Get the free Insurance & Risk Management Volunteer Activity Waiver Form

Show details

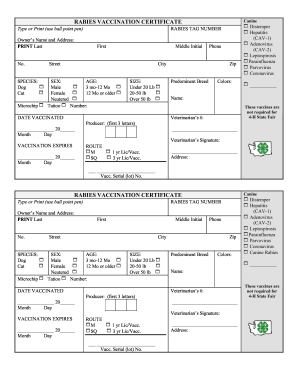

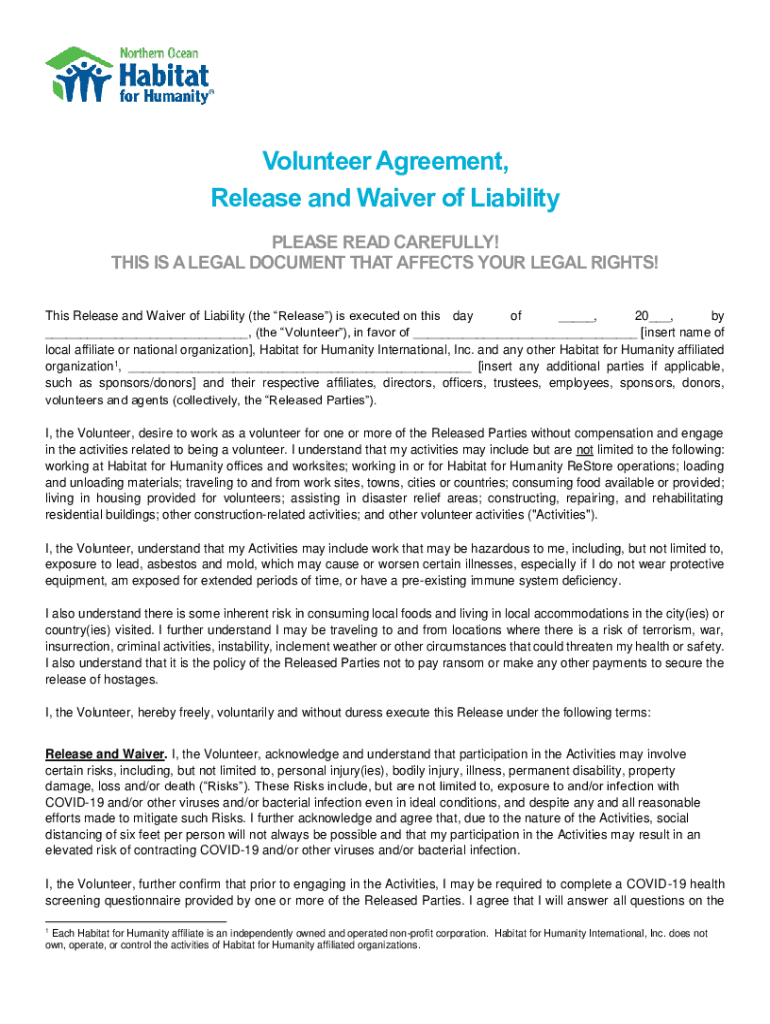

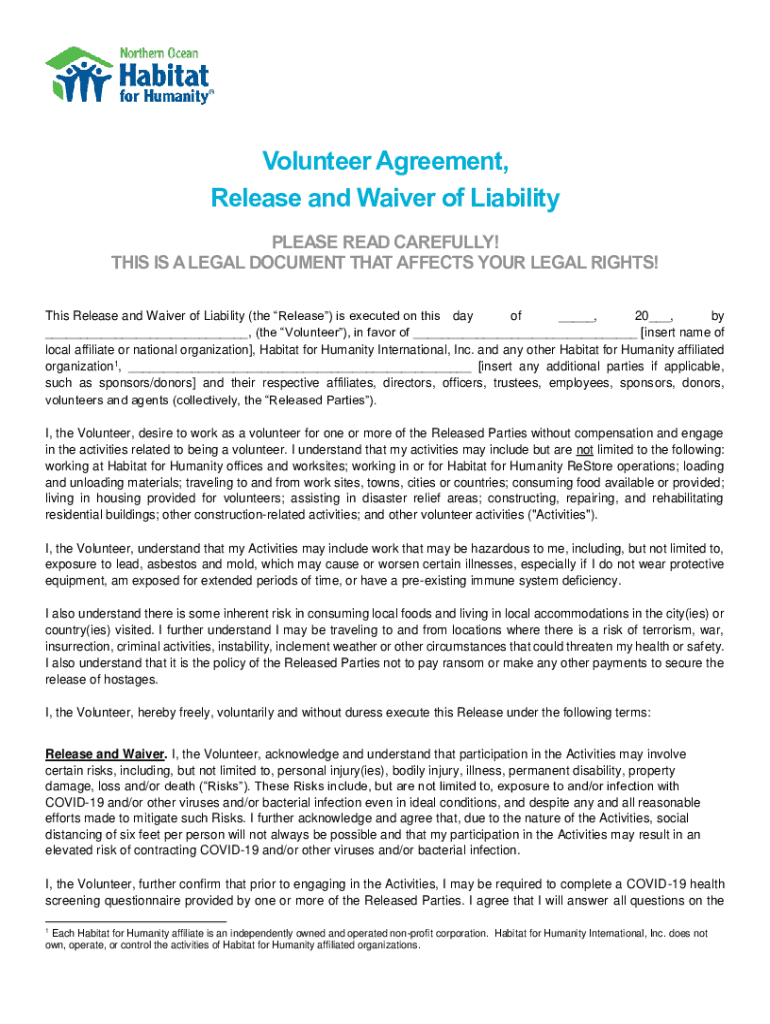

Volunteer Agreement, Release and Waiver of Liability PLEASE READ CAREFULLY! THIS IS A LEGAL DOCUMENT THAT AFFECTS YOUR LEGAL RIGHTS! This Release and Waiver of Liability (the Release) is executed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance amp risk management

Edit your insurance amp risk management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance amp risk management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance amp risk management online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance amp risk management. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance amp risk management

How to fill out insurance amp risk management

01

Step 1: Identify the risks - Start by identifying all potential risks that your business may face. This includes property damage, liability risks, employee injuries, etc.

02

Step 2: Assess the risks - Once you have identified the risks, assess the potential impact and likelihood of each risk. This will help you prioritize the risks that require immediate attention.

03

Step 3: Develop a risk management plan - Create a detailed plan outlining how you will mitigate and manage each identified risk. This may involve implementing safety measures, purchasing insurance coverage, or establishing emergency protocols.

04

Step 4: Purchase insurance policies - Determine the type of insurance coverage you need based on your risk management plan. This may include general liability insurance, property insurance, workers' compensation insurance, etc. Work with insurance providers to purchase the appropriate policies.

05

Step 5: Implement risk management strategies - Take steps to reduce the likelihood and impact of the identified risks. This may involve training employees, maintaining a safe work environment, conducting regular inspections, etc.

06

Step 6: Review and update your plan regularly - Risks and business needs change over time. It's important to review and update your risk management plan periodically to ensure it remains effective and up to date.

07

Step 7: Continuously monitor and evaluate risks - Regularly monitor and evaluate the effectiveness of your risk management strategies. Make adjustments as necessary to address new risks or improve existing controls.

Who needs insurance amp risk management?

01

Businesses of all sizes and types need insurance and risk management. This includes:

02

- Small businesses that need protection against potential financial losses due to property damage, lawsuits, or other unexpected events.

03

- Large corporations that have complex risk profiles and need comprehensive risk management strategies to protect their assets and liability exposure.

04

- Professionals such as doctors, lawyers, architects, and consultants who require professional liability insurance to protect against claims of negligence or errors.

05

- Individuals who want to protect their personal assets, such as homeowners who need homeowners insurance or drivers who need auto insurance.

06

- Non-profit organizations that need insurance coverage for their operations, volunteers, and directors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit insurance amp risk management from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like insurance amp risk management, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit insurance amp risk management online?

With pdfFiller, the editing process is straightforward. Open your insurance amp risk management in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the insurance amp risk management in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your insurance amp risk management.

What is insurance amp risk management?

Insurance and risk management is a practice where individuals or organizations protect themselves against financial losses and uncertainties by transferring the risk to an insurance company.

Who is required to file insurance amp risk management?

Businesses, individuals, and organizations who want to protect themselves against financial losses and uncertainties.

How to fill out insurance amp risk management?

To fill out insurance and risk management, one must assess their potential risks, choose appropriate insurance coverage, and regularly review and update their policies.

What is the purpose of insurance amp risk management?

The purpose of insurance and risk management is to protect individuals or organizations from financial losses due to unforeseen events or circumstances.

What information must be reported on insurance amp risk management?

Information such as the types of insurance coverage, policy details, risk assessment, and any claims history may need to be reported on insurance and risk management documents.

Fill out your insurance amp risk management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Amp Risk Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.