Get the free Evaluating Your Estate Plan - Iowa State University Extension and ... - extension ia...

Show details

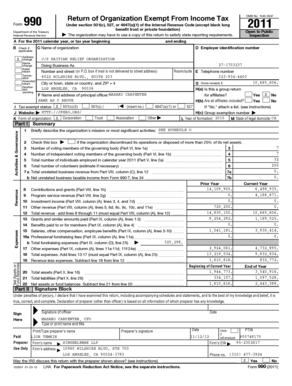

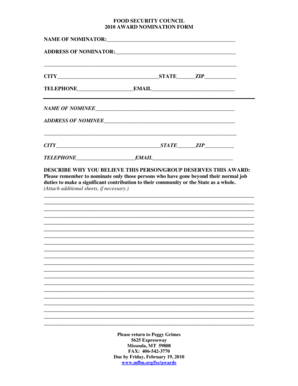

Help improve our materials by answering our on-line survey! Evaluating Your Estate Plan: Estate Planning Questionnaire Table of Contents I. II. III. Ag Decision Maker File C4-57 Personal and Family

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign evaluating your estate plan

Edit your evaluating your estate plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your evaluating your estate plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing evaluating your estate plan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit evaluating your estate plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out evaluating your estate plan

How to fill out evaluating your estate plan:

01

Start by reviewing your current estate plan documents, including your will, trust, power of attorney, and healthcare directives. Make sure they reflect your current wishes and circumstances.

02

Consider any changes in your life circumstances that may require updates to your estate plan. This could include marriage, divorce, birth of children, death of a beneficiary, or changes in your financial situation.

03

Evaluate your assets and ensure they are properly included in your estate plan. This may include real estate, investments, bank accounts, retirement accounts, and personal property.

04

Consider the distribution of your assets and determine if any changes or updates are necessary. You may want to update beneficiaries, revise the allocation of your assets, or create trusts for specific purposes.

05

Review and update your healthcare directives, including your living will and healthcare power of attorney. Ensure that your wishes regarding medical treatment and end-of-life care are clearly stated.

06

Consult with an estate planning attorney to review your plan and make any necessary modifications. They can provide guidance on tax-efficient strategies, asset protection, and ensuring that your plan is legally valid.

07

Communicate your estate plan with your loved ones and key individuals, such as your executor or trustee, to ensure they understand your wishes and can fulfill their roles effectively.

Who needs evaluating your estate plan?

01

Individuals who have not created an estate plan yet and want to ensure their assets are distributed according to their wishes.

02

Individuals who already have an estate plan but need to review and update it due to changes in their life circumstances or preferences.

03

Those who want to minimize estate taxes, protect assets, or plan for long-term care needs.

04

Parents who need to appoint guardians for minor children.

05

Those who want to ensure a smooth transition of assets and minimize family conflicts after their passing.

06

Individuals with complex or high-value estates who require specialized estate planning strategies.

07

Anyone who wants to have peace of mind knowing that their affairs are in order and their loved ones will be cared for according to their wishes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find evaluating your estate plan?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific evaluating your estate plan and other forms. Find the template you need and change it using powerful tools.

How can I edit evaluating your estate plan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing evaluating your estate plan, you need to install and log in to the app.

How do I edit evaluating your estate plan on an Android device?

You can make any changes to PDF files, like evaluating your estate plan, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is evaluating your estate plan?

Evaluating your estate plan involves reviewing and assessing the various components of your estate plan, such as wills, trusts, and beneficiary designations, to ensure they still align with your wishes and financial goals.

Who is required to file evaluating your estate plan?

There is no specific requirement to file evaluating your estate plan. It is a recommended process for individuals who have an existing estate plan or are in the process of creating one.

How to fill out evaluating your estate plan?

Evaluating your estate plan is not something that requires a specific form to be filled out. It involves a thorough review and analysis of your existing estate planning documents, including consulting with professionals such as attorneys or financial planners, to make any necessary updates or adjustments.

What is the purpose of evaluating your estate plan?

The purpose of evaluating your estate plan is to ensure that it remains up-to-date and meets your current objectives, financial situation, and any changes in applicable laws or regulations. It helps to identify any gaps or areas that may need attention or modification.

What information must be reported on evaluating your estate plan?

Evaluating your estate plan does not require any specific information to be reported. It is an internal review process to assess the adequacy and effectiveness of your estate planning strategies and documents.

Fill out your evaluating your estate plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Evaluating Your Estate Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.