FL DR-15N 2021 free printable template

Show details

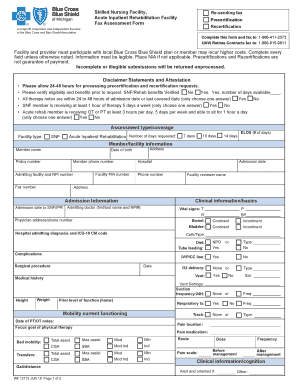

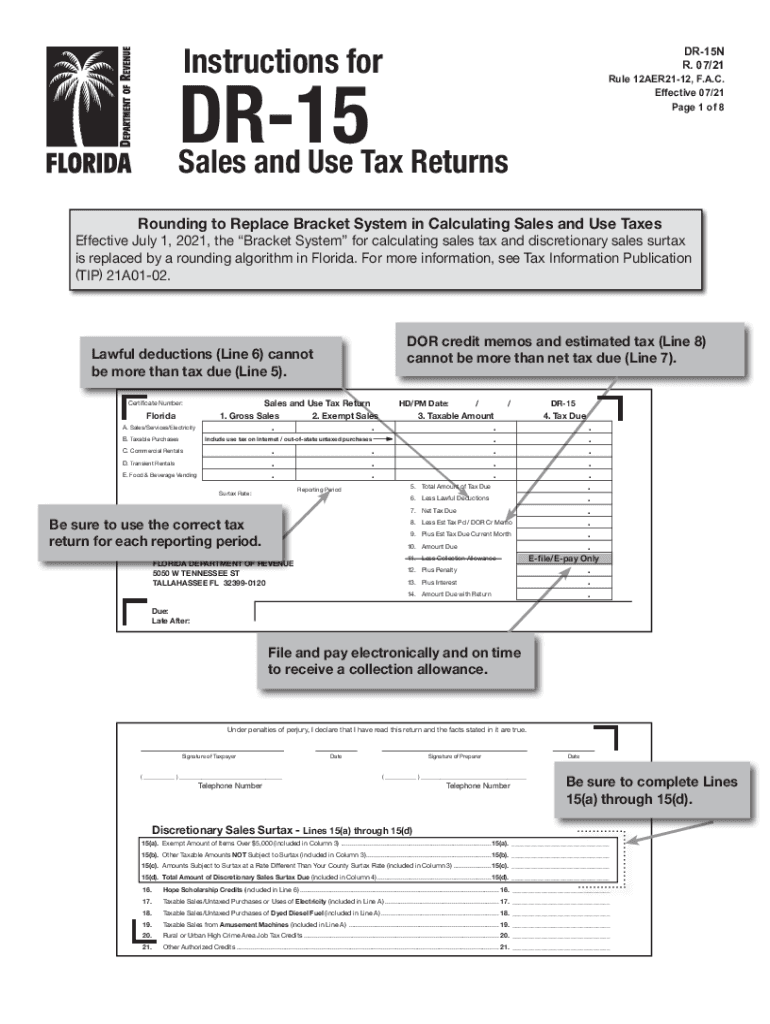

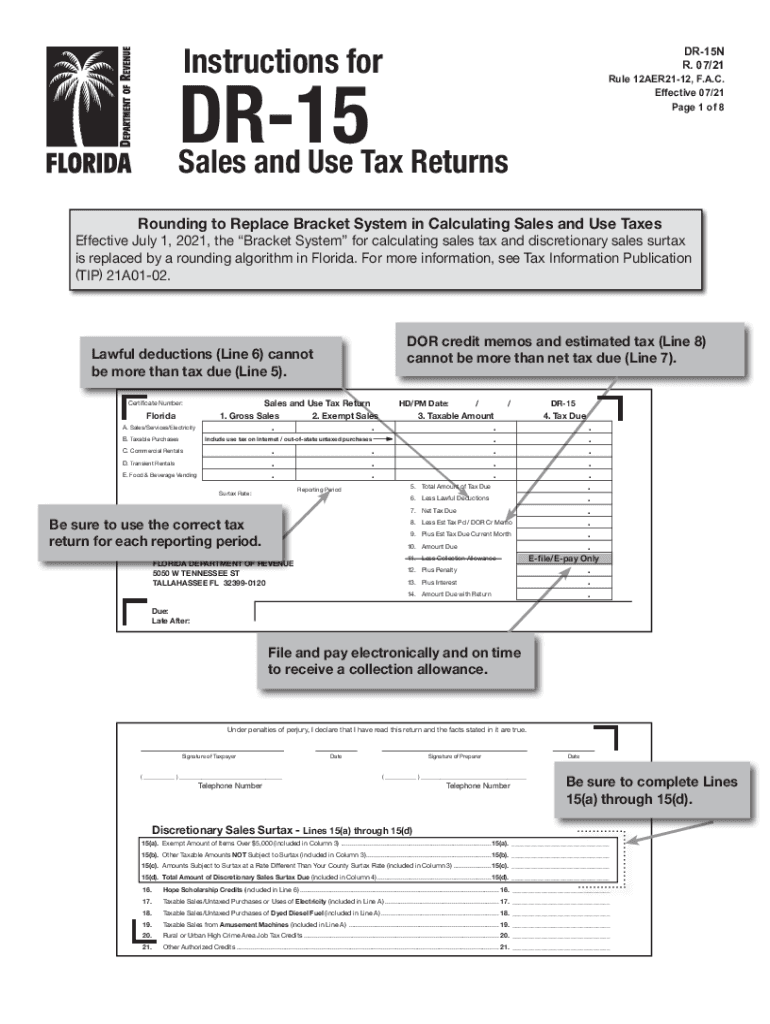

Instructions forDR15N R. 07/21DR15 Sales and Use Tax Returnable 12AER2112, F.A.C. Effective 07/21-Page 1 of 8Rounding to Replace Bracket System in Calculating Sales and Use Taxes Effective July 1,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-15N

Edit your FL DR-15N form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-15N form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DR-15N online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DR-15N. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-15N Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-15N

How to fill out FL DR-15N

01

Begin by downloading the FL DR-15N form from the official Florida Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Indicate the reason for filing the form by selecting the appropriate option provided.

04

Enter the relevant financial information as requested in the specific sections of the form.

05

Review all entries for accuracy and completeness to ensure no information is missing.

06

Sign and date the form at the designated area.

07

Submit the completed form via mail or in-person to the appropriate office as specified in the filing instructions.

Who needs FL DR-15N?

01

Individuals or businesses in Florida who are looking to claim a specific tax exemption or adjustment.

02

Taxpayers who have been notified by the Florida Department of Revenue to complete this form.

03

Anyone who wishes to report a change in their exemption status or correct previously filed information.

Fill

form

: Try Risk Free

People Also Ask about

How do I calculate Florida collection allowance for sales tax?

Be sure to calculate it correctly. The collection allowance is 2.5% (.025) of the first $1,200 of tax due, not to exceed $30 for each reporting location. If you have less than $1,200 in tax due, your collection allowance will be less than $30.

What is the interest on late sales tax in Florida?

Businesses who collect less than $1000 in sales taxes annually may file on a quarterly, semi-annual or annual basis. Florida assesses a late filing or late payment penalty of 10% if the return or payment of the tax is received later than the due date and charges interest at a 9% annual rate.

Do I need to file sales tax in Florida?

In Florida, you will be required to file and remit sales tax either monthly, quarterly, or annually. Florida sales tax returns are always due the last day of the month following the reporting period. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day.

Does everyone in Florida have to file sale tax?

A return must be filed for each reporting period, even if no tax is due. Taxpayers who paid $5,000 or more in sales and use tax during the most recent state fiscal year (July 1 - June 30) are required to file and pay electronically during the next calendar year.

How much is collection allowance for Florida sales tax?

When you electronically file your sales and use tax return and electronically pay timely, you are entitled to deduct a collection allowance. The collection allowance is 2.5% (.025) of the first $1,200 of tax due, not to exceed $30. You can sign up to receive due date reminder emails every reporting period.

How do I file sales and use tax in Florida?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Who is exempt from Florida sales tax?

Facilities that are registered as 501(c)(3) nonprofit, educational or charitable entities are free to purchase materials, supplies and most services without paying Florida sales tax.

Do I need to file a Florida state tax return?

Since Florida does not collect an income tax on individuals, you are not required to file a FL State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

How do I file for sales tax in Florida?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

What happens if you don't file taxes in Florida?

Tax Penalties in Florida If you don't owe any tax, the late filing penalty is $50 per month, up to a total of $300. If you have an unpaid tax bill for 90 days, the FL DOR will add an administrative collection processing fee of 10% of the balance.

How to calculate total discretionary sales surtax in Florida?

NOTE: TAX COLLECTION ALLOWNANCE CANNOT EXCEED $30.00. To figure the amount of Total Discretionary Sales Surtax to report, do the. following: Multiply the total Gross Sales Amount by 1.5%. Example: $1,161.53 X .015 = $17.42.

What is exempt from sales tax in Florida?

Florida offers generous exemptions to manufacturers. New machinery and equipment are not subject to Florida sales tax. Repair parts and labor to that machinery and equipment are also exempt. Utilities including electricity and natural gas consumed in production are exempt from Florida sales tax.

What is a DR 15 form in Florida?

If you only report tax collected for the lease or rental of commercial property (you have no other sales or untaxed purchases to report), you may use Form DR-15EZ to report sales and use tax due.

How do you calculate DR-15?

Total machine receipts ÷ Tax Rate Divisor = Gross Sales. Total machine receipts - Gross Sales = Tax Due, including discretionary sales surtax. Gross Sales x Surtax Rate = Discretionary Sales Surtax due.

How do I file a Florida sales tax return?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Does Florida require state tax filing?

Taxpayers are required to file Florida corporate income tax returns electronically if required to file federal income tax returns electronically, or if $5,000 or more in Florida corporate income tax was paid during the prior state fiscal year.

What form is used for Florida use tax?

If you're filing a use tax return to the Florida DOR, you can do that online or by completing ands submitting Form DR-15, Florida Sales and Use Tax Return, along with your use tax payment.

What form is used for Florida use tax?

Once registered, you will be sent a Certificate of Registration (Form DR-11), a Florida Annual Resale Certificate for Sales Tax (Form DR-13), and tax return forms. If you are registered to pay use tax only, you will not receive a resale certificate.

Is there a state tax form for Florida?

Since Florida does not collect an income tax on individuals, you are not required to file a FL State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

How much money do you have to make in Florida to file taxes?

For 2022, individuals making more than $12,950 and married couples filing jointly earning more than $25,900 are required to file taxes.

How do I file Florida sales tax?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Do I need to collect sales tax in Florida?

You'll need to collect sales tax in Florida if you have nexus there. There are two ways that sellers can be tied to a state when it comes to nexus: physical or economic. Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute FL DR-15N online?

With pdfFiller, you may easily complete and sign FL DR-15N online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in FL DR-15N without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your FL DR-15N, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete FL DR-15N on an Android device?

Complete your FL DR-15N and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is FL DR-15N?

FL DR-15N is a form used in Florida for reporting and calculating the corporate income tax for certain businesses, specifically for those with non-resident income.

Who is required to file FL DR-15N?

Businesses that have non-resident income in Florida and meet specific criteria set by the Florida Department of Revenue are required to file FL DR-15N.

How to fill out FL DR-15N?

To fill out FL DR-15N, businesses must provide identifying information, report their income, deductions, and calculate the tax liability, following the instructions provided by the Florida Department of Revenue.

What is the purpose of FL DR-15N?

The purpose of FL DR-15N is to determine and collect the corporate income tax owed by non-resident businesses that derive income from Florida sources.

What information must be reported on FL DR-15N?

FL DR-15N requires reporting of business income, deductions, contact information, and any applicable tax credits that impact the tax calculation.

Fill out your FL DR-15N online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-15n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.