Get the free NOTICE TO TAX SALE PURCHASERS - Iowa Treasurers

Show details

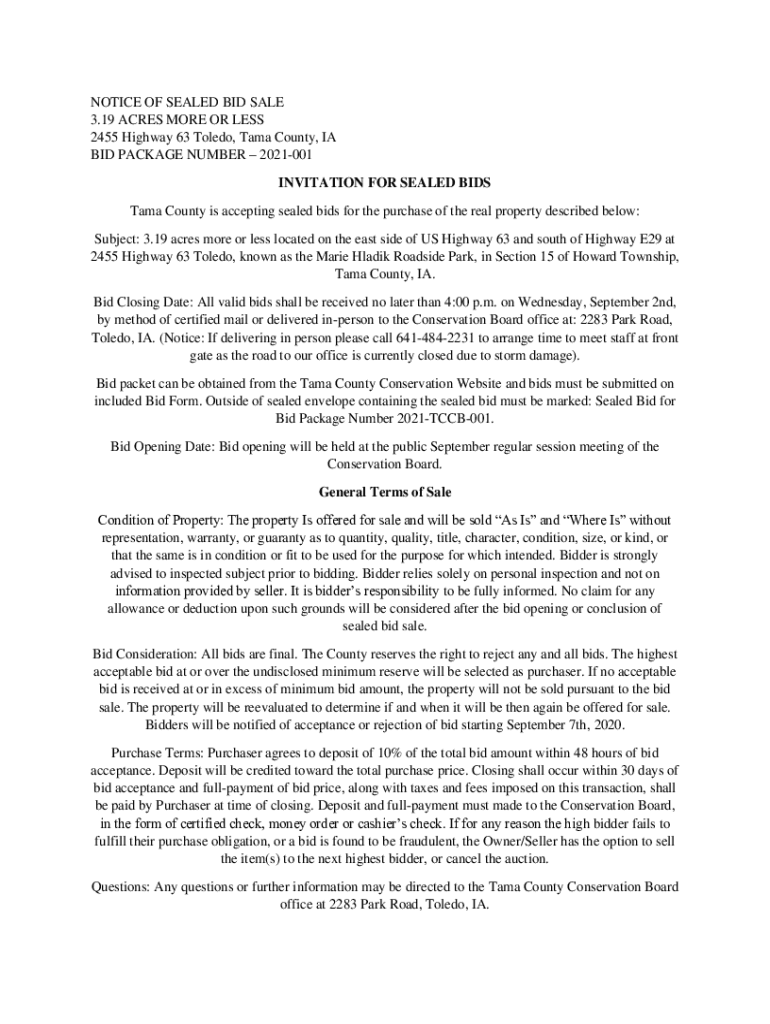

NOTICE OF SEALED BID SALE 3.19 ACRES MORE OR LESS 2455 Highway 63 Toledo, Tampa County, IA BID PACKAGE NUMBER 2021001 INVITATION FOR SEALED BIDS Tampa County is accepting sealed bids for the purchase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice to tax sale

Edit your notice to tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice to tax sale online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit notice to tax sale. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice to tax sale

How to fill out notice to tax sale

01

To fill out a notice to tax sale, follow these steps:

02

Begin by collecting all relevant information about the property, including the address, legal description, and owner's name.

03

Determine the deadline for the notice to be sent, which is typically a certain number of days before the tax sale date.

04

Create a header for the notice, stating that it is a Notice to Tax Sale and including the property information.

05

Address the notice to the owner of the property. If the owner's identity is unknown, use phrases such as 'To the Owner(s) of the Property', 'To Whom It May Concern', or 'To the Interested Parties'.

06

Include a clear statement that the property is subject to a tax sale due to unpaid taxes and specify the tax amount owed.

07

Provide details on how the owner can prevent the tax sale, such as paying the taxes in full or entering into a payment agreement.

08

Include contact information for the tax office or relevant authorities where the owner can get more information or ask questions.

09

Sign the notice and include the name and contact information of the sender.

10

Make copies of the notice for distribution and keep a record of when and how the notice was sent.

11

Send the notice to the owner via certified mail with return receipt requested, or use an alternative method as required by local regulations.

12

Follow up with any required public notifications or publishing of the notice as mandated by local laws.

13

Remember to consult with legal counsel or tax authorities to ensure compliance with all applicable rules and regulations.

14

Note: This is a general guideline and may vary depending on your jurisdiction. It is important to refer to specific local laws and regulations when filling out a notice to tax sale.

Who needs notice to tax sale?

01

Anyone who is responsible for conducting a tax sale or enforcing tax liens may need a notice to tax sale.

02

This includes tax collectors, county or municipal governments, or other entities with the authority to sell properties for unpaid taxes.

03

The notice is typically sent to the owner of the property to inform them of the pending tax sale and provide an opportunity to settle the overdue taxes.

04

It may also be required to be publicly posted or published to notify interested parties or potential buyers of the tax sale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my notice to tax sale directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your notice to tax sale along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify notice to tax sale without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including notice to tax sale. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit notice to tax sale on an iOS device?

Create, edit, and share notice to tax sale from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is notice to tax sale?

Notice to tax sale is a legal notification informing property owners that their property will be sold at a tax sale to recover unpaid property taxes.

Who is required to file notice to tax sale?

The taxing authority or municipality is required to file notice to tax sale.

How to fill out notice to tax sale?

Notice to tax sale can typically be filled out online or in person at the tax office. It usually requires information about the property owner, property address, and amount of unpaid taxes.

What is the purpose of notice to tax sale?

The purpose of notice to tax sale is to notify property owners about the impending tax sale and give them an opportunity to pay their overdue taxes.

What information must be reported on notice to tax sale?

Information such as property owner's name, property address, amount of unpaid taxes, date of tax sale, and contact information for the taxing authority must be reported on notice to tax sale.

Fill out your notice to tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.