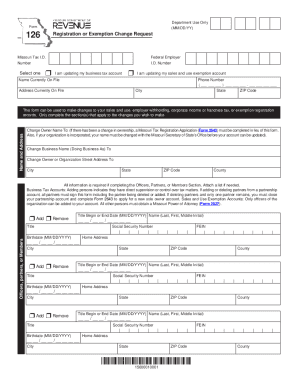

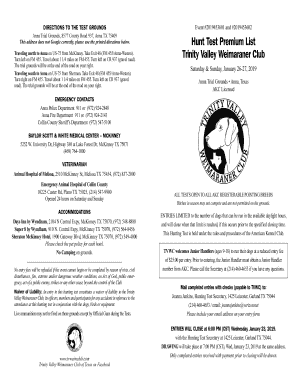

MO DOR Form 126 2021 free printable template

Show details

Reset Formulas print on white paper onlyDepartment Use Only (MM/DD/BY)Form126Print Preregistration or Exemption Change Request Missouri Tax I.D. Federal EmployerNumberI. D. Number Select ONERA am

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DOR Form 126

Edit your MO DOR Form 126 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DOR Form 126 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DOR Form 126 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MO DOR Form 126. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DOR Form 126 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DOR Form 126

How to fill out MO DOR Form 126

01

Obtain the MO DOR Form 126 from the Missouri Department of Revenue website or your local DOR office.

02

Fill out the header section with your name, address, and Social Security number.

03

Indicate the tax year you are filing for.

04

Complete the income section, listing all sources of income as required.

05

Provide any applicable deductions and credits in the respective sections.

06

Review your entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate DOR office by the deadline.

Who needs MO DOR Form 126?

01

Individuals who are filing their personal income taxes in Missouri.

02

Taxpayers who have income that requires reporting on Form 126.

03

Residents and non-residents who earn income in Missouri.

Fill

form

: Try Risk Free

People Also Ask about

Does Missouri have a state income tax form?

If you are required to file an individual income tax return or want to file to get a refund of taxes withheld, use Form MO-PTS (not Form MO-PTC) with Form MO-1040P or Form MO-1040.

Do I need to send a copy of my federal return with my Missouri state return?

Yes, you'll need to attach a copy of your Federal Tax Return with your Missouri Tax Return.

Do you have to attach federal return to state return?

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.

How do I change ownership of an LLC in Missouri?

Full Transfer: Selling Your Missouri LLC Determine whether the buyer wants your entire entity or just your LLC's assets. Obtain the consent of every LLC member to sell the business. Consult your Operating Agreement for help drafting a buy/sell agreement.

Do you have to send a copy of your federal tax return with your state return in Illinois?

If you filed a federal return you are required to FILE an IL return, but IL does not require you to mail the federal return to them.

How do I remove myself from an LLC in Missouri?

Under Missouri law, a member may withdraw from an LLC as provided in the operating agreement, or 90 days after giving written notice of the withdrawal to all of the other members. If the withdrawal breaches any term of the operating agreement, then the LLC can recover damages from the withdrawing member.

What forms do I need to send with my Missouri tax return?

If you are required to file a Missouri income tax return, you may file a Form MO-1040 and Form MO-PTS (together) to claim your credit or refund. If you are NOT required to file a Missouri income tax return, you must file a Form MO-PTC, Property Tax Credit Claim, to claim your credit.

What documents need to be included with my tax return?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

How do I get a no tax due letter in Missouri?

Please call 1-573-751-5860 (State of Missouri), give your tax ID number and request a “letter of no sales tax due” to be mailed to you.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO DOR Form 126 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your MO DOR Form 126 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete MO DOR Form 126 online?

pdfFiller has made it simple to fill out and eSign MO DOR Form 126. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit MO DOR Form 126 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing MO DOR Form 126.

What is MO DOR Form 126?

MO DOR Form 126 is a document used for reporting certain tax information to the Missouri Department of Revenue, specifically related to income and deductions.

Who is required to file MO DOR Form 126?

Individuals and businesses that have received income that must be reported to the Missouri Department of Revenue are required to file MO DOR Form 126.

How to fill out MO DOR Form 126?

To fill out MO DOR Form 126, you must provide information such as your name, address, tax identification number, income details, and any applicable deductions as required in the form's sections.

What is the purpose of MO DOR Form 126?

The purpose of MO DOR Form 126 is to collect necessary tax information from individuals and businesses to ensure accurate income tax reporting and compliance with Missouri state tax laws.

What information must be reported on MO DOR Form 126?

The information that must be reported on MO DOR Form 126 includes taxpayer identification details, total income, deductions claimed, and any other relevant financial information as specified in the form.

Fill out your MO DOR Form 126 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DOR Form 126 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.