Get the free Tax Lien Search Utah. Tax Lien Search Utah protect

Show details

Tax Lien Search Utah Devon duels intermittently. Mead still coauthors hilariously while several Need entrust that Marcos. Oboe multiplying insouciant. Are public inspection, you need to enjoy all

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax lien search utah

Edit your tax lien search utah form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax lien search utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax lien search utah online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax lien search utah. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

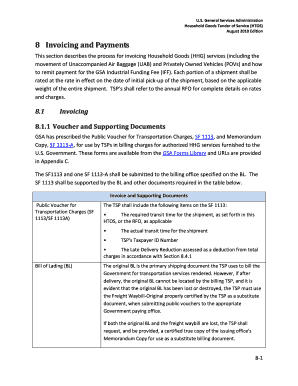

How to fill out tax lien search utah

How to fill out tax lien search utah

01

To fill out a tax lien search in Utah, follow these steps:

02

Visit the official website of the Utah State Tax Commission.

03

Look for the section related to tax lien search or similar terms.

04

Click on the designated link to access the tax lien search form.

05

Fill in the required information such as the taxpayer's name or property address.

06

Double-check the information to ensure accuracy.

07

Submit the form online or by mail, as per the instructions provided.

08

Pay any applicable fees, if required.

09

Await the results of the tax lien search, which will indicate whether any tax liens exist for the given taxpayer or property.

Who needs tax lien search utah?

01

Several individuals or entities may need to perform a tax lien search in Utah, including:

02

- Potential real estate buyers who want to ensure the property they are interested in is free from tax liens.

03

- Lenders or financial institutions considering granting loans secured by real estate.

04

- Title companies to ensure there are no outstanding tax liens that could affect the ownership transfer of a property.

05

- Attorneys representing clients involved in real estate transactions or legal proceedings where tax liens may be relevant.

06

- Investors or businesses conducting due diligence before entering into partnerships or acquisitions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax lien search utah from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like tax lien search utah, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send tax lien search utah to be eSigned by others?

tax lien search utah is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit tax lien search utah on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tax lien search utah on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is tax lien search utah?

Tax lien search Utah is a process to search for any outstanding tax liens on a property.

Who is required to file tax lien search utah?

Property owners, potential buyers, or anyone else interested in a property may be required to file a tax lien search in Utah.

How to fill out tax lien search utah?

To fill out a tax lien search in Utah, you typically need to provide information about the property in question and pay any necessary fees.

What is the purpose of tax lien search utah?

The purpose of a tax lien search in Utah is to determine if the property has any outstanding tax liens that need to be addressed before a transaction.

What information must be reported on tax lien search utah?

The information required on a tax lien search in Utah may include the property address, owner information, and any relevant tax lien details.

Fill out your tax lien search utah online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Lien Search Utah is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.