Get the free Retired certified accountant - Kelowna - Castanet Classifieds

Show details

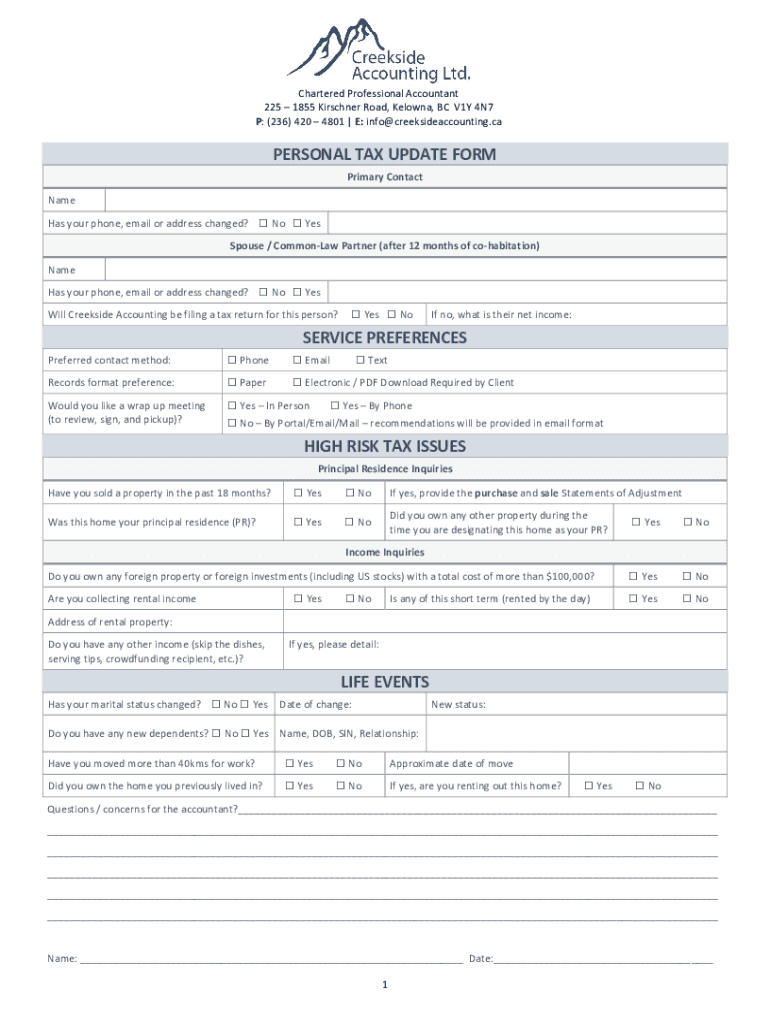

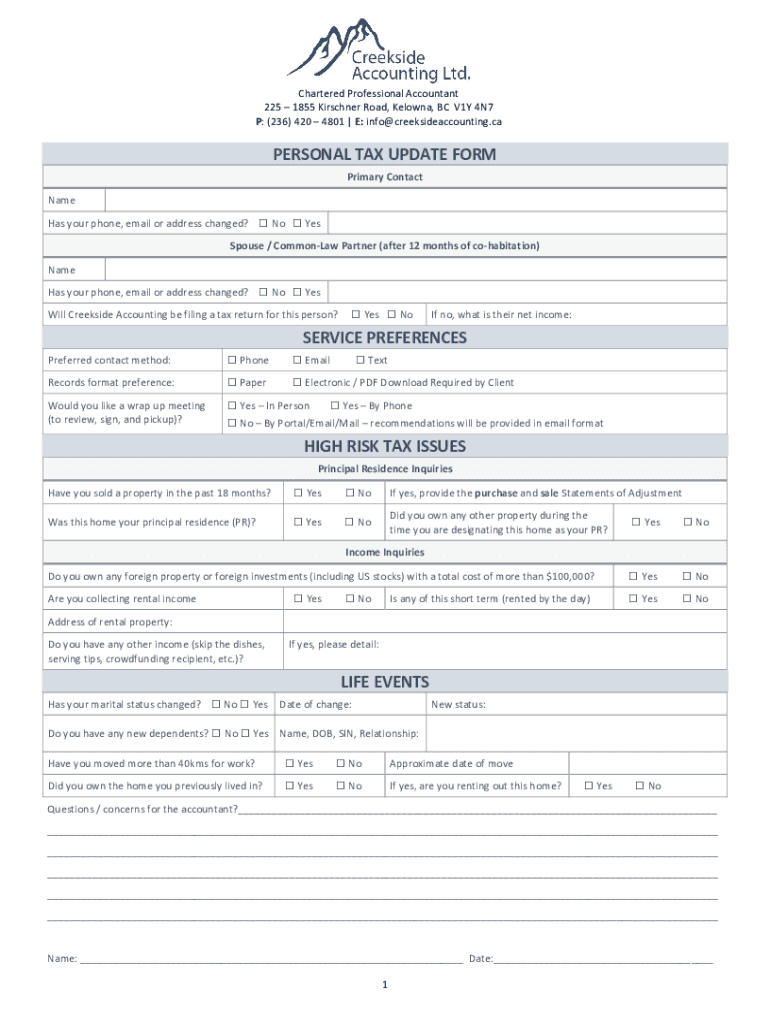

Chartered Professional Accountant 225 1855 Kirchner Road, Kelowna, BC V1Y 4N7 P: (236) 420 4801 E: info creeksideaccounting. Personal TAX UPDATE FORM Primary Contact Name Has your phone, email or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retired certified accountant

Edit your retired certified accountant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retired certified accountant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retired certified accountant online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit retired certified accountant. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retired certified accountant

How to fill out retired certified accountant

01

To fill out retired certified accountant, follow these steps:

02

Start by entering the retired certified accountant's personal information, such as their name, address, and contact details.

03

Provide details about their professional background, including the dates of their retirement, any professional certifications they hold, and their areas of expertise.

04

Include any relevant work experience, highlighting key roles and responsibilities they had in their career.

05

Mention any special achievements, awards, or recognition they received during their career as a certified accountant.

06

Add references or testimonials from previous employers or clients, showcasing their skills and expertise.

07

Include any additional information that may be relevant, such as their availability for part-time consulting or mentoring roles.

08

Double-check all the information provided to ensure accuracy and completeness.

09

Save the completed retired certified accountant form and submit it as per the instructions provided by the relevant authority or organization.

Who needs retired certified accountant?

01

Retired certified accountants are needed by various individuals and organizations, including:

02

- Individuals who require financial advice or assistance with tax planning and preparation.

03

- Businesses and corporations seeking accounting expertise to manage their financial records, analyze data, and ensure compliance with regulations.

04

- Non-profit organizations in need of financial guidance to manage their budgets and grants effectively.

05

- Government agencies and departments that require experienced professionals to handle complex accounting tasks and audits.

06

- Startups and small businesses looking for cost-effective accounting solutions and guidance.

07

- Educational institutions or professional training organizations in need of accounting instructors or consultants.

08

- Individuals or organizations involved in legal proceedings requiring financial expertise for litigation support or expert witness services.

09

- Self-employed individuals or freelancers who need help with bookkeeping, invoicing, or tax filings.

10

Overall, retired certified accountants can be valuable assets to anyone seeking financial expertise and guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my retired certified accountant directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your retired certified accountant and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for signing my retired certified accountant in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your retired certified accountant directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete retired certified accountant on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your retired certified accountant. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is retired certified accountant?

A retired certified accountant is an individual who was previously certified as an accountant but has since retired from active practice.

Who is required to file retired certified accountant?

Retired certified accountants are required to file their status with the appropriate governing body or regulatory agency.

How to fill out retired certified accountant?

To fill out the retired certified accountant status, individuals must typically submit a formal notification to the governing body or regulatory agency.

What is the purpose of retired certified accountant?

The purpose of filing as a retired certified accountant is to inform the governing body or regulatory agency that the individual is no longer actively practicing as an accountant.

What information must be reported on retired certified accountant?

The information typically reported on retired certified accountant status includes the individual's name, certification number, date of retirement, and any other requested details.

Fill out your retired certified accountant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retired Certified Accountant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.