Get the free Deed of In-Kind Gift

Show details

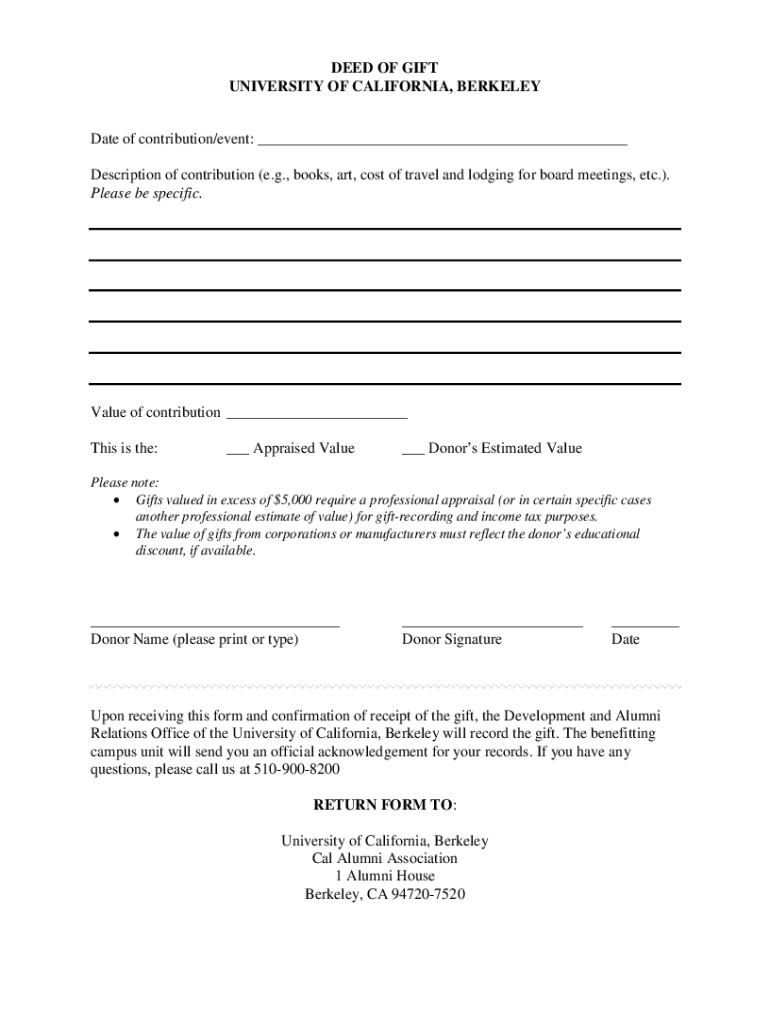

DEED OF GIFT UNIVERSITY OF CALIFORNIA, BERKELEYDate of contribution/event: Description of contribution (e.g., books, art, cost of travel and lodging for board meetings, etc.). Please be specific.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of in-kind gift

Edit your deed of in-kind gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of in-kind gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of in-kind gift online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deed of in-kind gift. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of in-kind gift

How to fill out deed of in-kind gift

01

To fill out a deed of in-kind gift, follow these steps:

02

Begin by providing a clear and concise title for the deed, such as 'Deed of In-Kind Gift'.

03

Identify the parties involved in the transaction, including the donor (person or organization giving the gift) and the recipient (person or organization receiving the gift).

04

Specify the date of the gift. This is important for legal purposes and to establish the timeline of the transaction.

05

Describe the nature of the gift in detail. Include specific information about the property, goods, or services being donated. Be as precise as possible to avoid any misunderstandings in the future.

06

Provide a statement confirming that the donor is transferring ownership of the gift to the recipient without any conditions or expectations of payment.

07

Include any additional terms or conditions that both parties agree upon. These can include provisions for how the gift will be used, restrictions on its transfer or disposal, or any other relevant agreements.

08

Date and sign the deed. Both the donor and the recipient should sign the document to make it legally binding.

09

Consider having the deed notarized or witnessed by a neutral party. This provides additional legal assurance and credibility to the document.

10

Keep a copy of the completed deed for your records and provide a copy to the other party involved in the transaction.

11

Remember, it is always a good idea to consult with legal professionals or seek expert advice to ensure that the deed of in-kind gift adheres to all relevant laws and regulations.

Who needs deed of in-kind gift?

01

A deed of in-kind gift is typically needed by individuals or organizations involved in the process of making or receiving non-monetary donations.

02

Some examples of who may need a deed of in-kind gift include:

03

- Non-profit organizations: They often receive in-kind donations from individuals or businesses, and a deed helps establish ownership and legal rights around these donations.

04

- Donors: If you are donating a valuable non-monetary item, such as real estate, artwork, or equipment, having a deed of in-kind gift protects your interests and provides proof of the transfer.

05

- Recipients of in-kind gifts: Individuals or organizations receiving in-kind gifts may require a deed to establish legal ownership and to clarify any terms or conditions associated with the gift.

06

It is important to consult legal professionals or seek expert advice specific to your situation to determine if a deed of in-kind gift is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete deed of in-kind gift online?

pdfFiller has made filling out and eSigning deed of in-kind gift easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in deed of in-kind gift?

The editing procedure is simple with pdfFiller. Open your deed of in-kind gift in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit deed of in-kind gift in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing deed of in-kind gift and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is deed of in-kind gift?

A deed of in-kind gift is a legal document used to transfer ownership of a property or asset from one individual or entity to another, where the transfer is made without monetary compensation. It typically reflects the value of donated items or services.

Who is required to file deed of in-kind gift?

Individuals or organizations that transfer property or assets as gifts without receiving payment are required to file a deed of in-kind gift, especially if the value of the gift exceeds a certain threshold that mandates reporting.

How to fill out deed of in-kind gift?

To fill out a deed of in-kind gift, include information such as the names of the donor and recipient, a description of the gift, its value, the date of the transfer, and both parties' signatures. It's important to follow any specific state forms and regulations.

What is the purpose of deed of in-kind gift?

The purpose of a deed of in-kind gift is to provide a formal record of the transfer of property or assets, ensuring legal recognition of the gift for both the donor and the recipient, and for tax purposes.

What information must be reported on deed of in-kind gift?

The deed of in-kind gift must report the donor's name, the recipient's name, a detailed description of the gift, its assessed value, the date of transfer, and both parties' signatures to validate the transaction.

Fill out your deed of in-kind gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of In-Kind Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.