Get the free Retirement Topics LoansInternal Revenue Service

Show details

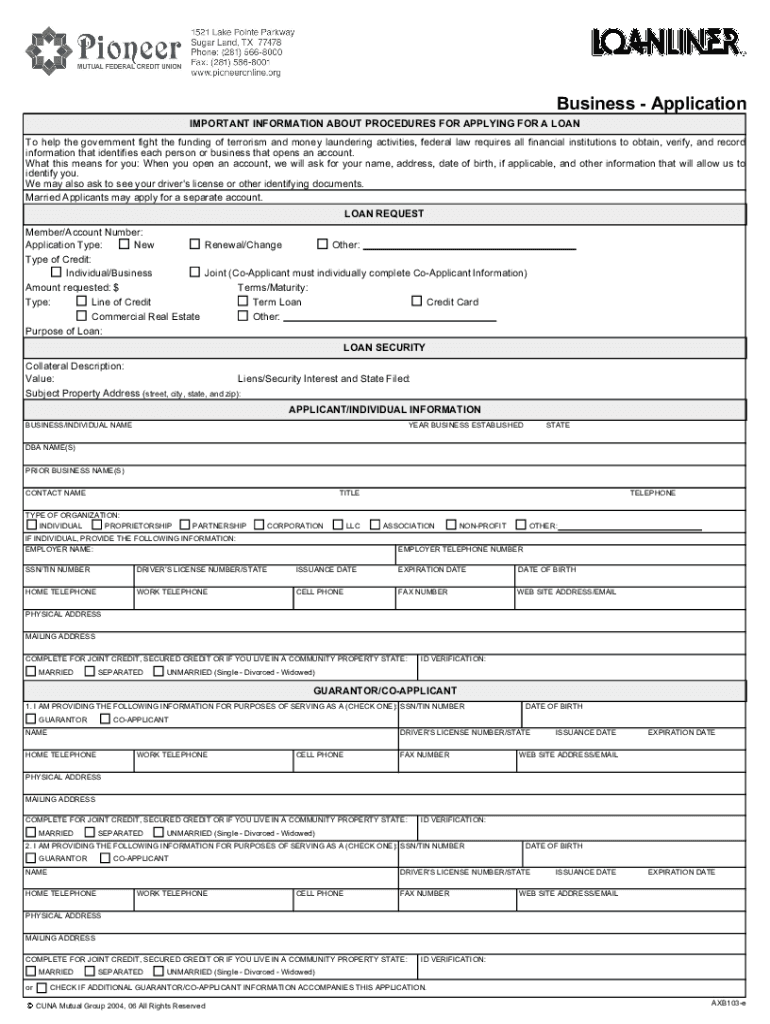

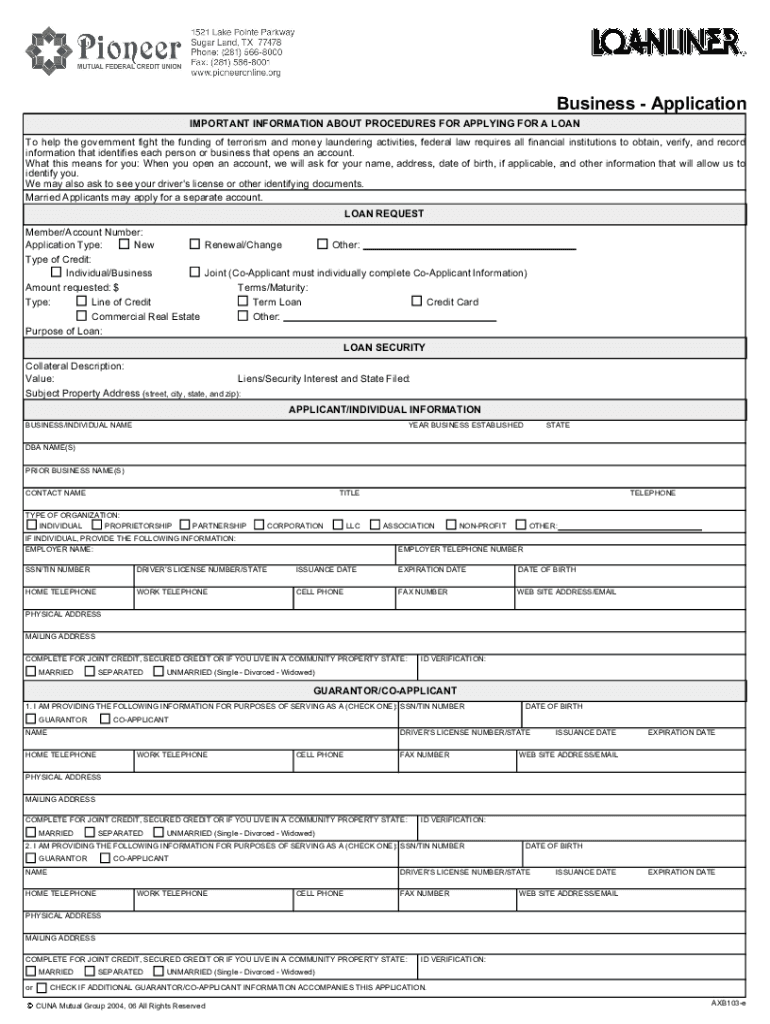

EQUIPMENT LOAN REQUIREMENT LOAN AMOUNT: LOAN TERM: INTEREST RATE: PROCESSING FEE: LOAN COLLATERAL:MAXIMUM $50,000 MAXIMUM 72 MONTHS AS PER RATE & FEE SCHEDULE AS PER RATE & FEE SCHEDULE FIRST LIEN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement topics loansinternal revenue

Edit your retirement topics loansinternal revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement topics loansinternal revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement topics loansinternal revenue online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retirement topics loansinternal revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement topics loansinternal revenue

How to fill out retirement topics loansinternal revenue

01

To fill out retirement topics loans internal revenue, follow these steps:

02

Gather all the necessary information and documentation such as your retirement account details, loan details, and any other relevant documents.

03

Access the Internal Revenue Service (IRS) website or visit your local IRS office to obtain the required forms for retirement topics loans.

04

Fill out the forms accurately and completely with the requested information. This may include details about the loan amount, repayment terms, retirement account information, etc.

05

Double-check all the information provided to ensure its accuracy and validity.

06

Submit the filled-out forms to the appropriate authority or office, either online or in person.

07

Keep a copy of the filled-out forms and any supporting documents for your records.

08

Follow any additional instructions or requirements provided by the IRS or your retirement account provider to complete the process successfully.

09

Monitor the status of your loan application or any further communication from the IRS or your retirement account provider regarding the loan.

10

If approved, ensure timely repayment of the loan according to the agreed-upon terms to avoid any penalties or potential negative impacts on your retirement savings.

11

Seek professional advice or guidance if you have any doubts or questions during the process.

Who needs retirement topics loansinternal revenue?

01

Retirement topics loans internal revenue may be needed by individuals who:

02

- Are planning to borrow against their retirement savings for certain purposes.

03

- Need additional funds for essential expenses or unexpected financial emergencies.

04

- Want to take advantage of potential tax advantages or benefits associated with retirement loans.

05

- Wish to explore alternative borrowing options rather than traditional loans from financial institutions.

06

- Have a well-defined repayment plan and the ability to repay the loan without jeopardizing their retirement savings goals.

07

- Have thoroughly evaluated the potential risks and benefits associated with borrowing against their retirement accounts.

08

- Comply with the eligibility criteria and requirements set by the IRS or their retirement account provider.

09

- Seek professional financial advice to ensure making informed decisions regarding retirement loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send retirement topics loansinternal revenue to be eSigned by others?

Once you are ready to share your retirement topics loansinternal revenue, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find retirement topics loansinternal revenue?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific retirement topics loansinternal revenue and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute retirement topics loansinternal revenue online?

Easy online retirement topics loansinternal revenue completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is retirement topics loansinternal revenue?

Retirement topics loansinternal revenue refers to loans or distributions taken from retirement accounts that may be subject to taxation.

Who is required to file retirement topics loansinternal revenue?

Individuals who have taken loans or distributions from their retirement accounts are required to report it on their tax return.

How to fill out retirement topics loansinternal revenue?

To fill out retirement topics loansinternal revenue, individuals must include the relevant information on their tax return forms, such as the amount of the loan or distribution and any tax withholding.

What is the purpose of retirement topics loansinternal revenue?

The purpose of retirement topics loansinternal revenue is to ensure that individuals accurately report any loans or distributions taken from their retirement accounts and pay any applicable taxes.

What information must be reported on retirement topics loansinternal revenue?

Information such as the amount of the loan or distribution, any tax withholding, and any applicable tax rules must be reported on retirement topics loansinternal revenue.

Fill out your retirement topics loansinternal revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Topics Loansinternal Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.