Get the free 83323 Sales Tax - Avalara

Show details

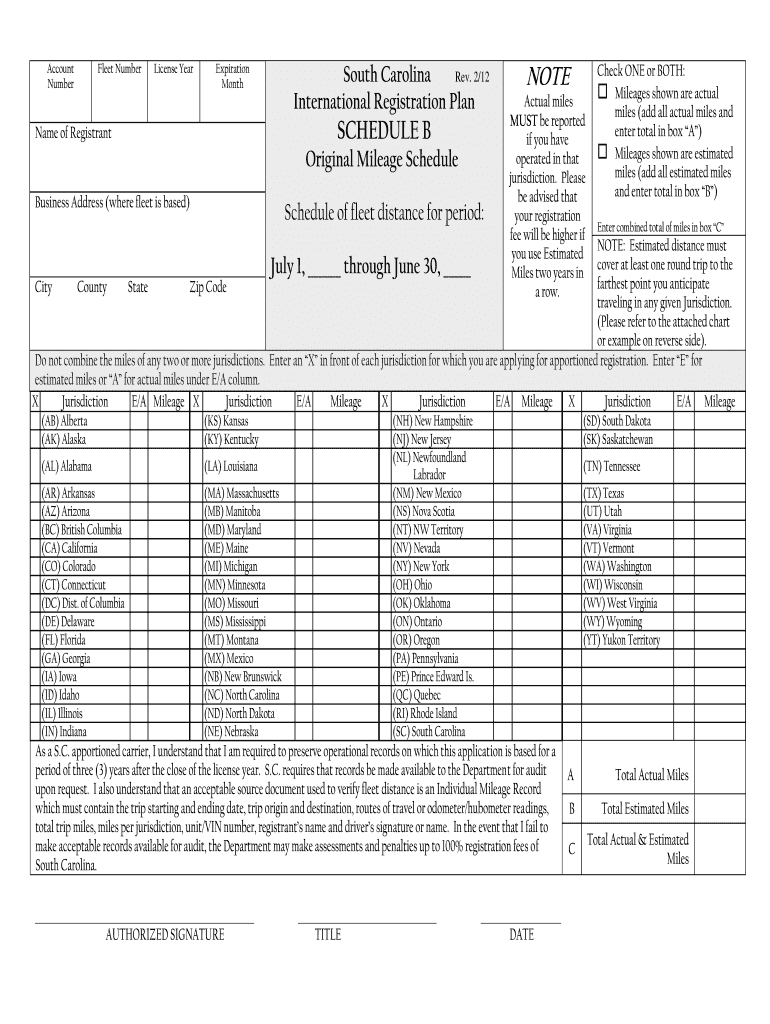

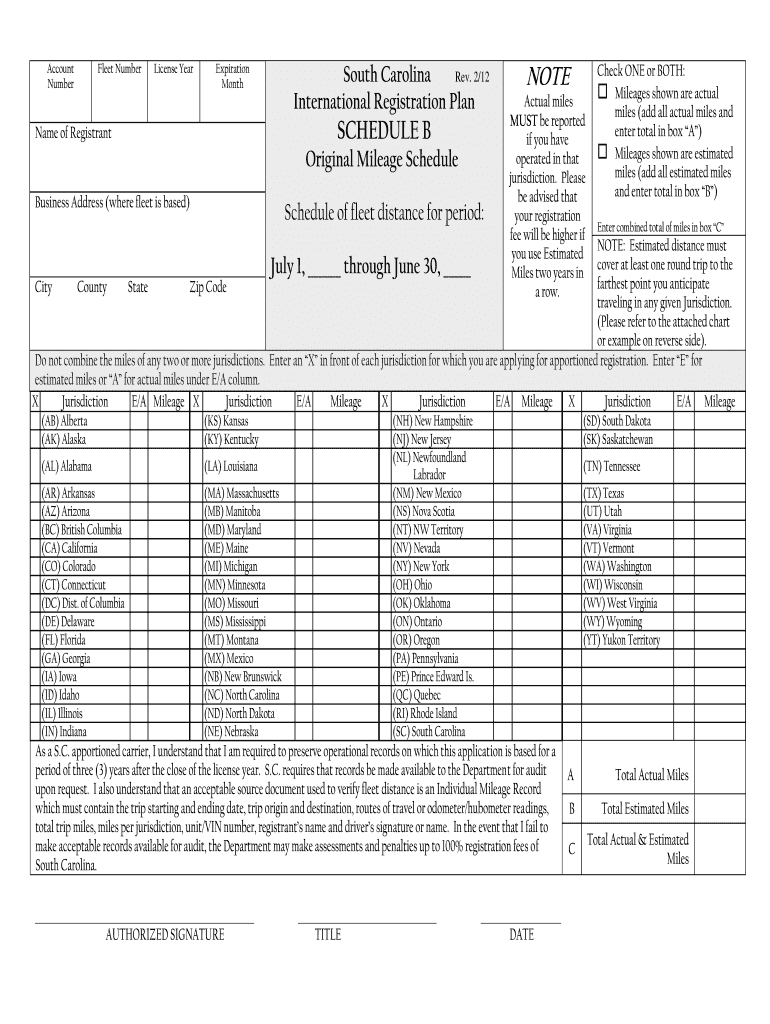

Account Number Fleet Number License Year Expiration Month South Carolina Rev. 2/12 International Registration Plan Name of Registrant SCHEDULE B Original Mileage Schedule of fleet distance for period:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 83323 sales tax

Edit your 83323 sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 83323 sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 83323 sales tax online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 83323 sales tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 83323 sales tax

How to fill out 83323 sales tax:

01

Obtain the necessary forms: Make sure you have the correct sales tax form for the 83323 jurisdiction. This form can usually be found on the local government's website or obtained from their office.

02

Gather required information: Collect all relevant sales and purchase records, including receipts, invoices, and any other supporting documents needed to accurately report your sales tax.

03

Calculate sales tax owed: Use the collected data to calculate the amount of sales tax you owe. This is typically done by multiplying the taxable amount by the sales tax rate for your jurisdiction.

04

Complete the form: Fill out the sales tax form accurately and legibly. Include all required information, such as business details, sales figures, and payment details.

05

Review and double-check: Carefully review the completed form to ensure accuracy and that all necessary information is provided. Mistakes or omissions may result in penalties or delays in processing.

06

Submit the form: Once you are confident that the form is filled out correctly, send it to the appropriate tax authority. This may involve mailing the form or submitting it electronically, depending on the jurisdiction's requirements.

07

Keep records: Make copies of the filled-out form, along with the supporting documents, for your records. Retain these records for the recommended period of time, typically several years, in case of future audits or inquiries.

Who needs 83323 sales tax:

01

Businesses: Any business or individual engaged in selling taxable goods or services within the jurisdiction of 83323 may need to collect and remit sales tax. This includes retailers, wholesalers, and service providers.

02

Remote sellers: With the rise of e-commerce, even businesses located outside of the 83323 jurisdiction may be required to collect and remit sales tax if they meet certain criteria. This is often determined by factors such as sales volume, the number of transactions, or economic nexus laws.

03

Consumers: While consumers do not directly need to collect or remit sales tax, they are responsible for paying the sales tax when purchasing taxable goods or services in the 83323 jurisdiction. It is important for consumers to understand the applicable sales tax rates and factor them into their purchasing decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 83323 sales tax in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 83323 sales tax in minutes.

How do I complete 83323 sales tax on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 83323 sales tax. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete 83323 sales tax on an Android device?

Complete your 83323 sales tax and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is 83323 sales tax?

The 83323 sales tax is a tax levied on the sale of goods and services in the 83323 zip code area.

Who is required to file 83323 sales tax?

Businesses and individuals who make sales within the 83323 zip code area are required to file 83323 sales tax.

How to fill out 83323 sales tax?

To fill out 83323 sales tax, you will need to report the total sales made in the 83323 zip code area during the reporting period.

What is the purpose of 83323 sales tax?

The purpose of 83323 sales tax is to generate revenue for the local government to fund public services and projects in the 83323 zip code area.

What information must be reported on 83323 sales tax?

The information that must be reported on 83323 sales tax includes total sales made, taxable sales, sales tax collected, and any exemptions or deductions claimed.

Fill out your 83323 sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

83323 Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.