Get the free ELKHART COUNTY ESTATE PLANNING COUNTY MEMBERSHIP FORM

Show details

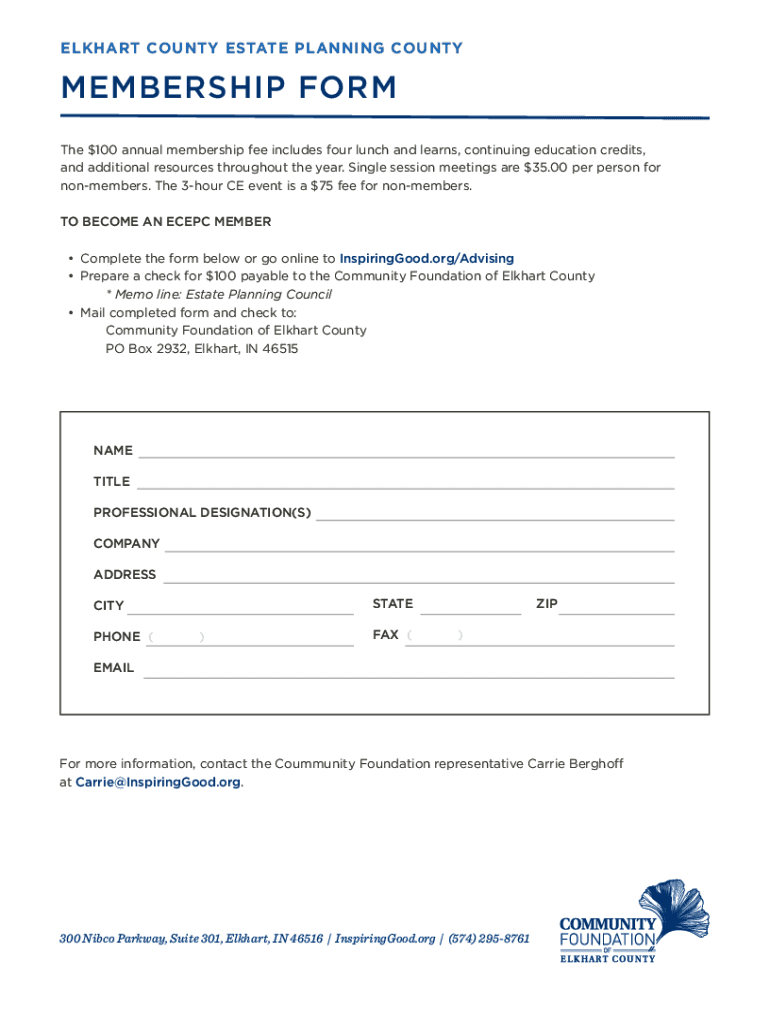

ELKHART COUNTY ESTATE PLANNING COUNTYMEMBERSHIP FORM The $100 annual membership fee includes four lunch and learns, continuing education credits, and additional resources throughout the year. Single

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign elkhart county estate planning

Edit your elkhart county estate planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your elkhart county estate planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing elkhart county estate planning online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit elkhart county estate planning. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out elkhart county estate planning

How to fill out elkhart county estate planning

01

To fill out Elkhart County estate planning, follow these steps:

02

Gather all important documents related to your assets, such as property deeds, bank statements, investment statements, and insurance policies.

03

Make a list of all your assets, including real estate, bank accounts, investments, vehicles, and personal belongings.

04

Determine how you want your assets to be distributed after your death. Consider who you want to be the beneficiaries and what specific instructions you have for each asset.

05

Consult with an estate planning attorney in Elkhart County to create the necessary legal documents, such as a will, trust, power of attorney, and healthcare directives.

06

Review and revise your estate planning documents periodically as your circumstances and wishes may change.

07

Make sure to inform your loved ones about your estate planning decisions and provide them with necessary information to access your documents in case of your incapacity or death.

08

Store your estate planning documents in a safe and accessible place, and consider sharing copies with your attorney and trusted family members.

09

Update your estate planning documents whenever there are major changes in your life, such as marriage, divorce, birth of a child, or acquisition of new assets.

Who needs elkhart county estate planning?

01

Elkhart County estate planning is recommended for anyone who wants to ensure their assets are distributed according to their wishes after their death. It is especially important for individuals with significant assets, dependents, or specific instructions for their assets. Estate planning can also provide tools for incapacity planning, allowing someone to make healthcare and financial decisions on your behalf if you become unable to do so. Ultimately, anyone who wants control over their assets and desires to minimize potential conflicts among family members should consider Elkhart County estate planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get elkhart county estate planning?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific elkhart county estate planning and other forms. Find the template you need and change it using powerful tools.

How do I execute elkhart county estate planning online?

pdfFiller has made it easy to fill out and sign elkhart county estate planning. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit elkhart county estate planning straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing elkhart county estate planning.

What is elkhart county estate planning?

Elkhart County estate planning is the process of arranging for the management and distribution of a person's assets and affairs after their passing.

Who is required to file elkhart county estate planning?

Individuals with assets and properties in Elkhart County may be required to file estate planning documents.

How to fill out elkhart county estate planning?

To fill out Elkhart County estate planning documents, you may need to consult with legal professionals or estate planning experts.

What is the purpose of elkhart county estate planning?

The purpose of Elkhart County estate planning is to ensure that a person's assets are distributed according to their wishes and to minimize estate taxes and legal complications.

What information must be reported on elkhart county estate planning?

Information such as assets, debts, beneficiaries, and executor names may need to be reported on Elkhart County estate planning documents.

Fill out your elkhart county estate planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Elkhart County Estate Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.