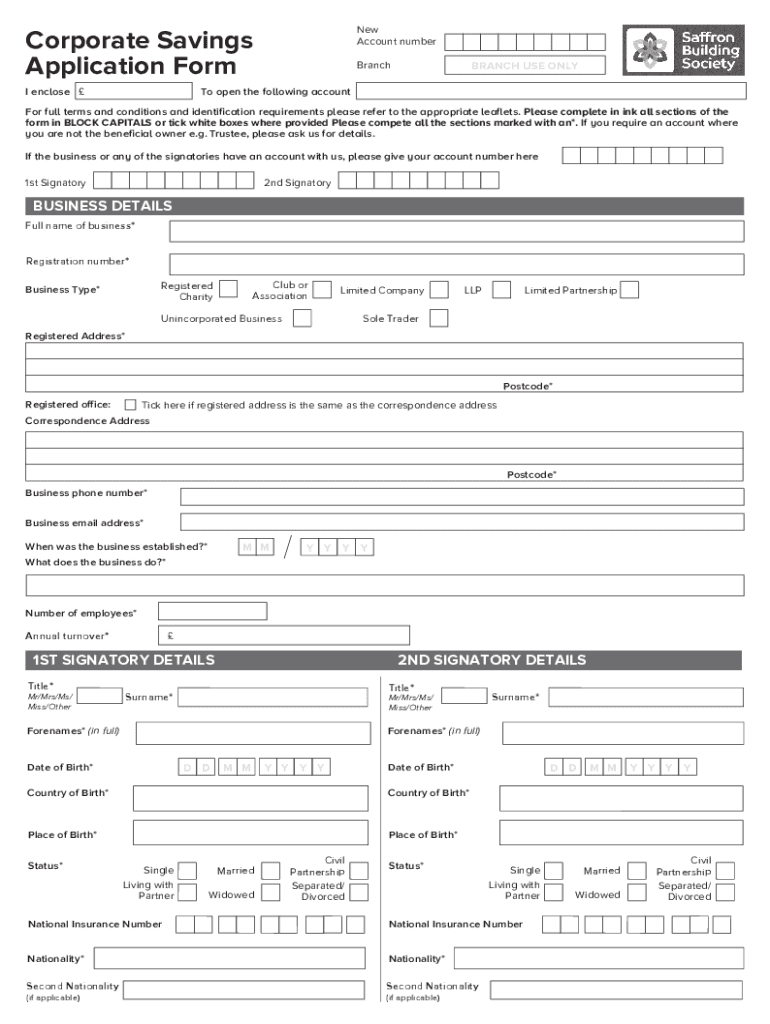

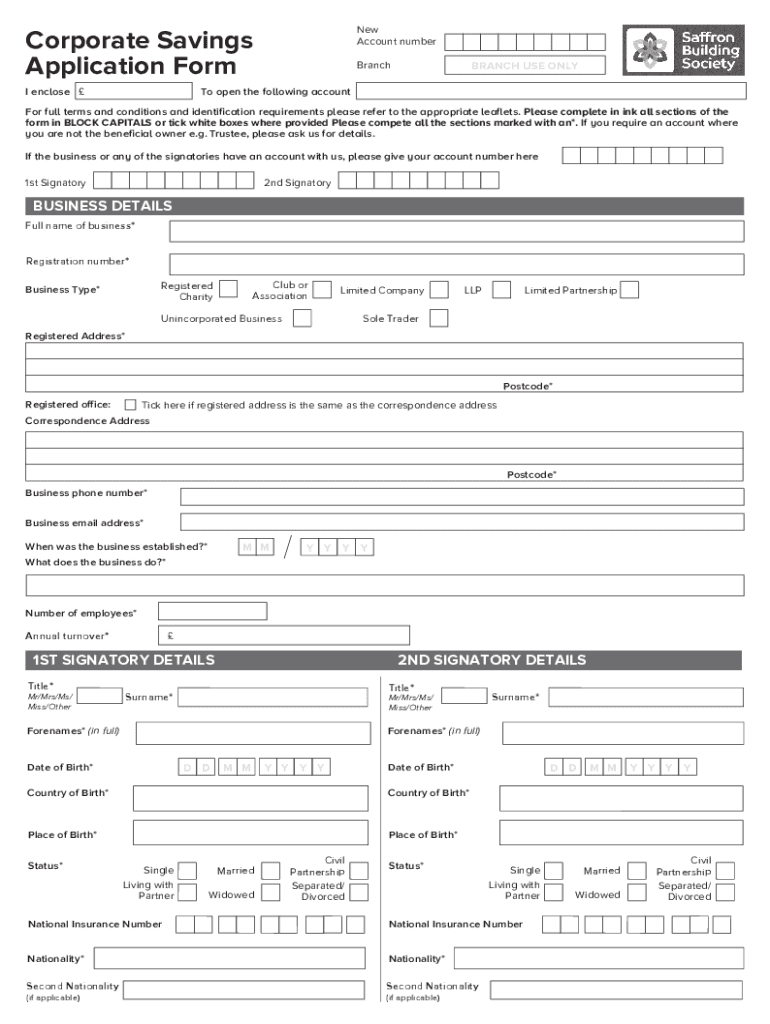

New Account numberCorporate Savings Application Form I enclose BranchBRANCH USE Only open the following account full terms and conditions and identification requirements please refer to the appropriate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate savings

Edit your corporate savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate savings online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate savings. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate savings

How to fill out corporate savings

01

Gather all necessary financial documents, such as bank statements, profit and loss statements, and tax returns.

02

Identify the purpose of the corporate savings account, whether it be for emergency funds, investment, or other specific needs.

03

Choose a bank or financial institution that offers corporate savings accounts and meets the specific requirements of your business.

04

Schedule an appointment with the chosen bank or financial institution to discuss the corporate savings account setup process.

05

Provide the required documentation and complete any application forms as per the bank's instructions.

06

Review and sign any necessary agreements, such as terms and conditions or account opening documents.

07

Fund the corporate savings account by transferring funds from your business account or other sources.

08

Set up any additional features or services associated with the corporate savings account, such as online banking access or automatic deposits.

09

Regularly monitor the account balance and transactions to ensure that the funds are growing and being utilized according to the business's goals and needs.

10

Periodically review the corporate savings account to evaluate its performance and determine if any adjustments or changes are necessary.

Who needs corporate savings?

01

Small and large businesses that want to allocate funds for future financial needs.

02

Companies that want to secure emergency funds in case of unexpected expenses or downturns in business.

03

Businesses with excess cash flow that want to earn interest on their funds.

04

Startups looking to save money for future expansion or investment opportunities.

05

Entities that want to separate their personal and business finances by having a dedicated savings account for the company.

06

Organizations that require a savings account to meet specific regulatory or compliance requirements.

07

Corporations that want to save money for tax payments or business expenses.

08

Businesses that want to build a financial safety net or contingency fund for unpredictable events.

09

Companies seeking to accumulate funds for long-term goals, such as equipment purchases, acquisitions, or research and development.

10

Any business owner or entity looking to responsibly manage their finances and have a more organized approach to saving and managing funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my corporate savings in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your corporate savings as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit corporate savings on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing corporate savings.

How do I edit corporate savings on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign corporate savings on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is corporate savings?

Corporate savings refer to the funds that a corporation sets aside for future use or unexpected expenses.

Who is required to file corporate savings?

Corporations are required to file corporate savings as part of their financial reporting obligations.

How to fill out corporate savings?

Corporate savings can be filled out by providing details of the amount set aside, the reasons for saving, and any relevant financial information.

What is the purpose of corporate savings?

The purpose of corporate savings is to ensure financial stability, prepare for future investments, and cover unexpected expenses.

What information must be reported on corporate savings?

The information reported on corporate savings typically includes the amount saved, the purpose of the savings, and any financial data related to the savings.

Fill out your corporate savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.