Get the free SIMPLE IRA APPLICATION - Specialized Trust Company

Show details

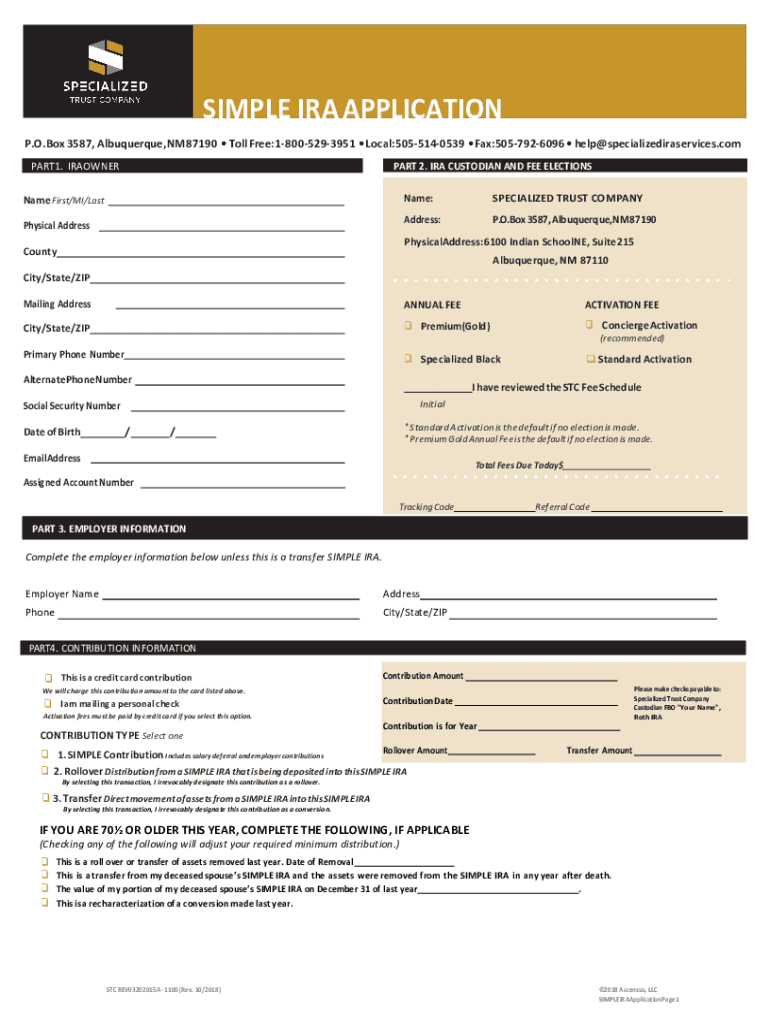

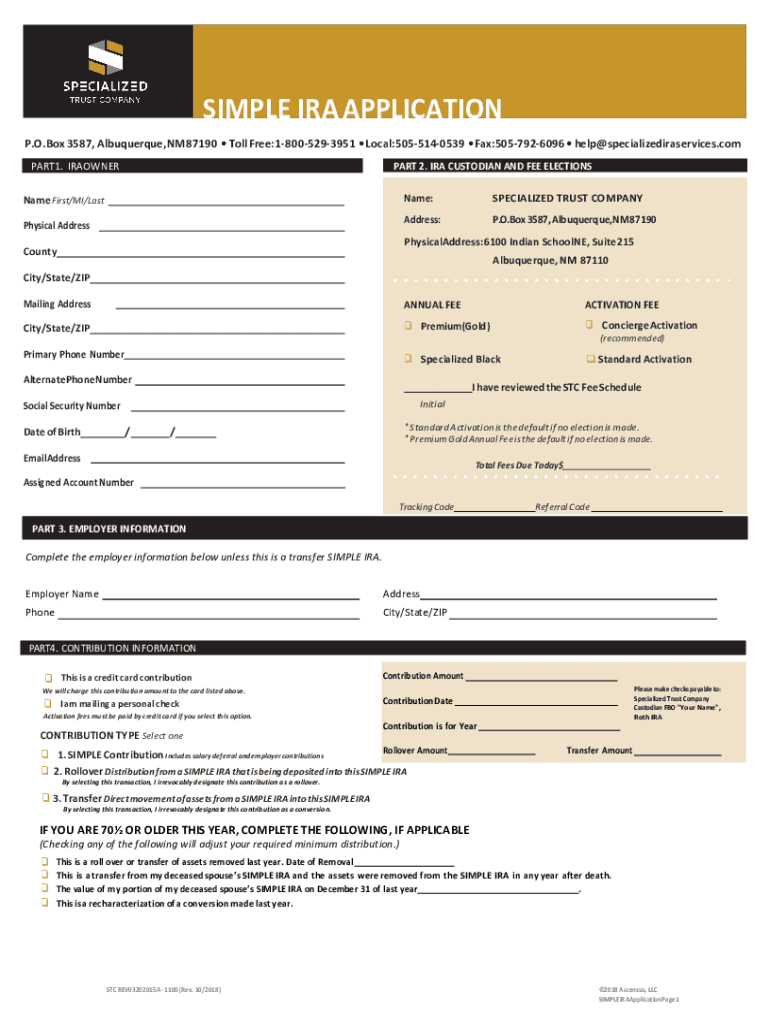

SIMPLE IRA APPLICATION P.O. Box 3587, Albuquerque, NM 87190 Toll Free: 18 005293951 Local: 5055140539 Fax: 5057926096 help@specializediraservices.com PART 2. IRA CUSTODIAN AND FEE ELECTIONSPART1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simple ira application

Edit your simple ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing simple ira application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit simple ira application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simple ira application

How to fill out simple ira application

01

Obtain a Simple IRA application form from the financial institution or employer offering the Simple IRA plan.

02

Fill out the applicant information section, providing your personal details such as name, address, social security number, and contact information.

03

Provide information about your employment status and employer, including the company name, address, and employer identification number.

04

Indicate your desired contribution amount or percentage, keeping in mind the annual contribution limits set by the IRS.

05

Review and understand the terms and conditions of the Simple IRA plan, including the eligibility requirements, withdrawal rules, and any potential penalties or fees.

06

Sign and date the application form, certifying that the information provided is accurate and complete.

07

Submit the completed application to the appropriate financial institution or employer, along with any required supporting documentation.

Who needs simple ira application?

01

Anyone who is eligible and interested in saving for retirement can benefit from a Simple IRA application.

02

This includes employees of small businesses that offer Simple IRA plans, self-employed individuals, and freelancers.

03

A Simple IRA provides individuals with a relatively easy and straightforward way to save for retirement, offering potential tax advantages and employer contributions.

04

It is particularly suited for those who may not have access to other retirement plans, such as a 401(k) or pension, or prefer a simpler retirement savings option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send simple ira application to be eSigned by others?

When you're ready to share your simple ira application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in simple ira application without leaving Chrome?

simple ira application can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out simple ira application on an Android device?

Use the pdfFiller mobile app to complete your simple ira application on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is simple ira application?

Simple IRA application is a form used to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA plan, which is a retirement savings plan for small businesses and their employees.

Who is required to file simple ira application?

Employers with 100 or fewer employees who want to offer a retirement savings plan may be required to file a SIMPLE IRA application.

How to fill out simple ira application?

To fill out a SIMPLE IRA application, the employer must provide information about the company, employees eligible for the plan, and contribution percentages.

What is the purpose of simple ira application?

The purpose of a SIMPLE IRA application is to establish a retirement savings plan for employees of small businesses, allowing both employers and employees to make contributions to the plan.

What information must be reported on simple ira application?

Information such as employer details, employee eligibility, and contribution percentages must be reported on a SIMPLE IRA application.

Fill out your simple ira application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simple Ira Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.