Get the free Individual X Corporation Partnership Other

Show details

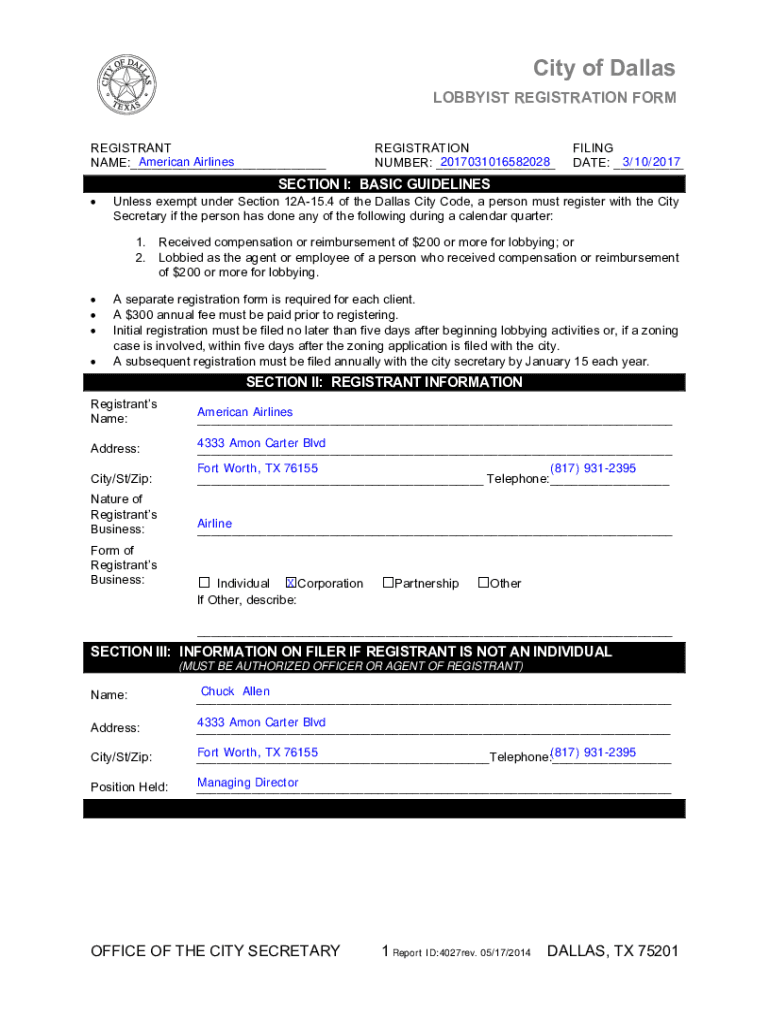

City of Dallas LOBBYIST REGISTRATION FORM REGISTRANT American Airlines NAME: REGISTRATION 2017031016582028 NUMBER: FILING 3/10/2017 DATE: SECTION I: BASIC GUIDELINES Unless exempt under Section 12A15.4

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual x corporation partnership

Edit your individual x corporation partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual x corporation partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual x corporation partnership online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual x corporation partnership. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual x corporation partnership

How to fill out individual x corporation partnership

01

Gather all the necessary information about your business and partners. This includes the names, addresses, and social security numbers of all partners, as well as the legal name and address of the partnership itself.

02

Determine the type of partnership you want to form. Is it a general partnership, limited partnership, or limited liability partnership? Each type has different legal and tax consequences, so it's important to understand the differences.

03

Prepare and file the necessary documents with the appropriate government agency. This usually involves completing a partnership agreement and filing it with the state's secretary of state office.

04

Obtain any required licenses or permits. Depending on the nature of your business, you may need to obtain specific licenses or permits before you can legally operate as a partnership.

05

Open a business bank account. This will help keep your personal and business finances separate, which is important for both legal and tax purposes.

06

Obtain any necessary insurance coverage. Depending on the nature of your business, you may need to obtain various types of insurance, such as liability insurance or workers' compensation insurance.

07

Keep thorough and accurate records. This includes maintaining comprehensive financial records, as well as documenting any important decisions or agreements made by the partnership.

08

Comply with all tax obligations. Partnerships are typically subject to different tax rules than other business entities, so it's important to understand and comply with all relevant tax laws and regulations.

09

Regularly review and update your partnership agreement. As your business grows and evolves, it's important to periodically review and update your partnership agreement to ensure it reflects the current needs and goals of the partnership.

10

Seek legal and professional advice. Forming and operating a partnership can be complex, so it's a good idea to consult with legal and financial professionals who can provide guidance and ensure you're meeting all legal requirements.

Who needs individual x corporation partnership?

01

Individuals who want to start a business with others and share the profits and losses.

02

Entrepreneurs who want to minimize personal liability for the business's debts and legal obligations.

03

Business owners who prefer a less formal and more flexible business structure than a corporation.

04

Professionals, such as doctors or lawyers, who want to form a partnership with colleagues to practice together.

05

Companies or organizations that want to pool resources or expertise with other entities to pursue a specific venture or project.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my individual x corporation partnership directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign individual x corporation partnership and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find individual x corporation partnership?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific individual x corporation partnership and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my individual x corporation partnership in Gmail?

Create your eSignature using pdfFiller and then eSign your individual x corporation partnership immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is individual x corporation partnership?

An individual x corporation partnership is a business arrangement where an individual partners with a corporation to conduct business together.

Who is required to file individual x corporation partnership?

Both the individual and the corporation are required to file the partnership agreement.

How to fill out individual x corporation partnership?

To fill out the partnership agreement, both parties need to provide their information, contributions, responsibilities, and profit-sharing arrangements.

What is the purpose of individual x corporation partnership?

The purpose of such partnership is to combine the expertise and resources of an individual with the resources and structure of a corporation.

What information must be reported on individual x corporation partnership?

Information such as partners' names, contact details, contributions, profit-sharing ratio, and responsibilities must be reported.

Fill out your individual x corporation partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual X Corporation Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.