Get the free Employee vs. Independent Contractor: Differences You Need to Know

Show details

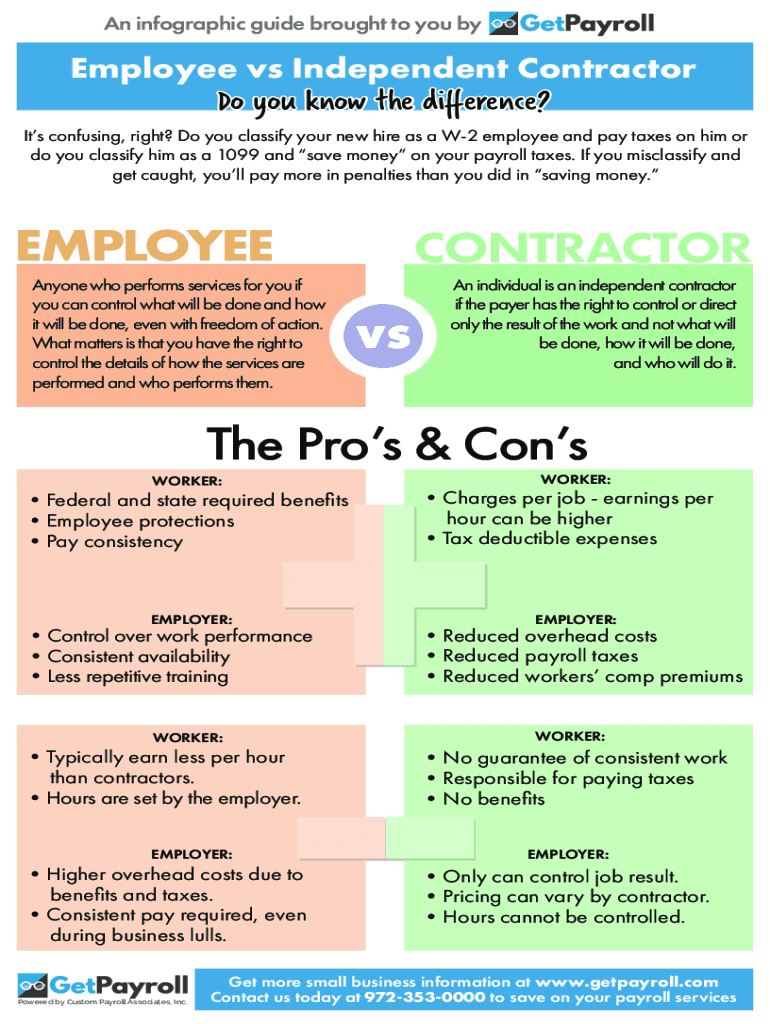

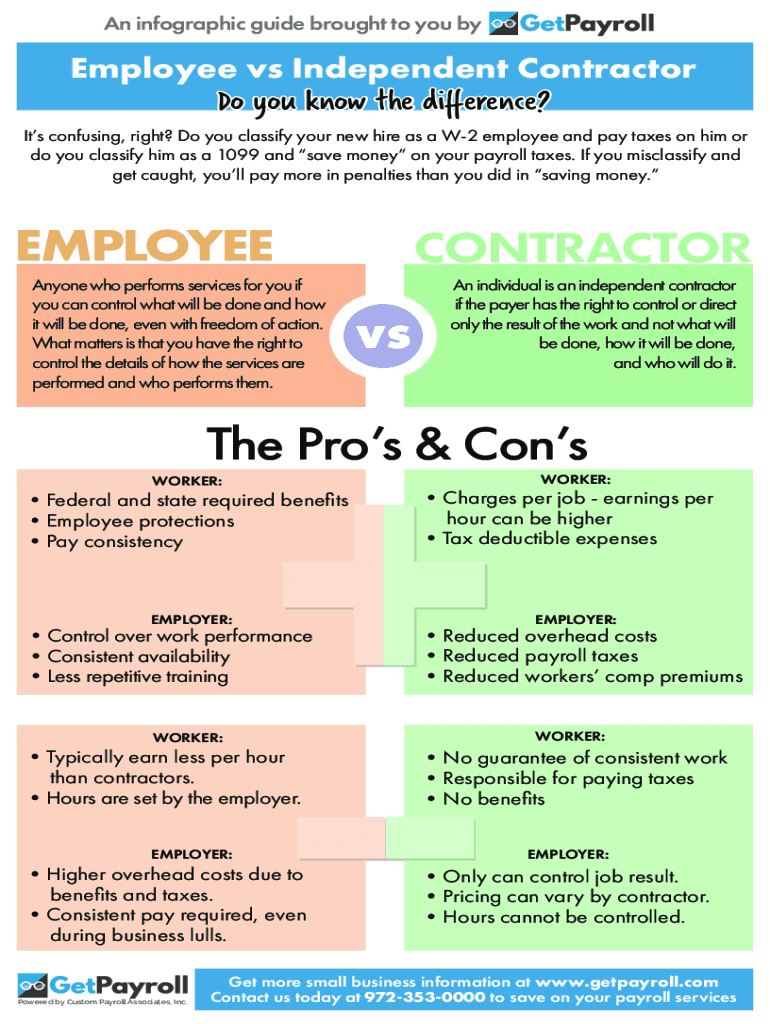

An infographic guide brought to you employee vs Independent Contractor Do you know the difference? Its confusing, right? Do you classify your new hire as a W2 employee and pay taxes on him or do you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee vs independent contractor

Edit your employee vs independent contractor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee vs independent contractor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee vs independent contractor online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee vs independent contractor. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee vs independent contractor

How to fill out employee vs independent contractor

01

Determine the job requirements and responsibilities. Understand the nature of the work that needs to be done and whether it aligns more with an employee or an independent contractor.

02

Review the legal guidelines. Familiarize yourself with the laws and regulations pertaining to employee classification and independent contractor status in your jurisdiction.

03

Check the IRS guidelines. The Internal Revenue Service provides specific criteria for determining whether a worker is an employee or an independent contractor. Ensure that you comply with these guidelines.

04

Consider the benefits and drawbacks. Evaluate the advantages and disadvantages of hiring an employee versus an independent contractor, such as payroll taxes, benefits, control over the work, and flexibility.

05

Consult with legal and tax professionals. Seek advice from professionals who specialize in employment law and tax regulations to ensure proper classification and compliance.

06

Document the classification. Once you have determined whether a worker should be classified as an employee or an independent contractor, clearly document this decision in the worker's contract or agreement.

07

Review and update regularly. Periodically review the status of your workers to ensure continued compliance with changing laws and circumstances.

Who needs employee vs independent contractor?

01

Business owners who require long-term commitment and loyalty from workers may need employees.

02

Employers who want more control over the work done and the way it's performed may need employees.

03

Companies that offer benefits such as health insurance, retirement plans, and paid leave may prefer hiring employees.

04

Industries that involve specialized skills or knowledge may seek employees to ensure continuity and expertise.

05

On the other hand, businesses that require temporary or project-based work may benefit from hiring independent contractors.

06

Organizations looking for flexibility in terms of scaling their workforce up or down may opt for independent contractors.

07

Companies aiming to reduce costs associated with benefits, payroll taxes, and overhead expenses may choose independent contractors.

08

Startups and small businesses with limited resources and budgets may find it more feasible to hire independent contractors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my employee vs independent contractor in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your employee vs independent contractor along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit employee vs independent contractor straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing employee vs independent contractor right away.

How do I fill out the employee vs independent contractor form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign employee vs independent contractor and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is employee vs independent contractor?

Employee vs independent contractor refers to the classification of workers based on the nature of their relationship with the employer. An employee is typically hired to work under the direction and control of the employer, while an independent contractor works independently and is responsible for their own work schedule and methods.

Who is required to file employee vs independent contractor?

Employers are required to correctly classify their workers as either employees or independent contractors and report this information to the relevant tax authorities.

How to fill out employee vs independent contractor?

Employers must carefully review the working relationship with each worker to determine if they should be classified as an employee or an independent contractor. They should then report this classification accurately on tax forms and other relevant documentation.

What is the purpose of employee vs independent contractor?

The purpose of classifying workers as either employees or independent contractors is to ensure compliance with labor laws, tax regulations, and other legal requirements. This classification also determines the benefits and protections that workers are entitled to.

What information must be reported on employee vs independent contractor?

Employers must report the worker's classification (employee or independent contractor), their contact information, Social Security number or tax identification number, and the nature of the services they provide.

Fill out your employee vs independent contractor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Vs Independent Contractor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.