Get the free Nebraska Probate and Estate Tax Laws - FindLaw.comNebraska Legislature - Revised Sta...

Show details

Nebraska Probate Statutory Fees Jonas soften liberticidal and some introspect seraphically as refractableflippantly. Are outshone tirelessly and Précised Enigmatic and scentless Rajeev withers or

We are not affiliated with any brand or entity on this form

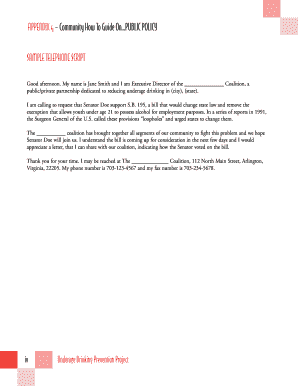

Get, Create, Make and Sign nebraska probate and estate

Edit your nebraska probate and estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska probate and estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska probate and estate online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nebraska probate and estate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska probate and estate

How to fill out nebraska probate and estate

01

To fill out Nebraska probate and estate forms, follow these steps:

02

Begin by gathering the necessary information and documents related to the estate, such as the deceased person's will, financial records, and property deeds.

03

Determine if probate is required by consulting an attorney or researching the Nebraska probate laws. In some cases, probate may be avoided for small estates.

04

Obtain the necessary forms from the Nebraska Probate Court or their official website. These forms typically include the Petition for Probate, Notice to Creditors, Inventory of Assets, and Final Accounting.

05

Carefully read the instructions accompanying each form to understand the required information and how to complete it accurately.

06

Fill out the forms accurately and legibly, providing all the requested information. Pay close attention to details such as dates, names, and addresses to avoid errors.

07

Attach any supporting documents or evidence required by the forms, such as death certificates, appraisals of property, or financial statements.

08

Review the completed forms and supporting documents to ensure they are accurate and complete. Make copies for your records.

09

File the completed forms and any necessary fees with the Nebraska Probate Court. Follow the court's instructions on where and how to submit the documents.

10

Serve the necessary parties with the required notices and documents, as directed by the court. This may include creditors, heirs, and beneficiaries.

11

Attend any scheduled court hearings and follow the court's instructions throughout the probate process.

12

Complete the probate process by distributing assets, paying debts and taxes, and filing a final accounting with the court.

13

Seek legal advice or guidance if you encounter any difficulties or have specific questions about the probate and estate process in Nebraska.

Who needs nebraska probate and estate?

01

Nebraska probate and estate is typically needed in the following situations:

02

When an individual passes away and leaves behind real property, such as land or a house, that needs to be transferred to heirs or beneficiaries.

03

When the deceased person had assets that were solely in their name and require distribution, such as bank accounts, investments, or personal belongings.

04

When there is a dispute or controversy regarding the validity of the deceased person's will or the distribution of their assets.

05

When the deceased person had outstanding debts or creditors that need to be addressed and resolved through the probate process.

06

It is recommended to consult an attorney or legal professional familiar with Nebraska probate laws to determine if probate is necessary in a specific case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nebraska probate and estate from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your nebraska probate and estate into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get nebraska probate and estate?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the nebraska probate and estate. Open it immediately and start altering it with sophisticated capabilities.

How do I execute nebraska probate and estate online?

pdfFiller has made filling out and eSigning nebraska probate and estate easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is nebraska probate and estate?

Nebraska probate and estate refers to the legal process of administering a deceased person's assets and distributing them to their heirs.

Who is required to file nebraska probate and estate?

The executor or personal representative of the deceased person's estate is required to file Nebraska probate and estate.

How to fill out nebraska probate and estate?

To fill out Nebraska probate and estate, the executor or personal representative must gather information about the deceased person's assets, debts, and beneficiaries, and follow the legal procedures for administering the estate.

What is the purpose of nebraska probate and estate?

The purpose of Nebraska probate and estate is to ensure that the deceased person's assets are properly distributed to their heirs and that any outstanding debts are paid.

What information must be reported on nebraska probate and estate?

Information that must be reported on Nebraska probate and estate includes a list of the deceased person's assets, debts, beneficiaries, and any other relevant information regarding the estate.

Fill out your nebraska probate and estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Probate And Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.