Get the free 19 Depreciation and depletion

Show details

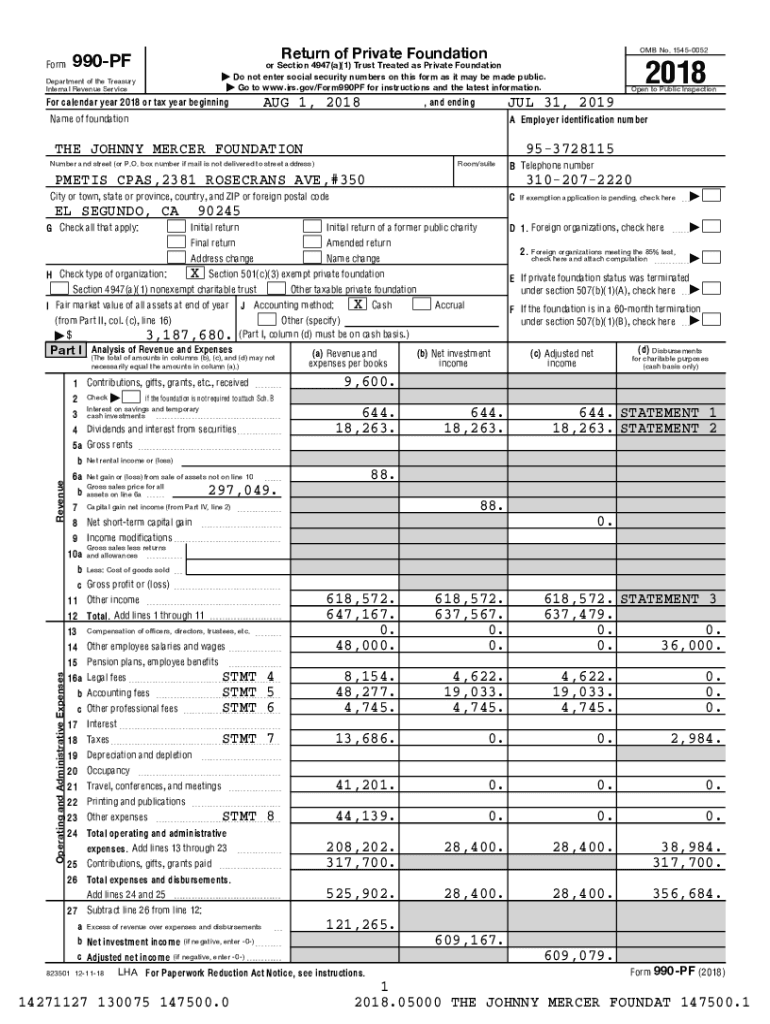

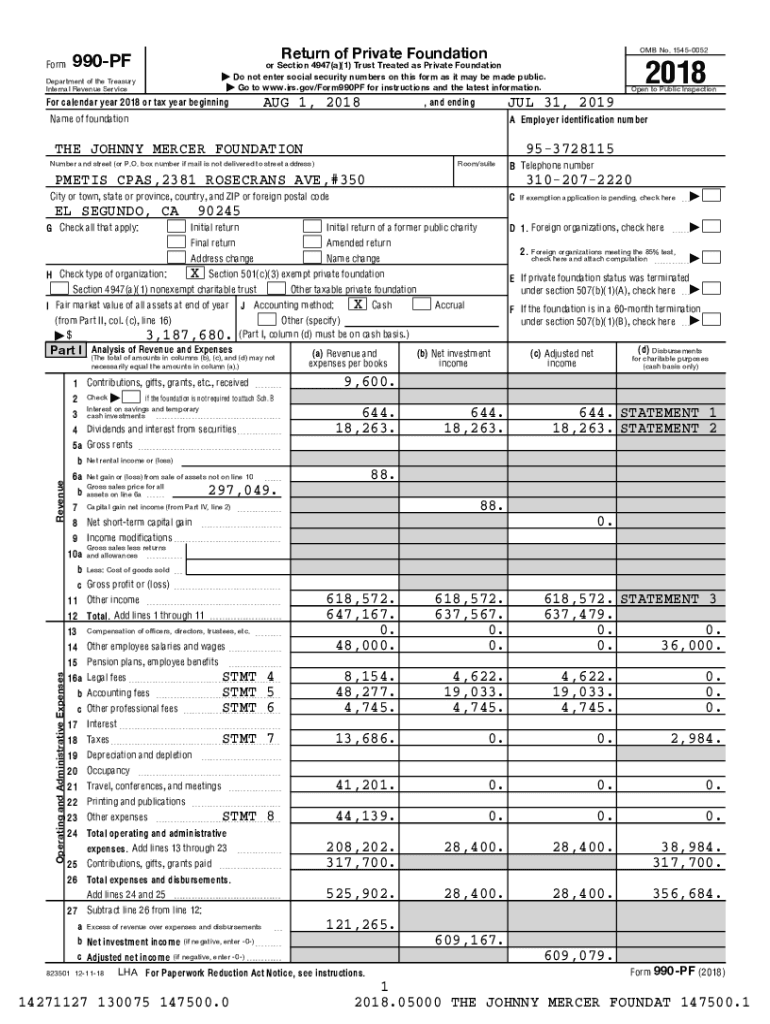

Return of Private Foundation990PFFormOMB No. 15450052Department of the Treasury Internal Revenue Service AUG 1, 2018For calendar year 2018 or tax year beginning 31, 2019, and endgame of foundation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 19 depreciation and depletion

Edit your 19 depreciation and depletion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 19 depreciation and depletion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 19 depreciation and depletion online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 19 depreciation and depletion. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 19 depreciation and depletion

How to fill out 19 depreciation and depletion

01

Step 1: Start by gathering all relevant information about the assets that you want to calculate depreciation and depletion for.

02

Step 2: Determine the useful life of each asset. This is the estimated period over which the asset will be used or the resource will be depleted.

03

Step 3: Calculate the depreciation expense for each asset. This can be done using various methods such as straight-line depreciation, declining balance method, or units of production method.

04

Step 4: Record the depreciation expense in the appropriate account in your financial statements.

05

Step 5: Calculate depletion if you are dealing with natural resources. This involves determining the depletion rate and applying it to the quantity of resources extracted.

06

Step 6: Record the depletion expense in the appropriate account in your financial statements.

07

Step 7: Review and update the depreciation and depletion calculations regularly to reflect any changes in asset values or resource quantities.

08

Step 8: Consult with a professional accountant or tax advisor if you have any doubts or questions about the depreciation and depletion process.

Who needs 19 depreciation and depletion?

01

Companies that own and use tangible assets, such as buildings, machinery, vehicles, etc., need to track and account for depreciation.

02

Industries involved in extracting natural resources, such as mining or oil drilling, need to calculate and report depletion expenses.

03

Financial professionals, including accountants, auditors, and financial analysts, need to understand and analyze depreciation and depletion for accurate financial reporting and decision-making.

04

Regulatory bodies and tax authorities may require businesses to calculate and disclose depreciation and depletion for compliance and tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 19 depreciation and depletion to be eSigned by others?

To distribute your 19 depreciation and depletion, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the 19 depreciation and depletion in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 19 depreciation and depletion and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit 19 depreciation and depletion on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 19 depreciation and depletion on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is 19 depreciation and depletion?

19 depreciation and depletion refers to the reduction in value of assets and depletion of natural resources over time.

Who is required to file 19 depreciation and depletion?

Businesses and individuals who own assets or natural resources that are subject to depreciation and depletion are required to file 19 depreciation and depletion.

How to fill out 19 depreciation and depletion?

To fill out 19 depreciation and depletion, one must accurately report the depreciation expenses and depletion costs incurred during the reporting period.

What is the purpose of 19 depreciation and depletion?

The purpose of 19 depreciation and depletion is to accurately reflect the decrease in value of assets and the depletion of natural resources over time, allowing for proper financial reporting and tax deductions.

What information must be reported on 19 depreciation and depletion?

The information that must be reported on 19 depreciation and depletion includes details of assets subject to depreciation, depletion costs for natural resources, and the calculation of depreciation and depletion expenses.

Fill out your 19 depreciation and depletion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

19 Depreciation And Depletion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.