CO TR-1 2020-2025 free printable template

Show details

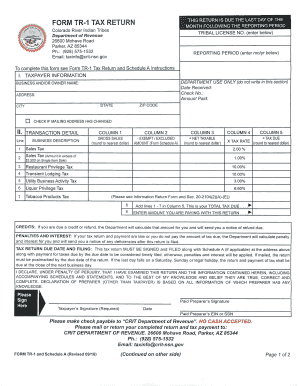

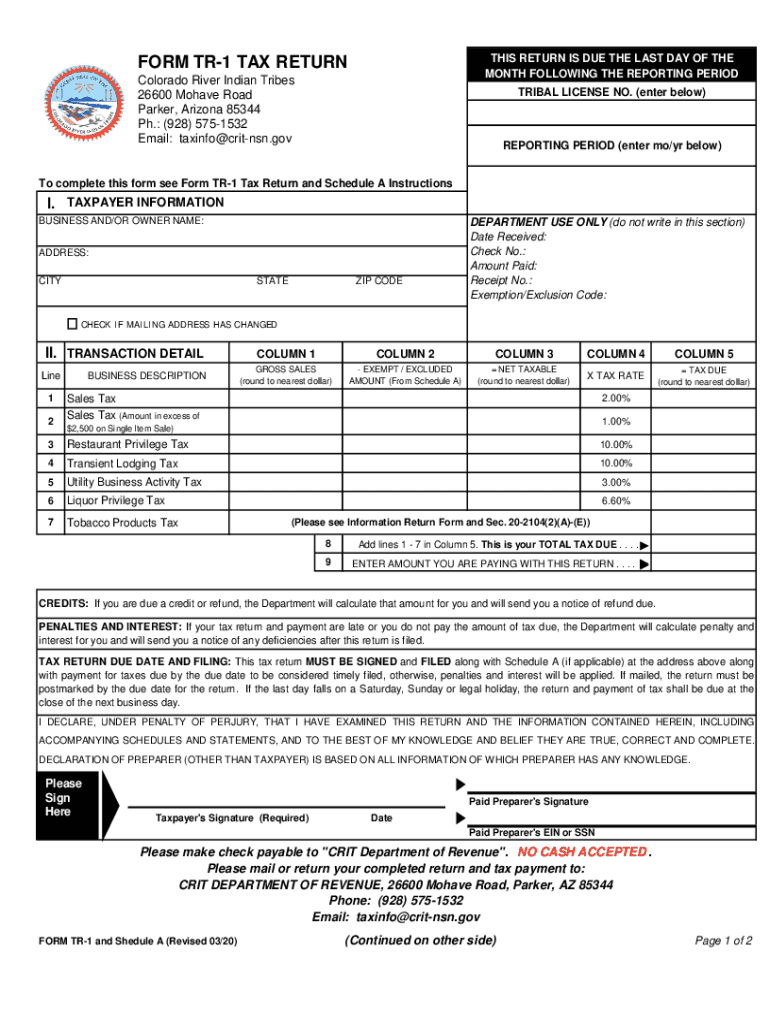

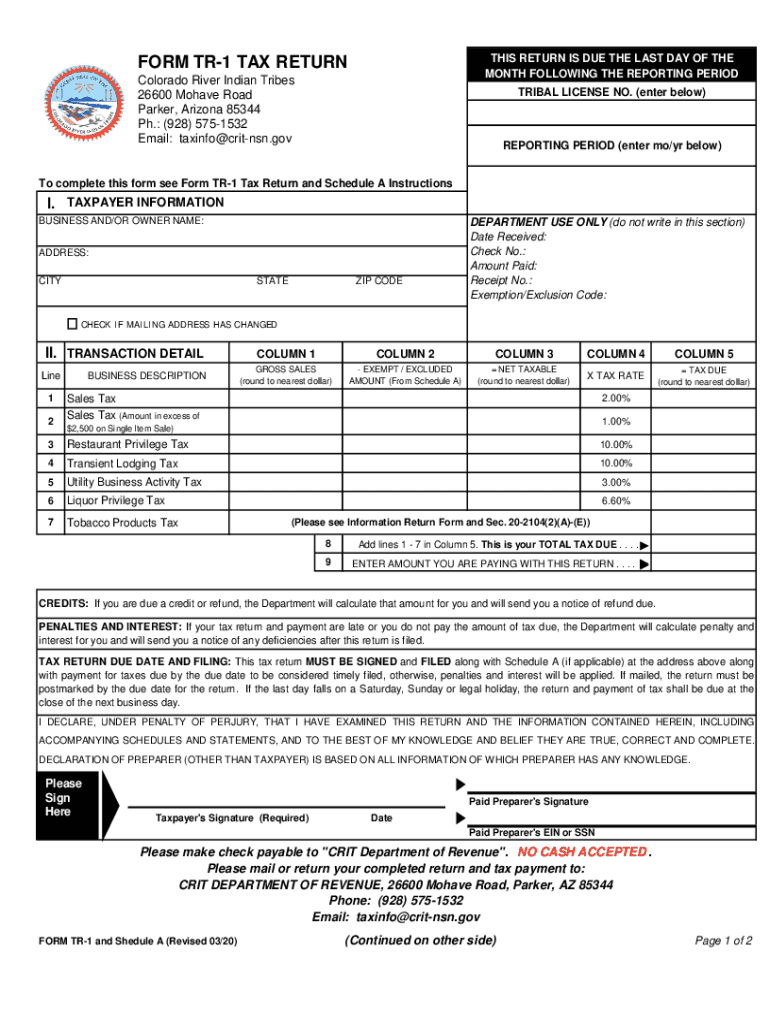

PrintClearTHIS RETURN IS DUE THE LAST DAY OF THE MONTH FOLLOWING THE REPORTING PERFORM TR1 TAX RETURN Colorado River Indian Tribes 26600 Mohave Road Parker, Arizona 85344 pH.: (928) 5751532 Email:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado tr 1 return schedule river tribe form

Edit your colorado form tr 1 return a tribe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado tax return river form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado tax return river online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit colorado tax return river. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO TR-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado tax return river

How to fill out CO TR-1

01

Obtain a copy of the CO TR-1 form from the official website or your local agency.

02

Start by filling out your personal information at the top of the form, including your name, address, and contact details.

03

Enter the relevant date in the designated field.

04

Provide details regarding the transaction or purpose for which the CO TR-1 is being completed.

05

Include any additional information requested, ensuring that all sections of the form are accurately filled.

06

Review the form for any errors or missing information.

07

Sign and date the form where required.

08

Submit the completed form to the appropriate authority or department as specified.

Who needs CO TR-1?

01

Individuals or businesses that are involved in certain transactions requiring documentation in the State of Colorado.

02

Those looking to report or request a specific type of transaction that requires the completion of the CO TR-1 form.

03

Any party who is mandated by law to file this form as part of regulatory or compliance requirements.

Fill

form

: Try Risk Free

People Also Ask about

What Indian tribes are on the Colorado River?

COMMUNITY PROFILE: The Colorado River Indian Tribes include the Mohave, Chemehuevl, Hopi, and Navajo. The federal government established the Colorado River Indian Tribes Reservation in 1865 originally for the Mohave and Chemehuevl people that had lived along the Colorado River for hundreds of years.

What is the Colorado River Indian Tribes water Resiliency Act?

S. 3308, the Colorado River Indian Tribes Water Resiliency Act of 2022: The Colorado River Indian Tribes Water Resiliency Act of 2022 authorizes the Colorado River Indian Tribes to lease, exchange, store, or conserve portions of their decreed water rights located in the State of Arizona to off-Reservation users.

What did natives call the Colorado River?

Originally the 16th century Spaniard explorers called the river Rio del Tizon, which translated to mean River of Embers or Firebrand River and supposedly described a practice local natives used to warm themselves.

What is the Colorado River water Act?

The Colorado River Compact is a 1922 agreement among the seven southwest U.S. states that fall within the drainage basin of the Colorado River. The pact governs the allocation of the river's water rights.

How many indigenous tribes are in Colorado River Basin?

There are ten tribes with reservations in central and southern Arizona interior from the Colorado River but within the Colorado River basin. Most of these tribes now hold quantified water rights, established through Congressionally-approved settlement agreements, and are seeking to put these rights to use.

What is the Colorado River Indian Tribes and State of Arizona water Resiliency Act?

S. 3308, the Colorado River Indian Tribes Water Resiliency Act of 2022: The Colorado River Indian Tribes Water Resiliency Act of 2022 authorizes the Colorado River Indian Tribes to lease, exchange, store, or conserve portions of their decreed water rights located in the State of Arizona to off-Reservation users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in colorado tax return river without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing colorado tax return river and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the colorado tax return river in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your colorado tax return river in minutes.

Can I create an electronic signature for signing my colorado tax return river in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your colorado tax return river and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is CO TR-1?

CO TR-1 is a tax form used in Colorado to report certain tax-related information to the state government.

Who is required to file CO TR-1?

Entities that are required to report specific tax information or make certain tax payments in Colorado must file the CO TR-1.

How to fill out CO TR-1?

To fill out CO TR-1, follow the instructions provided with the form, ensuring that all required fields are completed accurately with the appropriate tax information.

What is the purpose of CO TR-1?

The purpose of CO TR-1 is to provide the state of Colorado with necessary information related to tax compliance and to facilitate tax collection.

What information must be reported on CO TR-1?

On CO TR-1, taxpayers must report details such as their identification information, tax period, total tax liabilities, and any relevant exemptions or deductions.

Fill out your colorado tax return river online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Colorado Tax Return River is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.