Get the free Fair Credit Reporting Act - Consumer Information

Show details

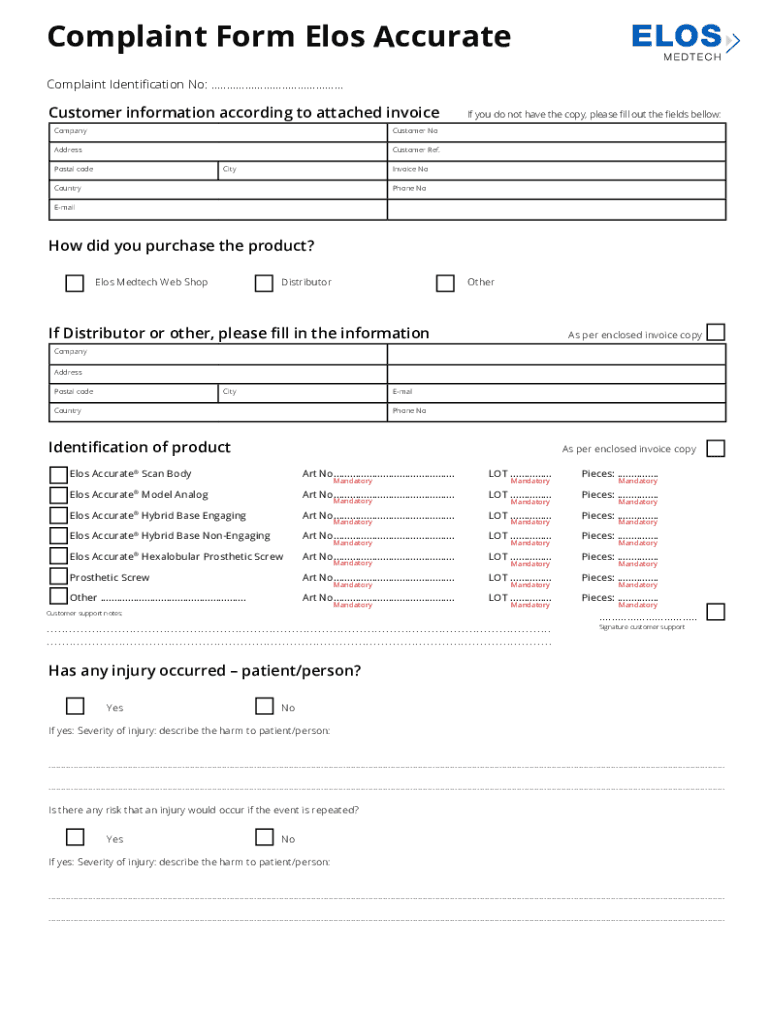

Complaint Form Los Accurate Complaint Identification No: ........................................... Customer information according to attached invoiceCompanyCustomer NoAddressCustomer Ref. Postal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair credit reporting act

Edit your fair credit reporting act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair credit reporting act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fair credit reporting act online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fair credit reporting act. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair credit reporting act

How to fill out fair credit reporting act

01

To fill out the Fair Credit Reporting Act (FCRA), follow these steps:

02

Obtain the FCRA form or download it from a reputable source.

03

Read the instructions provided with the form thoroughly to understand the requirements and guidelines.

04

Gather all the necessary information required for the form, such as your personal details, credit information, and any specific incidents or disputes you want to report.

05

Start filling out the form by entering your personal information accurately, including your full name, address, social security number, and contact details.

06

Provide your consent and authorization for the credit reporting agencies to disclose your credit information to potential creditors.

07

Describe the incidents or disputes you want to report clearly and concisely, providing any supporting documentation if required.

08

Double-check all the information you have entered to ensure accuracy and completeness.

09

Sign and date the form to acknowledge that the information provided is true and accurate to the best of your knowledge.

10

Make a copy of the filled-out form for your records.

11

Submit the completed FCRA form to the designated credit reporting agency via mail or online, as per their instructions.

12

Follow up with the credit reporting agency to ensure that your form has been received and processed.

13

Note: It is recommended to consult legal professionals or credit counseling agencies for assistance in filling out the FCRA form if you have any doubts or concerns.

Who needs fair credit reporting act?

01

The Fair Credit Reporting Act is relevant and needed by various entities and individuals, including:

02

- Consumers: Consumers who want to ensure accuracy and fairness in their credit reports, protect their credit rights, and address any discrepancies or errors in their credit information.

03

- Creditors: Creditors who use credit reports to make informed decisions regarding lending money or extending credit to individuals.

04

- Credit Reporting Agencies: Credit reporting agencies that collect, maintain, and provide credit information to creditors and other authorized parties.

05

- Employers: Employers who utilize credit reports in the hiring and employment process, subject to legal requirements and restrictions.

06

- Landlords: Landlords who rely on credit reports to assess the creditworthiness and rental history of potential tenants.

07

- Financial Institutions: Financial institutions that require credit reports for opening bank accounts, approving loans, or issuing credit cards.

08

It is important to note that compliance with the FCRA is essential for all these entities to protect the rights and privacy of individuals and ensure accurate credit reporting practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fair credit reporting act for eSignature?

When you're ready to share your fair credit reporting act, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete fair credit reporting act online?

Easy online fair credit reporting act completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit fair credit reporting act on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fair credit reporting act from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is fair credit reporting act?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer credit information.

Who is required to file fair credit reporting act?

Credit reporting agencies and certain businesses that provide consumer credit reports are required to comply with the Fair Credit Reporting Act.

How to fill out fair credit reporting act?

To comply with the Fair Credit Reporting Act, businesses must follow specific procedures when collecting, using, and sharing consumer credit information.

What is the purpose of fair credit reporting act?

The main purpose of the Fair Credit Reporting Act is to protect consumers' privacy and ensure the accuracy and fairness of the information in their credit reports.

What information must be reported on fair credit reporting act?

Credit reporting agencies must report accurate and up-to-date information about consumers' credit history, including their payment history, outstanding debts, and credit limits.

Fill out your fair credit reporting act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Credit Reporting Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.