Get the free The HR and Payroll Guide to Name ChangesBusiness Name ChangeInternal Revenue Service...

Show details

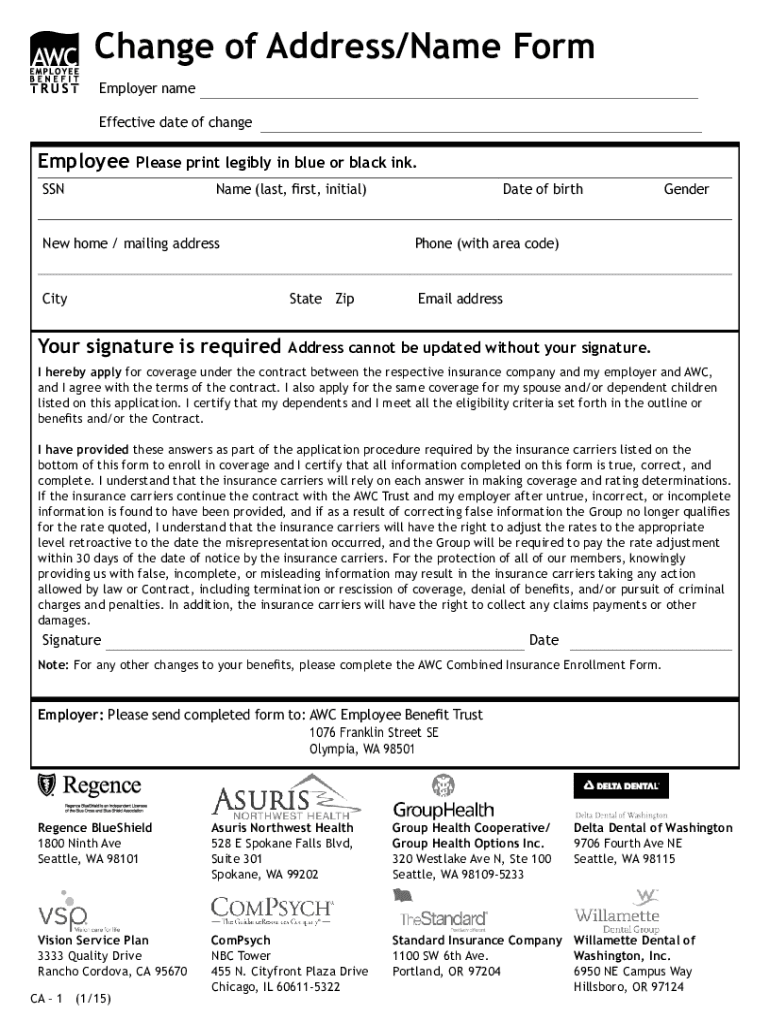

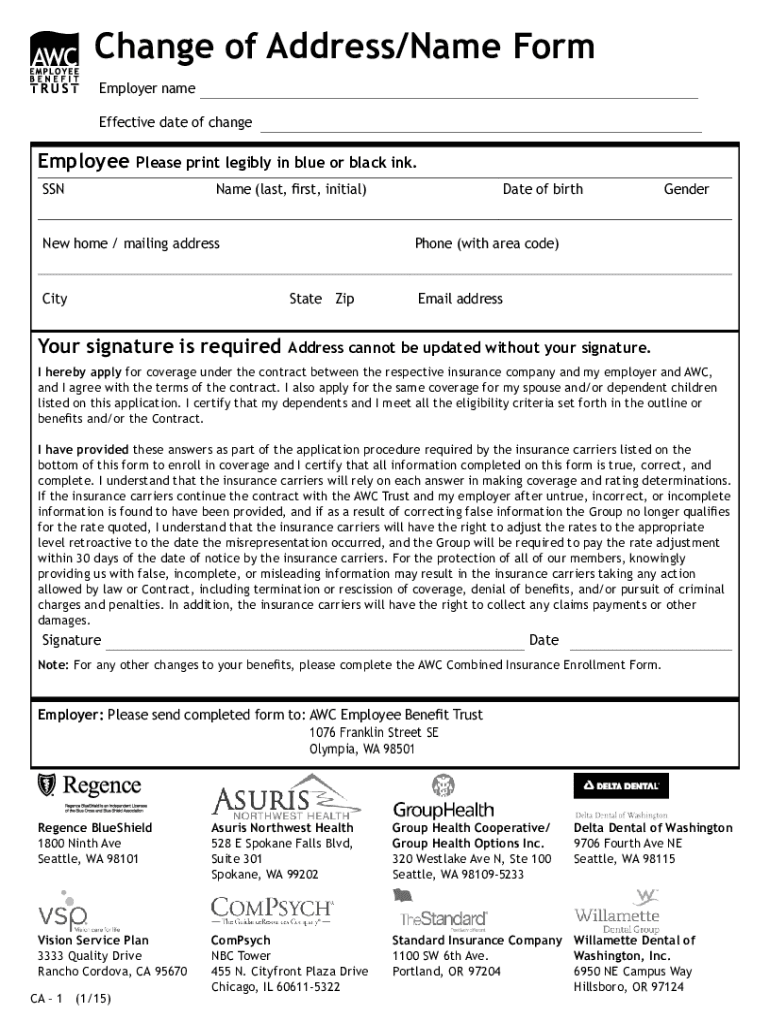

Change of Address/Name Form Employer name Effective date of changeEmployeePlease print legibly in blue or black ink. Surname (last, first, initial)New home / mailing addressCityGenderPhone (with area

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form hr and payroll

Edit your form hr and payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form hr and payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form hr and payroll online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form hr and payroll. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form hr and payroll

How to fill out the hr and payroll

01

Step 1: Collect all necessary employee information, such as name, address, contact details, tax information, and employment history.

02

Step 2: Set up a payroll system or software to calculate salaries, deductions, and taxes accurately.

03

Step 3: Develop a payroll schedule to ensure employees are paid on time.

04

Step 4: Determine and implement employee benefits, including healthcare, retirement plans, and paid time off.

05

Step 5: Maintain accurate employee records, including attendance, leave balances, and performance evaluations.

06

Step 6: Stay updated with labor laws and regulations to ensure compliance.

07

Step 7: Process payroll by calculating employee earnings, deductions, and taxes using the established system or software.

08

Step 8: Generate and distribute pay stubs or electronic pay statements to employees.

09

Step 9: File and remit payroll taxes to the appropriate government agencies as required.

10

Step 10: Reconcile and review payroll reports for accuracy and resolve any discrepancies.

Who needs the hr and payroll?

01

Companies and organizations of all sizes need HR and payroll services.

02

Small businesses often outsource these functions to help manage employee records, ensure timely and accurate payroll processing, and navigate complex tax regulations.

03

Large corporations require HR and payroll departments to handle a higher volume of employees and ensure compliance with labor laws and benefit administration.

04

Non-profit organizations also need HR and payroll services to manage their staff compensation and comply with reporting requirements.

05

In summary, any entity or business that employs staff needs HR and payroll services to effectively manage employee records, handle payroll processing, and ensure legal compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form hr and payroll directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form hr and payroll as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete form hr and payroll online?

pdfFiller has made filling out and eSigning form hr and payroll easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out form hr and payroll on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your form hr and payroll. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is the hr and payroll?

HR and payroll refer to the department responsible for managing employee-related tasks such as payroll processing, employee benefits, and compliance with labor laws.

Who is required to file the hr and payroll?

Employers are required to file HR and payroll information for their employees.

How to fill out the hr and payroll?

HR and payroll information can be filled out electronically using payroll software or manually on paper forms.

What is the purpose of the hr and payroll?

The purpose of HR and payroll is to ensure that employees are compensated accurately and in compliance with labor laws.

What information must be reported on the hr and payroll?

Information such as employee wages, hours worked, withholding taxes, and deductions must be reported on HR and payroll documents.

Fill out your form hr and payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Hr And Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.