Get the free Long-Term Care Insurance Rate Decision ... - PA.Gov

Show details

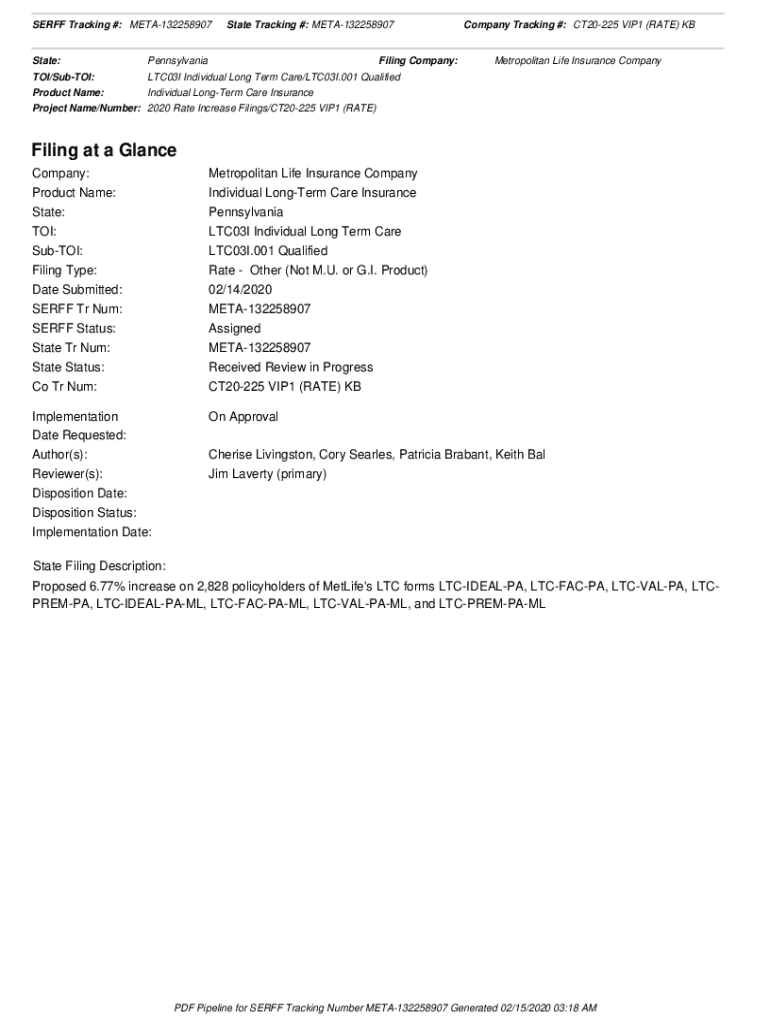

SERFS Tracking #: META132258907State Tracking #: META132258907State:Pennsylvania/Subtle:LTC03I Individual Long Term Care/LTC03I.001 QualifiedFiling Company:Product Name:Individual Longer Care InsuranceCompany

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term care insurance rate

Edit your long-term care insurance rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care insurance rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long-term care insurance rate online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long-term care insurance rate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term care insurance rate

How to fill out long-term care insurance rate

01

To fill out a long-term care insurance rate, follow these steps:

02

Gather all necessary information: Start by collecting all relevant details, such as personal information, health history, and any existing insurance policies.

03

Research available options: Explore different long-term care insurance providers and compare their rates, coverage options, and policy terms.

04

Understand the coverage: Review the coverage provided by each insurance policy and ensure it meets your specific needs. Consider factors like daily benefit amount, elimination period, inflation protection, and types of services covered.

05

Consult with an insurance agent: Schedule a meeting with a knowledgeable insurance agent who can guide you through the process and help you understand all the terms and conditions.

06

Fill out the application form: Once you have decided on a particular insurance policy, complete the application form accurately and provide all the required information. Double-check for any mistakes or missing details.

07

Review and submit: Carefully review your completed application form to ensure accuracy. Make copies for your records, if necessary, and submit the application to the insurance company according to their preferred method (mail, online submission, etc.).

08

Follow up: After submitting the application, follow up with the insurance company to ensure they received it and to inquire about any additional steps or documents required.

09

Review the policy documents: Once your application is approved, carefully review the policy documents sent by the insurance company. Understand the coverage, premiums, renewal terms, and any exclusions or limitations.

10

Pay premiums: Make sure to pay your premiums on time to keep your long-term care insurance policy active and in force.

11

Periodic review: Periodically review your policy and assess if it still meets your changing needs over time.

Who needs long-term care insurance rate?

01

Long-term care insurance rate is beneficial for individuals who want to safeguard their financial future in the event of needing long-term care services, which can be quite expensive. It can be suitable for:

02

- Individuals who do not have sufficient savings to cover potential long-term care costs.

03

- Individuals with a family history of certain health conditions or increased risk factors that may indicate a higher likelihood of needing long-term care in the future.

04

- Individuals who wish to preserve their assets and protect their estate for their beneficiaries while covering long-term care expenses.

05

- Individuals who do not want to rely on government assistance programs for long-term care coverage.

06

- Individuals who value having a choice in the type of long-term care services and facilities they receive.

07

It's important to evaluate personal circumstances and consider factors like age, health status, financial situation, and future care preferences when determining if long-term care insurance is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send long-term care insurance rate for eSignature?

Once you are ready to share your long-term care insurance rate, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete long-term care insurance rate online?

pdfFiller makes it easy to finish and sign long-term care insurance rate online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit long-term care insurance rate on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing long-term care insurance rate.

What is long-term care insurance rate?

Long-term care insurance rate refers to the cost of the insurance premium paid by individuals to receive coverage for long-term care services.

Who is required to file long-term care insurance rate?

Insurance companies or providers are required to file long-term care insurance rates with the appropriate regulatory agency.

How to fill out long-term care insurance rate?

Long-term care insurance rates can be filled out by providing information on the coverage options, premium amounts, and any discounts that may apply.

What is the purpose of long-term care insurance rate?

The purpose of long-term care insurance rates is to determine the cost of coverage for long-term care services and to ensure that individuals have access to affordable insurance options.

What information must be reported on long-term care insurance rate?

Information such as coverage details, premium amounts, any discounts, and the terms and conditions of the insurance policy must be reported on long-term care insurance rates.

Fill out your long-term care insurance rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Care Insurance Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.