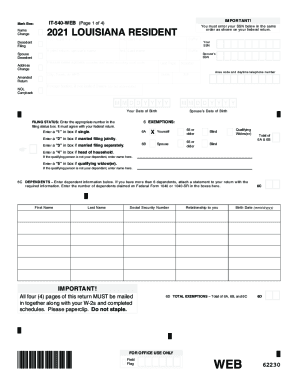

CT PC-242 2019-2026 free printable template

Show details

RESETDecedents Estate

Administration Account

(Short Form)

PC242 REV. 7/19CONNECTICUT PROBATE COURTSRECEIVED:A fiduciary may use this form to account for a decedents' estate unless the court has ordered

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct pc 242 probate form

Edit your connecticut form pc 242 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct pc 242 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT PC-242. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT PC-242 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT PC-242

How to fill out CT PC-242

01

Obtain the CT PC-242 form from the appropriate state website or office.

02

Fill in the required personal information, including your name, address, and contact details.

03

Provide details regarding the specific issue or request related to the form.

04

Include any relevant dates, document numbers, or additional information as prompted.

05

Review the completed form for accuracy.

06

Sign and date the form where indicated.

07

Submit the form as instructed, either digitally or by mailing it to the designated office.

Who needs CT PC-242?

01

Individuals or businesses involved in a legal matter requiring court documentation.

02

Parties seeking to request a court order or change related to an existing case.

03

Anyone needing to formally communicate with the court regarding a legal issue.

Fill

form

: Try Risk Free

People Also Ask about

How does CT probate work?

The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

Can probate be avoided in CT?

Create a Living Trust A living trust is one of the most common ways probate can be avoided in Connecticut. This is established when the assets of the trust's creator (known as the settlor) are put into a trust and then the settlor legally gives up their ownership of those assets.

What are the stages of probate?

The Five Steps of Probate Step One – The Immediate Post-Death Requirements. Step Two – Valuing the estate. Step Three – Preparing the IHT Return. Step Four – Applying for the Grant. Step Five – Post-Grant Estate Administration.

What is the threshold for probate in CT?

In the state of Connecticut, the minimum value of the deceased's assets is $40,000. When accessing the total value of the estate, you may only include the assets and property that must go through probate—and exclude and assets or property that was jointly owned or held in trust.

How long do you have to file probate after death in CT?

Step 1: File the will and Petition/Administration or Probate of Will, PC-200, within 30 days of the decedent's death. A petition for administration or probate of will should be submitted to the Probate Court within 30 days of the decedent's death.

What are the steps of probate in CT?

Here's a walk-through of the Connecticut probate process: Application for administration or probate of Will. Certificate for Land Records. Inventory of solely-owned assets. Pay expenses and claims. File estate tax returns. Final accounting and proposed distribution.

Can you administer an estate without probate?

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died ing to the instructions in the will. You do not always need probate to be able to deal with the estate.

Does an estate have to go through probate in CT?

Not all estates need to go through full probate. For instance, in Connecticut, if the decedent's solely-owned assets include no real property and are valued at less than $40,000 – which is the state's “small estates limit” – then the estate can be settled without full probate, under a much shorter and easier process.

How long does it take to go through probate in Connecticut?

The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process. Further, the expedited process only requires the filing of one piece of paper (plus a tax return) instead of up to ten or more documents required in a regular probate process.

Do you need probate for a small amount of money?

For a full list of Probate thresholds, see Bank Limits for Probate. If the deceased only had small amounts in bank accounts it is likely a Grant of Probate will not be needed to release the funds.

Is probate mandatory in CT?

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

In what circumstances do you not need probate?

There are certain occasions where a probate application will not be necessary. This includes cases where: All property and bank accounts of the person who has died were held jointly with someone who is still living (e.g. a spouse or civil partner) The estate consists of only cash and personal belongings.

How much does an estate have to be worth to go to probate in Connecticut?

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

What assets are subject to probate in CT?

Only three types of assets get probated: Personal possessions, business interests and assets in the decedent's name (which does not include assets in trusts or owned in the name of a business);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CT PC-242 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CT PC-242 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit CT PC-242 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing CT PC-242 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I fill out CT PC-242 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your CT PC-242. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CT PC-242?

CT PC-242 is a form used for reporting personal property taxes in the state of Connecticut.

Who is required to file CT PC-242?

Individuals or businesses that own personal property in Connecticut are required to file CT PC-242.

How to fill out CT PC-242?

To fill out CT PC-242, you need to provide information about the property owned, its value, and any exemptions that apply. Detailed instructions are usually available on the form itself or the state's tax website.

What is the purpose of CT PC-242?

The purpose of CT PC-242 is to ensure proper assessment and taxation of personal property owned in Connecticut.

What information must be reported on CT PC-242?

CT PC-242 requires reporting information such as the description of the property, its location, purchase price, current market value, and any applicable exemptions.

Fill out your CT PC-242 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT PC-242 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.