Get the free EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE ...

Show details

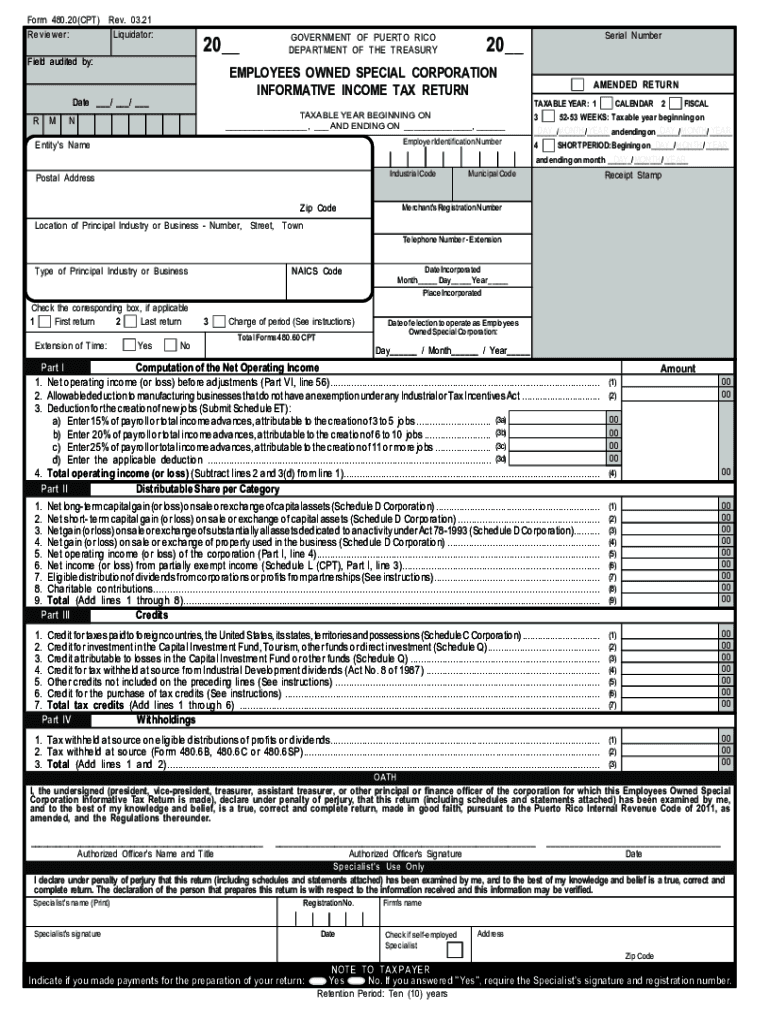

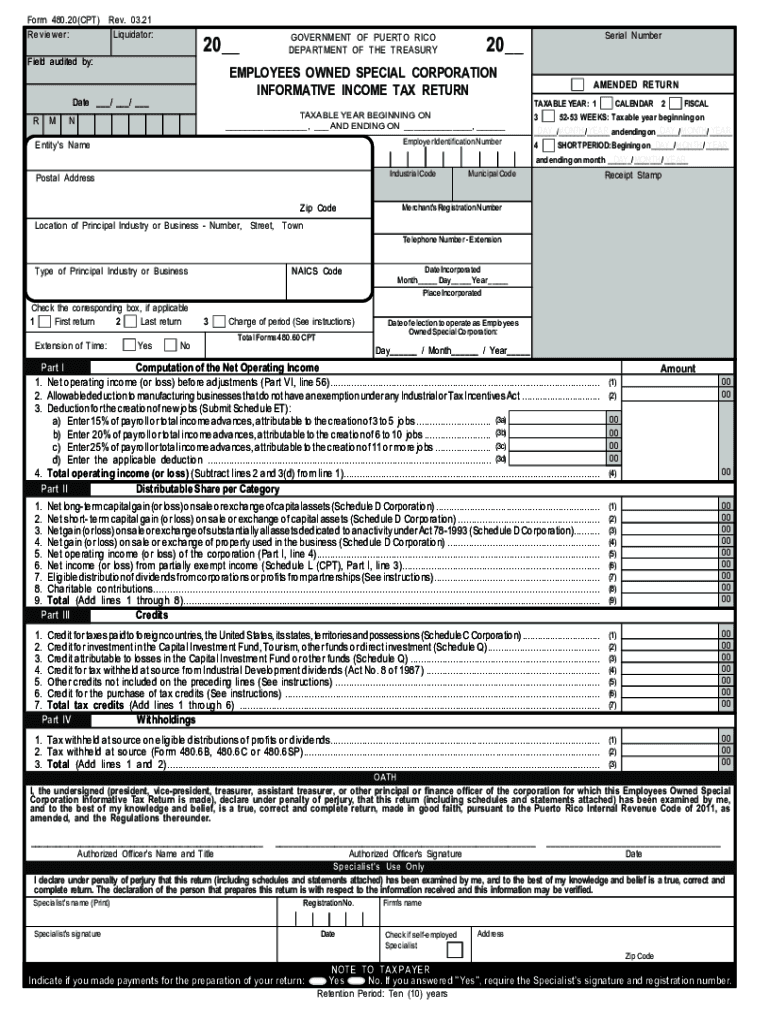

Form 480.20(CPT) Rev. 03.21 Liquidator: Reviewer:20 Field audited by:Serial Number20 EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE INCOME TAX Returnable / / GOVERNMENT OF PUERTO RICO DEPARTMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employees owned special corporation

Edit your employees owned special corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employees owned special corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employees owned special corporation online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employees owned special corporation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employees owned special corporation

How to fill out employees owned special corporation

01

Obtain the necessary legal documents and forms required to set up an employees owned special corporation.

02

Identify the employees who will become shareholders and owners of the corporation.

03

Determine the roles and responsibilities of each employee-shareholder within the corporation.

04

Decide on the ownership structure and distribution of shares among the employees.

05

Consider consulting with a legal professional or specialist in employee ownership to ensure compliance with applicable laws and regulations.

06

Complete and file the necessary paperwork with the appropriate government agencies to officially form the employees owned special corporation.

07

Establish effective communication channels and decision-making processes within the corporation to ensure smooth operation and collaboration among the employee-owners.

08

Develop a comprehensive plan for the financial management, governance, and long-term sustainability of the corporation.

09

Provide ongoing training and education for the employee-owners to enhance their understanding of the corporation and their roles as shareholders.

10

Regularly review and evaluate the performance and progress of the employees owned special corporation, making necessary adjustments and improvements as needed.

Who needs employees owned special corporation?

01

Small and medium-sized businesses looking to enhance employee engagement and motivation.

02

Companies aiming to align employee interests with company success and financial performance.

03

Organizations interested in fostering a culture of ownership and shared responsibility among their employees.

04

Entrepreneurs seeking to transition their business to a more sustainable and employee-driven model.

05

Businesses operating in industries where employee ownership is common or beneficial, such as certain cooperative sectors or social enterprises.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete employees owned special corporation online?

Filling out and eSigning employees owned special corporation is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit employees owned special corporation online?

The editing procedure is simple with pdfFiller. Open your employees owned special corporation in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the employees owned special corporation form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign employees owned special corporation and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is employees owned special corporation?

Employees owned special corporation refers to a type of company where the majority of shares are held by employees.

Who is required to file employees owned special corporation?

The employees owned special corporation is required to be filed by the company's management or designated officers.

How to fill out employees owned special corporation?

To fill out employees owned special corporation, the required forms must be completed accurately with all necessary information and submitted to the appropriate government agency.

What is the purpose of employees owned special corporation?

The purpose of employees owned special corporation is to give employees ownership in the company, which can lead to increased motivation and loyalty.

What information must be reported on employees owned special corporation?

The information that must be reported on employees owned special corporation includes details about the company's ownership structure, employee shareholders, and any changes in ownership.

Fill out your employees owned special corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employees Owned Special Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.