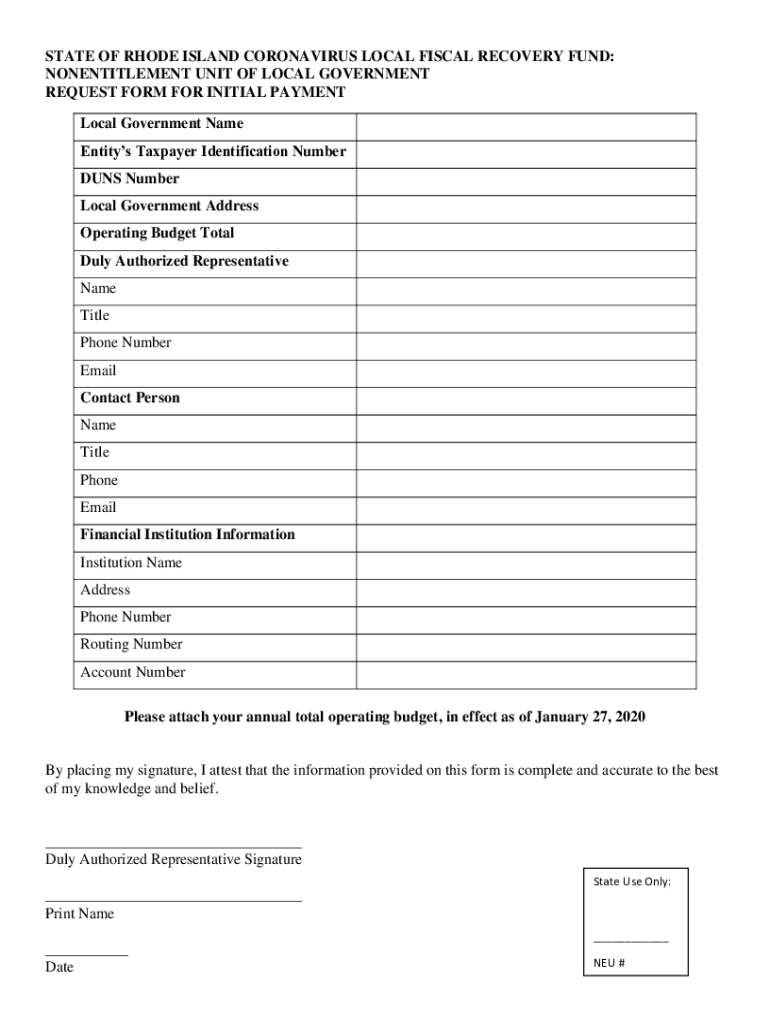

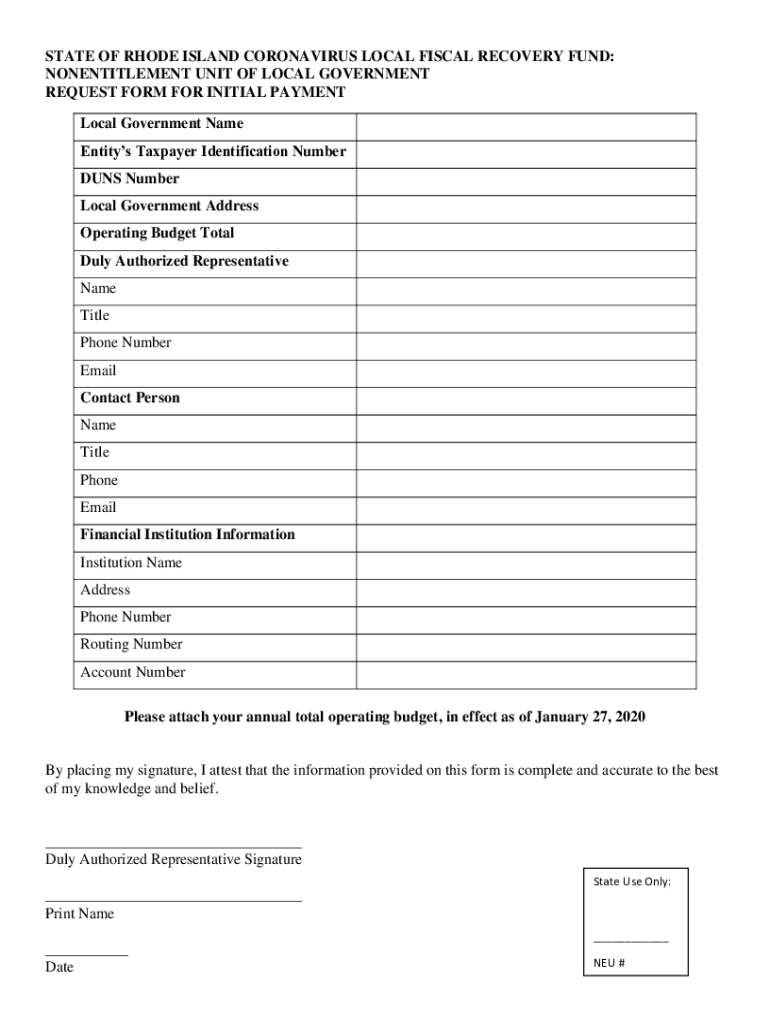

Get the free Local Fiscal Recovery Fund NEU Request Package

Show details

OFFICE OF MANAGEMENT & BUDGET PANDEMIC RECOVERY OFFICE One Capitol Hill Providence, RI 029085890Dorothy Z. Pascal, CPA Office: (401) 5748430 Fax: (401) 2226436Dear Fiscal Officer: The State of Rhode

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local fiscal recovery fund

Edit your local fiscal recovery fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local fiscal recovery fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local fiscal recovery fund online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit local fiscal recovery fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local fiscal recovery fund

How to fill out local fiscal recovery fund

01

Step 1: Obtain the application form for the local fiscal recovery fund from the respective government department.

02

Step 2: Read and understand the instructions provided in the application form.

03

Step 3: Gather all the necessary documents and information required to fill out the application form.

04

Step 4: Start filling out the application form accurately and completely.

05

Step 5: Provide all the requested details about your organization, including its name, address, and contact information.

06

Step 6: Clearly state the purpose and objectives for which you need the local fiscal recovery fund.

07

Step 7: Provide detailed financial information about your organization, including its annual budget and revenue sources.

08

Step 8: Attach any supporting documents, such as financial statements or project proposals, that strengthen your case for receiving the fund.

09

Step 9: Review the completed application form to ensure accuracy and completeness.

10

Step 10: Submit the filled-out application form along with all the required documents to the designated government authority.

Who needs local fiscal recovery fund?

01

Local governments and organizations in need of financial support to recover from economic downturns or crises.

02

Communities affected by natural disasters or emergencies that require assistance in rebuilding and reconstruction.

03

Non-profit organizations working towards community development and improvement.

04

Public institutions facing financial challenges and in need of additional funding for essential services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send local fiscal recovery fund to be eSigned by others?

Once your local fiscal recovery fund is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get local fiscal recovery fund?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific local fiscal recovery fund and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute local fiscal recovery fund online?

pdfFiller makes it easy to finish and sign local fiscal recovery fund online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is local fiscal recovery fund?

The local fiscal recovery fund is a fund established to provide financial assistance to local governments for economic recovery.

Who is required to file local fiscal recovery fund?

Local governments are required to file the local fiscal recovery fund.

How to fill out local fiscal recovery fund?

To fill out the local fiscal recovery fund, local governments need to provide detailed information on their financial situation and how the funds will be used for economic recovery.

What is the purpose of local fiscal recovery fund?

The purpose of the local fiscal recovery fund is to help local governments recover from economic challenges and support their communities.

What information must be reported on local fiscal recovery fund?

Local governments must report their financial status, budget plans, and how the funds will be utilized for economic recovery.

Fill out your local fiscal recovery fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Fiscal Recovery Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.