Get the free Oklahoma Sales Tax Prepayment Requirement

Show details

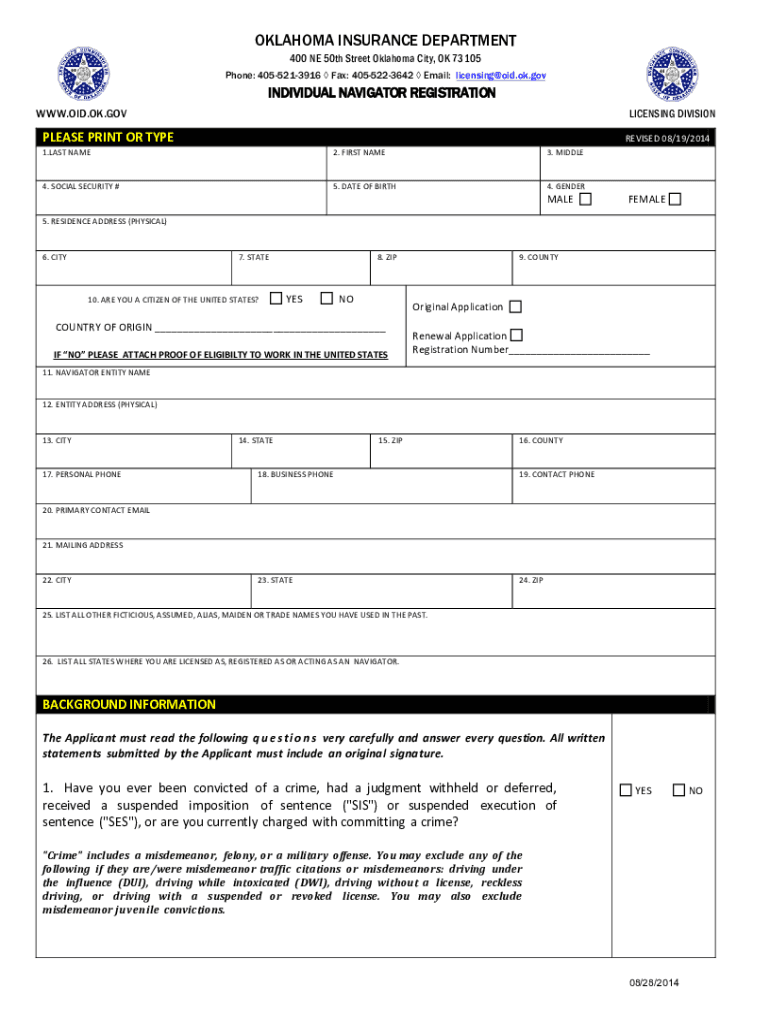

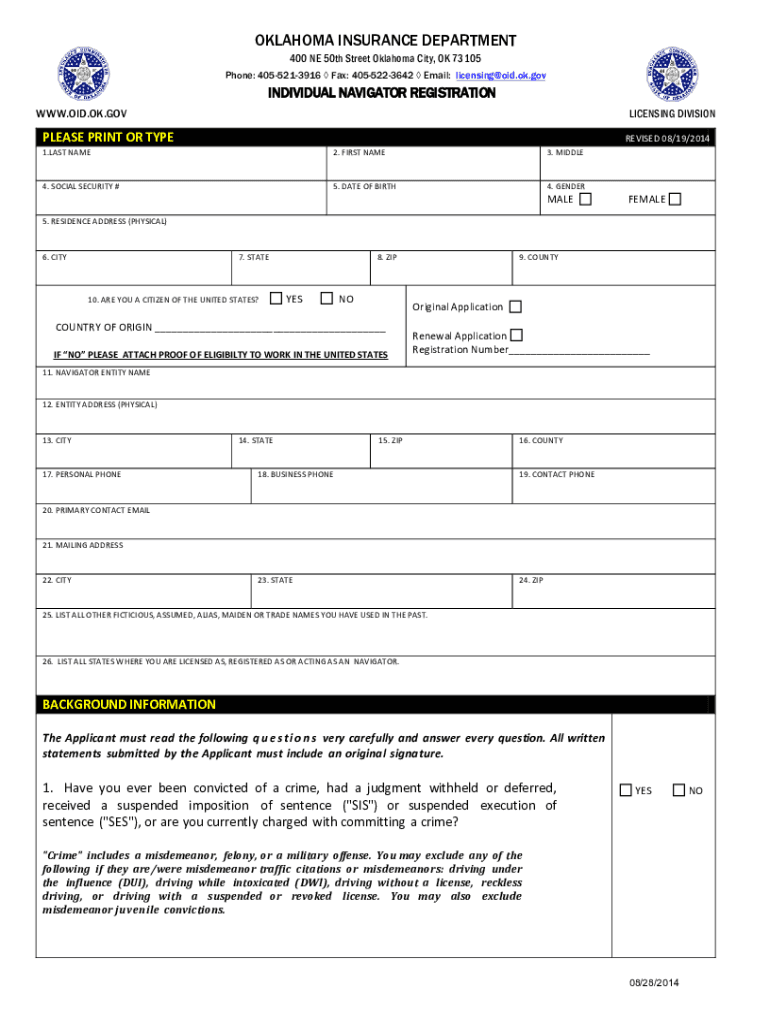

OKLAHOMA INSURANCE DEPARTMENT 400 NE 50th Street Oklahoma City, OK 73105 Phone: 4055213916 Fax: 4055223642 Email: licensing@oid.ok.govINDIVIDUAL NAVIGATOR REGISTRATION WWW.DID.OK.LICENSING DIVISIONPLEASE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma sales tax prepayment

Edit your oklahoma sales tax prepayment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma sales tax prepayment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma sales tax prepayment online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oklahoma sales tax prepayment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma sales tax prepayment

How to fill out oklahoma sales tax prepayment

01

To fill out Oklahoma sales tax prepayment form, follow these steps:

02

Gather the required information, including your business details, sales figures, and tax rates.

03

Start by completing the top section of the form, providing your business name, address, and other relevant details.

04

Proceed to the next section, where you will enter the total sales amount for the reporting period.

05

Calculate the actual sales tax due by multiplying the sales amount by the appropriate tax rate.

06

Enter the calculated sales tax amount in the designated field.

07

If you have made any prior prepayments, subtract those amounts from the calculated sales tax.

08

The resulting prepayment amount is what you need to pay for the current reporting period.

09

Finally, sign and date the form before submitting it to the Oklahoma Tax Commission.

Who needs oklahoma sales tax prepayment?

01

Any business that operates in Oklahoma and sells taxable goods or services needs to make the Oklahoma sales tax prepayment. This requirement applies to both in-state and out-of-state businesses that have economic nexus in Oklahoma. It is important for businesses to comply with this obligation to avoid penalties and ensure proper tax reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit oklahoma sales tax prepayment on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing oklahoma sales tax prepayment.

How can I fill out oklahoma sales tax prepayment on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your oklahoma sales tax prepayment. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit oklahoma sales tax prepayment on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute oklahoma sales tax prepayment from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is oklahoma sales tax prepayment?

Oklahoma sales tax prepayment is a system where businesses are required to estimate and pay their state sales tax in advance, typically on a monthly basis.

Who is required to file oklahoma sales tax prepayment?

Businesses in Oklahoma that have sales tax nexus are required to file oklahoma sales tax prepayment.

How to fill out oklahoma sales tax prepayment?

Businesses can fill out oklahoma sales tax prepayment online through the Oklahoma Tax Commission's website or by mail using the appropriate forms.

What is the purpose of oklahoma sales tax prepayment?

The purpose of oklahoma sales tax prepayment is to help businesses stay compliant with state tax laws and ensure a more steady flow of revenue for the state.

What information must be reported on oklahoma sales tax prepayment?

Businesses must report their estimated taxable sales, calculate the appropriate tax rate, and submit payment along with the necessary forms.

Fill out your oklahoma sales tax prepayment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Sales Tax Prepayment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.