MO DoR 4458 2010 free printable template

Show details

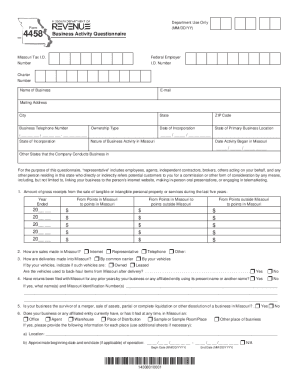

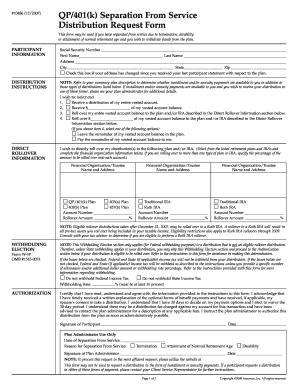

Signature of Preparer Printed Name Title Signature of Officer Form 4458 Revised 12-2014 Mail to Missouri Department of Revenue Phone 573 522-4989 Visit Taxation Division Fax 573 522-1721 dor. mo. gov/business/ for additional information. P. O. Box 295 E-mail nexus dor. mo. gov Jefferson City MO 65105-0295. Reset Form Form Print Form Department Use Only MM/DD/YY Missouri Department of Revenue Business Activity Questionnaire Missouri Tax I. Declar...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 573 522 4989

Edit your 573 522 4989 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 573 522 4989 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 573 522 4989 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 573 522 4989. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 4458 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 573 522 4989

How to fill out MO DoR 4458

01

Obtain a copy of the MO DoR 4458 form from the official website or local office.

02

Fill out the personal identification section with your name, address, and contact information.

03

Provide the relevant tax identification numbers as required.

04

Complete the financial information section, including income and deductions.

05

Review all entries to ensure accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate department by the deadline.

Who needs MO DoR 4458?

01

Individuals or entities filing state taxes in Missouri that require special consideration or exemptions.

02

Taxpayers seeking to claim deductions or credits specific to the Missouri Department of Revenue.

03

Businesses needing to report specific financial information or adjustments related to state tax.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to attach federal tax return to state tax return?

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.

Does Missouri require a copy of the federal tax return?

You must allocate your Missouri source income on Form MO-NRI and complete Form MO-1040. You must include a copy of your federal return with your state return.

Is Missouri a no return required military?

The military pay of nonresident military personnel stationed in Missouri due to military orders is not taxable to Missouri. If you are a servicemember and earned only military income while stationed in Missouri, complete a No Return Required-Military online form at the following link: Military No Return Required.

What is the phone number for the Missouri sales tax department?

Contact the Missouri Department of Revenue or call 573-751-9268, for assistance.

What is the phone number for Missouri refund status?

Then, click “Check Status”. You may also call 573-751-3505.

How do I talk to someone at the Missouri DMV?

Phone Numbers Phone-In License Plate Renewals (call to confirm eligibility) Services Available: Monday - Friday, 8 a.m. to 4:30 p.m. Motor Vehicle Titling & Registration (general) 573-526-3669. Child Support Liens. 573-526-3669. Dealer Licensing Office. 573-526-3669. Dealer Complaint Line. 800-887-3994.

How do I talk to a real person at the Missouri Department of Revenue?

State of Missouri: Department of Revenue (573) 751-4450. Automated Tax Credit Status. (573) 526-8299. Property Tax Credit Claim. (573) 751-3505.

What is the phone number for Missouri withholding employer?

Missouri Withholding Account Number If you're unable to locate this, contact the agency at (573) 751-8750.

What is the 8 digit tax ID number in Missouri?

Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes and is included on your sales tax license. Your PIN is a 4 digit number located on the cover of your voucher booklet or return.

How long is a Missouri tax ID number?

Withholding account number (Tax Identification Number) If you've run payroll in the past in MO, you can find your 8-digit Missouri Tax ID Number by: Reviewing the Employer's Return of Income Taxes Withheld (Form MO-941) received from the MO Department of Revenue or; Calling the agency at (573) 751-3505.

What is the number for Missouri state refund?

You may also call 573-751-3505.

How do I talk to someone at the Missouri Department of Revenue?

State of Missouri: Department of Revenue (573) 751-4450. Automated Tax Credit Status. (573) 526-8299. Property Tax Credit Claim. (573) 751-3505.

Why do I need a Missouri tax ID number?

Employer Withholding Tax - Every employer maintaining an office or transacting any business within the state of Missouri and making payment of wages to a resident or nonresident individual must obtain a Missouri Employer Tax Identification Number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 573 522 4989 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 573 522 4989 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the 573 522 4989 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 573 522 4989 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out 573 522 4989 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 573 522 4989. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MO DoR 4458?

MO DoR 4458 is a tax form used in the state of Missouri for reporting certain business-related activities or transactions, specifically pertaining to the reporting of nonresident income.

Who is required to file MO DoR 4458?

Businesses or individuals who have nonresident income in Missouri, or engage in transactions that necessitate reporting under this form, are required to file MO DoR 4458.

How to fill out MO DoR 4458?

To fill out MO DoR 4458, taxpayers should provide personal and business identification details, report income earned in Missouri, deduct any allowable expenses, and ensure all required fields are completed accurately.

What is the purpose of MO DoR 4458?

The purpose of MO DoR 4458 is to ensure that nonresident income earned in Missouri is reported and taxed appropriately according to Missouri state tax law.

What information must be reported on MO DoR 4458?

The information that must be reported on MO DoR 4458 includes the taxpayer's identification details, the amount of nonresident income earned, deductions, and other relevant financial information as specified in the instructions for the form.

Fill out your 573 522 4989 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

573 522 4989 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.