Fidelity Investments Advisor 529 Plan Rollover 2020-2026 free printable template

Show details

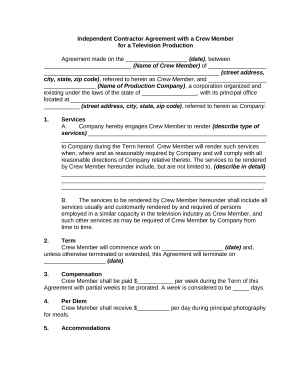

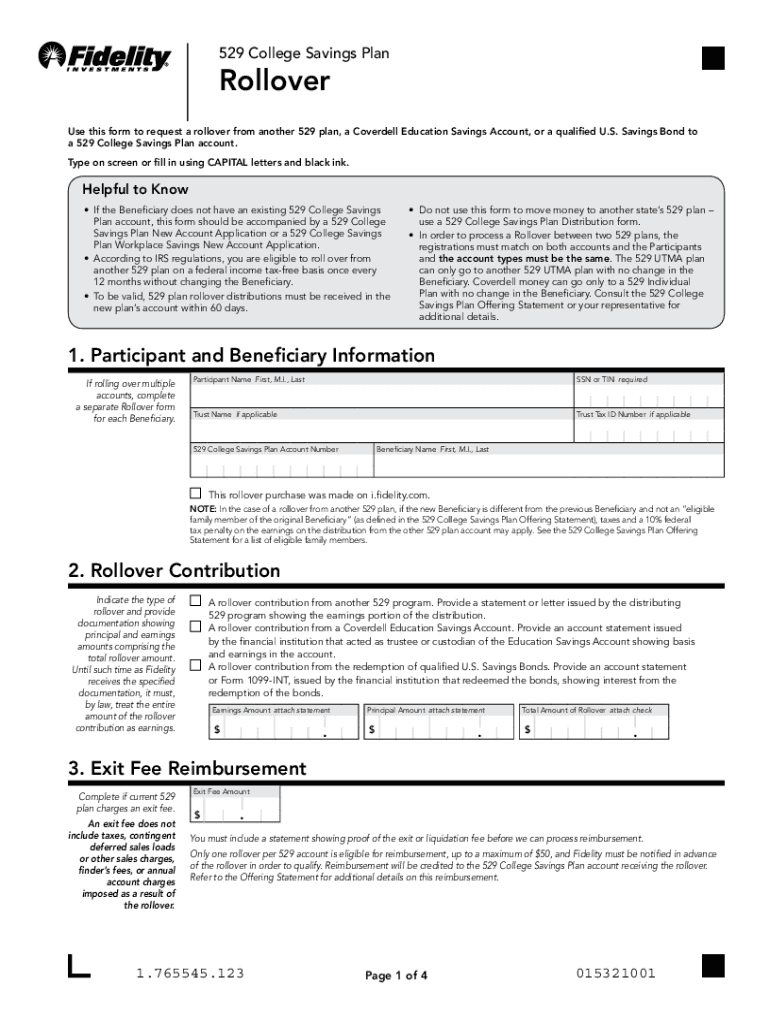

PrintReset529 College Savings PlanRollover Use this form to request a rollover from another 529 plan, a Cover dell Education Savings Account, or a qualified U.S. Savings Bond to a 529 College Savings

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign advisor 529 rollover printable form

Edit your fidelity plan rollover edit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nh fidelity rollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fidelity Investments Advisor 529 Plan Rollover online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Fidelity Investments Advisor 529 Plan Rollover. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Investments Advisor 529 Plan Rollover Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Fidelity Investments Advisor 529 Plan Rollover

How to fill out Fidelity Investments Advisor 529 Plan Rollover

01

Determine eligibility for the rollover from your current 529 plan to the Fidelity Investments Advisor 529 Plan.

02

Gather all necessary information, including account numbers and details of the current 529 plan.

03

Complete the Fidelity Investments Advisor 529 Plan Rollover Form, which can be found on the Fidelity website.

04

Include the required documentation, such as account statements from the current plan.

05

Submit the completed rollover form and any documentation to Fidelity Investments either online or via mail.

06

Follow up with both Fidelity and your current 529 plan to ensure that the rollover is processed smoothly.

Who needs Fidelity Investments Advisor 529 Plan Rollover?

01

Parents or guardians looking to consolidate college savings.

02

Individuals wanting to transfer funds from another 529 plan to the Fidelity Investments Advisor 529 Plan for better investment options.

03

Anyone whose financial situation has changed and wants to adjust their college savings strategy.

04

Beneficiaries of a 529 plan who are looking for more advantageous investment options or lower fees.

Fill

form

: Try Risk Free

People Also Ask about

What is a plan to IRA rollover?

A Rollover IRA is an account that allows you to move funds from your prior employer-sponsored retirement plan into an IRA. With an IRA rollover, you can preserve the tax-deferred status of your retirement assets, without paying current taxes or early withdrawal penalties at the time of transfer.

How to do a rollover from Fidelity?

How to move your old 401(k) into a rollover IRA Step 1: Set up your new account. Step 2: Contact your old 401(k) provider. Step 3: Deposit your money into your Fidelity account. Step 4: Invest your money.

What is a plan to plan transfer?

A qualified plan-to-plan transfer is the process of moving money from a qualified (as defined by IRS) pretax investment account / retirement plan to another qualified plan without incurring taxes or penalties on the money being transferred.

How do I roll out my 401k from Fidelity?

We've laid out a step-by-step guide to help you roll over your old Fidelity 401(k) in five key steps: Confirm a few key details about your 401(k) plan. Decide where to move your money. Initiate your rollover with Fidelity. Get a check in the mail and deposit it into the new account.

Can a rollover be done electronically?

To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401(k) plan administrator. The money is moved directly, either electronically or by check.

How long does a Fidelity Rollover take?

If you choose to wire your money to another account, the transfer should process immediately as long as you submit your request by 4 p.m. ET. If you request to have a check sent to you, the check takes about 5 to 6 business days to process before it's mailed to you.

How do I roll money out of my Fidelity 401k?

We've laid out a step-by-step guide to help you roll over your old Fidelity 401(k) in five key steps: Confirm a few key details about your 401(k) plan. Decide where to move your money. Initiate your rollover with Fidelity. Get a check in the mail and deposit it into the new account.

Does Fidelity offer rollover IRA?

With a broad range of investment options, a Fidelity rollover IRA gives you the choice to invest on your own or have Fidelity invest for you. With both, you'll enjoy the exceptional service, planning and guidance that Fidelity is known for.

What is a plan rollover?

A rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a Rollover IRA. Rollover distributions are reported to the IRS and may be subject to federal income tax withholding.

What is a qualifying retirement plan for rollover?

The rollover rules allow the individual to bring their prior assets to their new employer's retirement plan. Qualified plans are approved retirement plans by the IRS so that participants can benefit from their tax benefits.

Can you do a Fidelity Rollover online?

Our online process usually takes less than 10 minutes to complete. Once it's submitted, we'll take it from there. We'll contact your current IRA custodian to release the assets and then deposit them directly into your chosen Fidelity account.

How do I do a rollover option on Fidelity?

0:21 5:27 How to Roll Options on Fidelity Active Trader Pro - YouTube YouTube Start of suggested clip End of suggested clip With what rolling an option is all it is is closing out your current position. And then opening up aMoreWith what rolling an option is all it is is closing out your current position. And then opening up a new one all at the same. Time now generally the new option that you're opening up is either going

Does Fidelity allow direct rollover?

to initiate a transfer of your existing IRA directly from another custodian and to invest the transferred assets in a Fidelity Advisor IRA. Make a direct rollover of your eligible retirement plan distribution to a Fidelity Advisor Traditional, Rollover, BDA, or Roth IRA.

What is a plan to plan rollover?

Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

Does Fidelity allow rollover?

Yes, visit IRA Transfers for a quick overview of the online process. What should I do if my former employer's 401(k) was recordkept by Fidelity? If you would like to roll over a former employer's retirement savings plan that is recordkept by Fidelity, please call a rollover specialist at 800-343-3548 for assistance.

Does Fidelity charge fees for rollover IRA?

There is no cost to open and no annual fee for Fidelity's Traditional, Roth, SEP, and Rollover IRAs. A $50 account close out fee may apply. Fund investments held in your account may be subject to management, low balance and short term trading fees, as described in the offering materials.

What is the difference between a rollover IRA and a traditional IRA in Fidelity?

When it comes to a rollover IRA vs. traditional IRA, the only real difference is that the money in a rollover IRA was rolled over from an employer-sponsored retirement plan. Otherwise, the accounts share the same tax rules on withdrawals, required minimum distributions, and conversions to Roth IRAs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Fidelity Investments Advisor 529 Plan Rollover to be eSigned by others?

When you're ready to share your Fidelity Investments Advisor 529 Plan Rollover, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute Fidelity Investments Advisor 529 Plan Rollover online?

pdfFiller has made it simple to fill out and eSign Fidelity Investments Advisor 529 Plan Rollover. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit Fidelity Investments Advisor 529 Plan Rollover online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Fidelity Investments Advisor 529 Plan Rollover to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is Fidelity Investments Advisor 529 Plan Rollover?

Fidelity Investments Advisor 529 Plan Rollover is a process that allows account holders to transfer funds from one 529 college savings plan to another without incurring federal taxes or penalties, provided certain conditions are met.

Who is required to file Fidelity Investments Advisor 529 Plan Rollover?

Account holders who wish to transfer their savings from an existing 529 plan to a Fidelity Investments Advisor 529 Plan must initiate the rollover process and may need to file the appropriate forms.

How to fill out Fidelity Investments Advisor 529 Plan Rollover?

To fill out the Fidelity Investments Advisor 529 Plan Rollover, complete the required rollover application form provided by Fidelity, including details of both the current and new 529 plans, and submit it as instructed.

What is the purpose of Fidelity Investments Advisor 529 Plan Rollover?

The purpose of Fidelity Investments Advisor 529 Plan Rollover is to provide account holders with the flexibility to move their college savings to a different plan that may offer better investment options, lower fees, or different features.

What information must be reported on Fidelity Investments Advisor 529 Plan Rollover?

The information that must be reported on the Fidelity Investments Advisor 529 Plan Rollover includes the account holder's details, current plan information, new plan information, and the amount being rolled over.

Fill out your Fidelity Investments Advisor 529 Plan Rollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Advisor 529 Plan Rollover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.