CA Tenant Household Information Form 2021-2025 free printable template

Show details

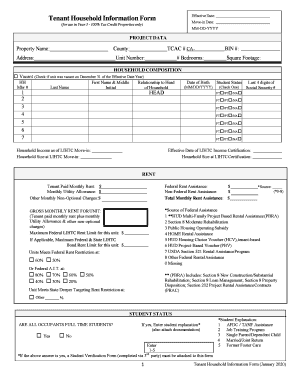

Effective Date:Tenant Household Information Forewoman Date:(for use in Year 3 100% Tax Credit Properties only)MMDDYYYYPROJECT DATA Project Name: Address: Unit Number #:County: Bedrooms:CAC#:BIN#:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tenant household form make

Edit your household information form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca household information form printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca household information form blank online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ctcac tax credit tenant form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Tenant Household Information Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca tax allocation tenant household form

How to fill out CA Tenant Household Information Form

01

Obtain the CA Tenant Household Information Form from your landlord or property management.

02

Fill out the top section with your personal information, including your name, address, and contact details.

03

Indicate the number of occupants in your household.

04

Provide the demographic information requested, such as age, gender, and relationship to the head of household.

05

Complete any additional sections that may ask for income details or special needs.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to your landlord or property management as instructed.

Who needs CA Tenant Household Information Form?

01

Any tenant in California applying for rental assistance or housing programs.

02

Landlords and property managers to gather demographic and household information for compliance and reporting purposes.

03

Individuals seeking to qualify for housing benefits or subsidies.

Fill

california tax allocation form create

: Try Risk Free

People Also Ask about

Is there a renter's credit in California?

Under California law, qualified renters are allowed a nonrefundable personal income tax credit. The credit is a flat amount and is not related to the amount of rent paid.

Is there a max rent credit on rent in California?

That's because California's AB-1482 rent control law caps the maximum allowable annual rent increase to only 10%.

How does the renters credit work in California?

Current state law allows qualifying renters who meet certain adjusted gross income limitations a nonrefundable credit of $60 or $120, based on filing status. The amount of the credit is unrelated to the amount of rent paid.

Is there a renters tax credit in California?

The March 21, 2022, amendments reduced the increased Renters' credit amount from $1000 to $500 for individuals not filing as married filing joint, head of household, or surviving spouse.

How much is the renter's credit in California?

The bill, Senate Bill 843 would increase the tax credit for joint filers making $87,066 or less from $120 to $1,000, and from $60 to $500 for single filers who earn $43,533 or less.

How do you qualify for CalEITC?

Check if you qualify for CalEITC Have taxable earned income. Have a valid social security number or individual taxpayer identification number (ITIN) for you, your spouse, and any qualifying children. Live in California for more than half the year.

Does California give a renters credit?

Under California law, qualified renters are allowed a nonrefundable personal income tax credit. The credit is a flat amount and is not related to the amount of rent paid.

What is renter's credit on California state tax?

A $60 credit is available to single taxpayers and married taxpayers filing separately with adjusted gross incomes of $34,936 or less. These phase-out amounts are indexed annually for inflation. place of residence for at least 50% of the taxable year.

Can you get renter's credit on taxes?

If you pay rent on your primary residence, you might be able to claim a tax credit. These are awarded only on the state level—there is no federal renter's tax credit.

Does the IRS give a renters credit?

If you pay rent on your primary residence, you might be able to claim a tax credit. These are awarded only on the state level—there is no federal renter's tax credit.

What is California nonrefundable renter's credit?

The Nonrefundable Renter's Credit is a credit for California residents who: paid rent for their main residence at least 6 months in 2022, had adjusted gross income (AGI) under the limit for their filing status.

Do I qualify for the California renter's credit?

You were a resident of California for at least 6 full months during 2022. Your California adjusted gross income (AGI) is $45,448 or less if your filing status is Single or Married Filing Separately or $90,896 or less if you are Married Filing Jointly, Head of Household, or Qualified Widow(er).

Can I claim my rent on my tax return in California?

There is good news for renters living and paying taxes in California. That is, California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters' tax credit.

Who can claim California renter's credit?

Check if you qualify Your California income was: $43,533 or less if your filing status is single or married/registered domestic partner (RDP) filing separately. $87,066 or less if you are married/RDP filing jointly, head of household, or qualified widow(er)

Can you claim rent on your taxes in California?

There is good news for renters living and paying taxes in California. That is, California is one of a handful of states that does permit renters to make a claim to reduce taxable income through a renters' tax credit.

How much is the renters credit in CA?

The March 21, 2022, amendments reduced the increased Renters' credit amount from $1000 to $500 for individuals not filing as married filing joint, head of household, or surviving spouse. This is the department's first analysis of the bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tenant household information form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tenant household information form in minutes.

How do I edit tenant household information form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tenant household information form, you need to install and log in to the app.

Can I edit tenant household information form on an Android device?

You can edit, sign, and distribute tenant household information form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is CA Tenant Household Information Form?

The CA Tenant Household Information Form is a document used by landlords in California to gather essential information about the households of tenants residing in rent-controlled or subsidized housing.

Who is required to file CA Tenant Household Information Form?

Landlords or property owners of rent-controlled or subsidized housing are required to file the CA Tenant Household Information Form to comply with housing regulations.

How to fill out CA Tenant Household Information Form?

To fill out the CA Tenant Household Information Form, landlords should provide accurate details regarding each tenant's household composition, income sources, and any applicable deductions or special circumstances.

What is the purpose of CA Tenant Household Information Form?

The purpose of the CA Tenant Household Information Form is to ensure compliance with housing regulations and to determine eligibility for rental assistance or adjustments based on household income and composition.

What information must be reported on CA Tenant Household Information Form?

The CA Tenant Household Information Form must report information such as tenant names, household size, income amounts, sources of income, and any relevant deductions.

Fill out your tenant household information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tenant Household Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.