Get the free Canada Life: Insurance, Investments, & Retirement

Show details

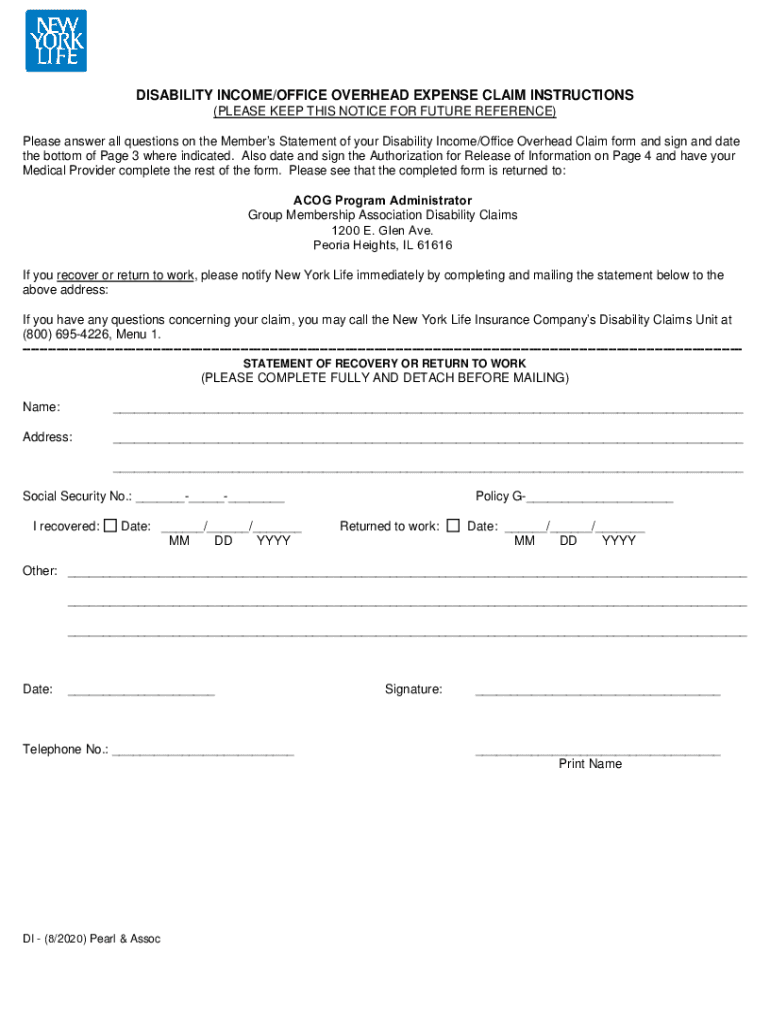

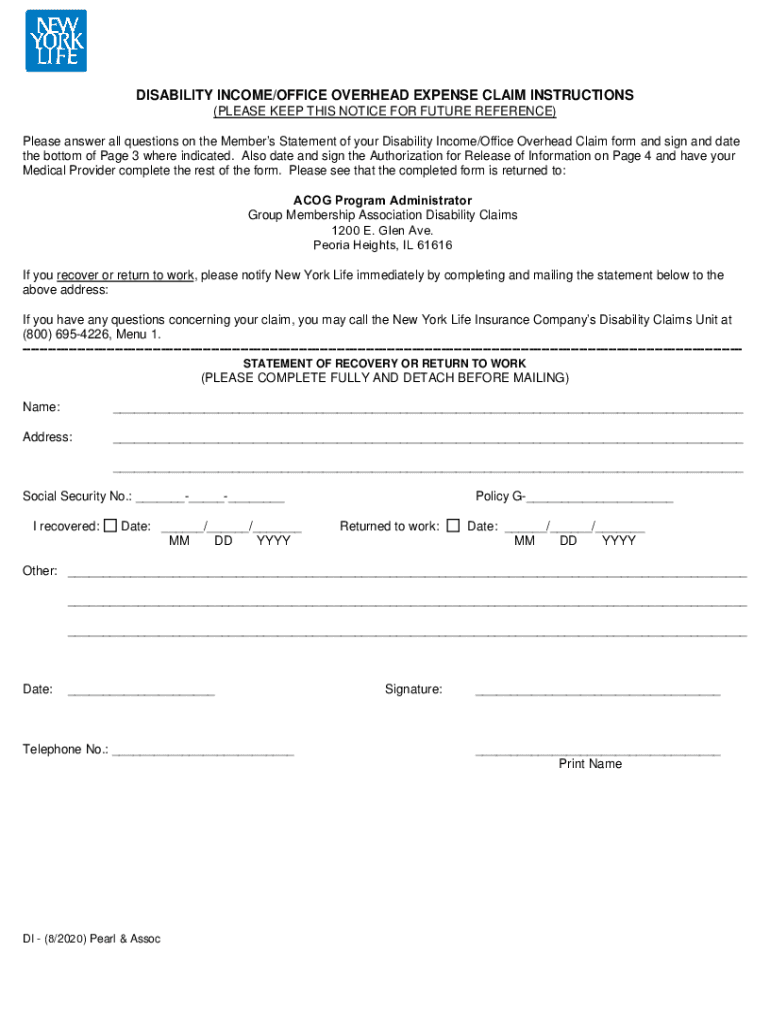

DISABILITY INCOME/OFFICE OVERHEAD EXPENSE CLAIM INSTRUCTIONS (PLEASE KEEP THIS NOTICE FOR FUTURE REFERENCE) Please answer all questions on the Members Statement of your Disability Income/Office Overhead

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canada life insurance investments

Edit your canada life insurance investments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada life insurance investments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canada life insurance investments online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit canada life insurance investments. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canada life insurance investments

How to fill out canada life insurance investments

01

To fill out Canada life insurance investments, follow these steps:

02

Gather all necessary documents such as identification, financial information, and personal health details.

03

Research and choose the type of life insurance investment that suits your needs and financial goals.

04

Contact a reputable Canada life insurance company or a licensed insurance agent for assistance.

05

Schedule a meeting with a representative to discuss your investment options and understand the terms and conditions.

06

Provide accurate and honest information during the application process.

07

Fill out the application form carefully, ensuring all details are complete and accurate.

08

Attach any required supporting documents as mentioned in the application form.

09

Double-check the filled application form for any errors or missing information.

10

Review the terms and conditions of the policy thoroughly before signing.

11

Submit the filled application form along with the required documentation.

12

Pay the applicable premiums or follow the payment instructions provided by the insurance company.

13

Wait for the verification and approval process to complete.

14

Once approved, review the policy document and keep a copy for future reference.

15

Follow any additional instructions provided by the insurance company for managing your investments.

16

Regularly review and assess your investment performance and make updates if necessary.

17

Note: It is recommended to consult with a financial advisor or an insurance expert before making any investment decisions.

Who needs canada life insurance investments?

01

Canada life insurance investments may be suitable for the following individuals or groups:

02

- Individuals who want to financially protect their loved ones in case of unexpected events or their premature death.

03

- People who want to accumulate savings over time through an investment-linked life insurance plan.

04

- Those who desire to leave a legacy or inheritance for their family or beneficiaries.

05

- Business owners who want to protect their business assets and ensure business continuity.

06

- Individuals with dependents or family members relying on their income to meet daily needs.

07

- Individuals with specific financial goals such as saving for retirement or children's education.

08

- People looking for tax-efficient ways to grow and manage their wealth.

09

- Those who want to have peace of mind and a sense of financial security.

10

It is recommended to assess personal financial goals, income, and risk tolerance before deciding if Canada life insurance investments are suitable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify canada life insurance investments without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including canada life insurance investments, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete canada life insurance investments online?

Easy online canada life insurance investments completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out canada life insurance investments on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your canada life insurance investments. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is canada life insurance investments?

Canada life insurance investments are financial products offered by insurance companies in Canada that allow policyholders to invest their premiums in various asset classes.

Who is required to file canada life insurance investments?

Insurance companies in Canada are required to file canada life insurance investments.

How to fill out canada life insurance investments?

Canada life insurance investments can be filled out by providing information on the investment products offered, premiums collected, and investment returns.

What is the purpose of canada life insurance investments?

The purpose of canada life insurance investments is to provide policyholders with the opportunity to grow their savings through investment options offered by insurance companies.

What information must be reported on canada life insurance investments?

Information such as premium income, investment portfolio, policyholder demographics, and investment returns must be reported on canada life insurance investments.

Fill out your canada life insurance investments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Life Insurance Investments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.