UK VAT431NB 2021 free printable template

Show details

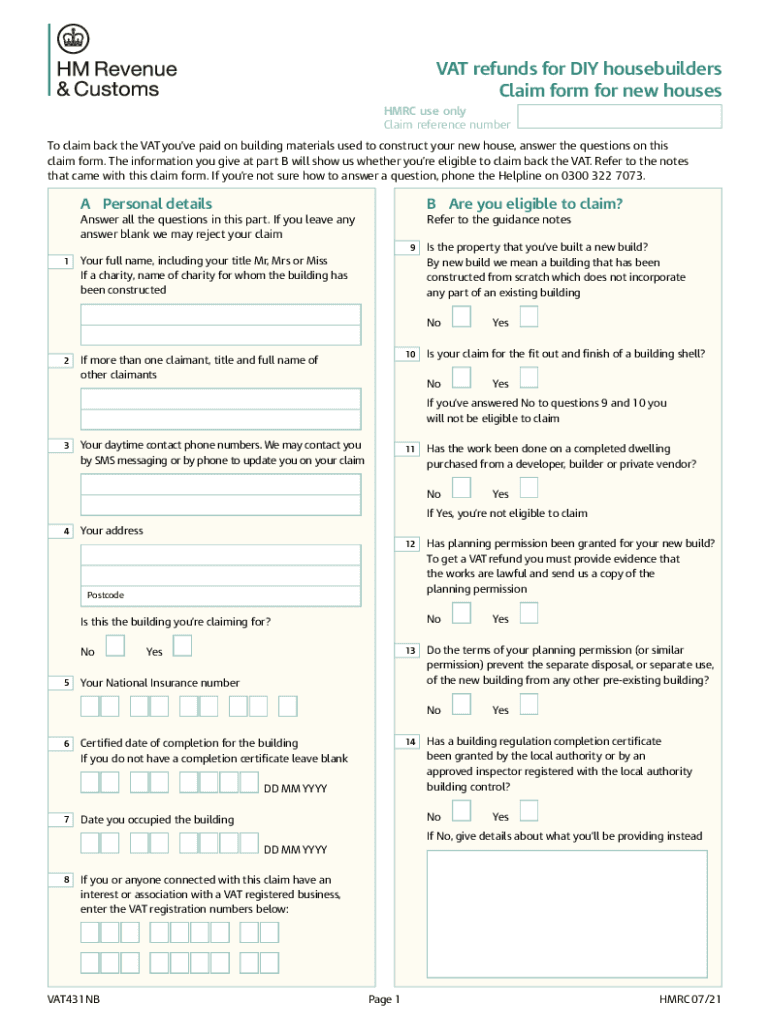

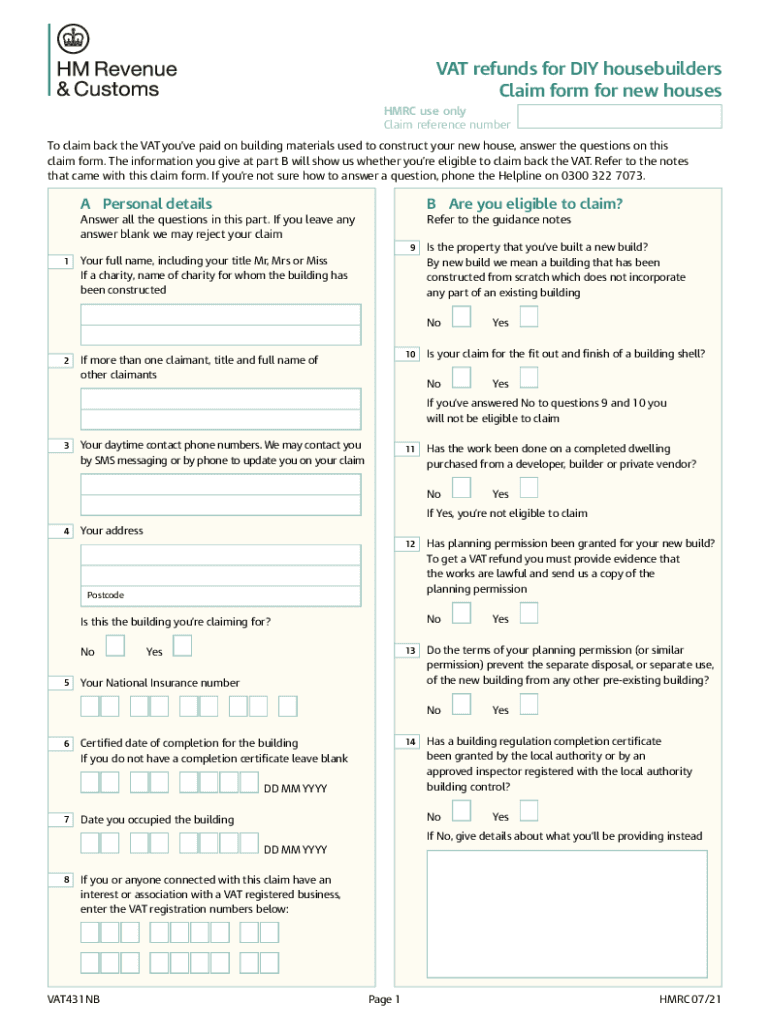

VAT refunds for DIY house builders Claim form for new houses HMRC use only Claim reference number To claim back the VAT you've paid on building materials used to construct your new house, answer the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK VAT431NB

Edit your UK VAT431NB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK VAT431NB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK VAT431NB online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK VAT431NB. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK VAT431NB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK VAT431NB

How to fill out UK VAT431NB

01

Begin by obtaining the UK VAT431NB form from the HMRC website or relevant tax office.

02

Fill in your VAT registration number at the top of the form.

03

Provide your business name and address in the designated sections.

04

Indicate the period for which you are claiming the refund.

05

Specify the amount of VAT you are claiming and include supporting documentation as required.

06

Sign and date the form at the bottom to validate your request.

07

Submit the completed form to HMRC either by post or through the online portal if available.

Who needs UK VAT431NB?

01

Businesses registered for VAT in the UK who are eligible to claim back VAT incurred on certain goods and services.

02

Companies or organizations that have purchased goods or services and have not yet claimed their VAT refund.

03

Any entity that has been operating and managing VAT in the UK and seeks a refund on overpaid VAT.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim VAT back on new windows?

DIY housebuilders can reclaim VAT on their windows and doors. They must initially pay the VAT on their purchase as normal, followed by completing the relevant form below. Then once they receive and send us their certificate/letter from HMRC, we can refund the VAT they initially paid.

Can you claim VAT back on building?

To claim back your VAT under the VAT Refunds For DIY Housebuilders scheme, you'll need to apply to HMRC by submitting a 431NB claim form for a new build, or a 431C form for a conversion. An application must be submitted within three months of completion, but it's best to do it as soon as possible.

Do you pay VAT on double glazed windows?

ing to section 2.18 of HMRC notice Notice 708/6 (Energy Saving Materials), double glazing is specifically excluded and attracts VAT at 20%. Target45Plus note that installing solar panels saves 0.5-1 tonne per year (5% VAT) and fitting double glazing saves at least one tonne per year (20% VAT).

Can you claim VAT back on a washing machine?

You're restricted from recovering VAT on things like refrigerators, washing machines, dishwashers, and so on. In addition, the treatment of flooring is quite important. You're not entitled to recover VAT on carpets, but if you lay down a hardwood floor, that VAT is recoverable.

Is VAT payable on replacement windows?

Despite being one of the most effective, and easiest, ways to reduce energy consumption in a home, double glazing is still liable for the full VAT charge of 20%.

How do I claim VAT back from Heathrow Airport?

You can either get paid immediately at a refund booth, for example at the airport, or send the approved form to the retailer or their refund company. The retailer will tell you how you'll get paid. If you're travelling to Great Britain the retailer will tell you if you need to send them copies of your travel documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete UK VAT431NB online?

Filling out and eSigning UK VAT431NB is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out UK VAT431NB using my mobile device?

Use the pdfFiller mobile app to fill out and sign UK VAT431NB on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit UK VAT431NB on an Android device?

The pdfFiller app for Android allows you to edit PDF files like UK VAT431NB. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is UK VAT431NB?

UK VAT431NB is a form used by businesses to claim VAT refunds in the UK, primarily for non-resident businesses that have incurred VAT on expenses related to services or goods purchased in the UK.

Who is required to file UK VAT431NB?

Non-resident businesses that have incurred VAT on goods or services bought in the UK and wish to reclaim this VAT are required to file UK VAT431NB.

How to fill out UK VAT431NB?

To fill out UK VAT431NB, businesses must provide details about their VAT refund claims, including their contact information, the VAT amount being claimed, and the nature of the purchases, ensuring all required supporting documentation is attached.

What is the purpose of UK VAT431NB?

The purpose of UK VAT431NB is to facilitate the process of reclaiming VAT for non-resident businesses that have incurred VAT expenses while operating in the UK.

What information must be reported on UK VAT431NB?

The information that must be reported includes the claimant's details, VAT registration number (if applicable), a breakdown of the VAT amounts being claimed, supporting documentation, and a declaration confirming the accuracy of the claim.

Fill out your UK VAT431NB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK vat431nb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.