Get the free Section 194NTDS on cash withdrawal in excess of Rs 1 crore

Show details

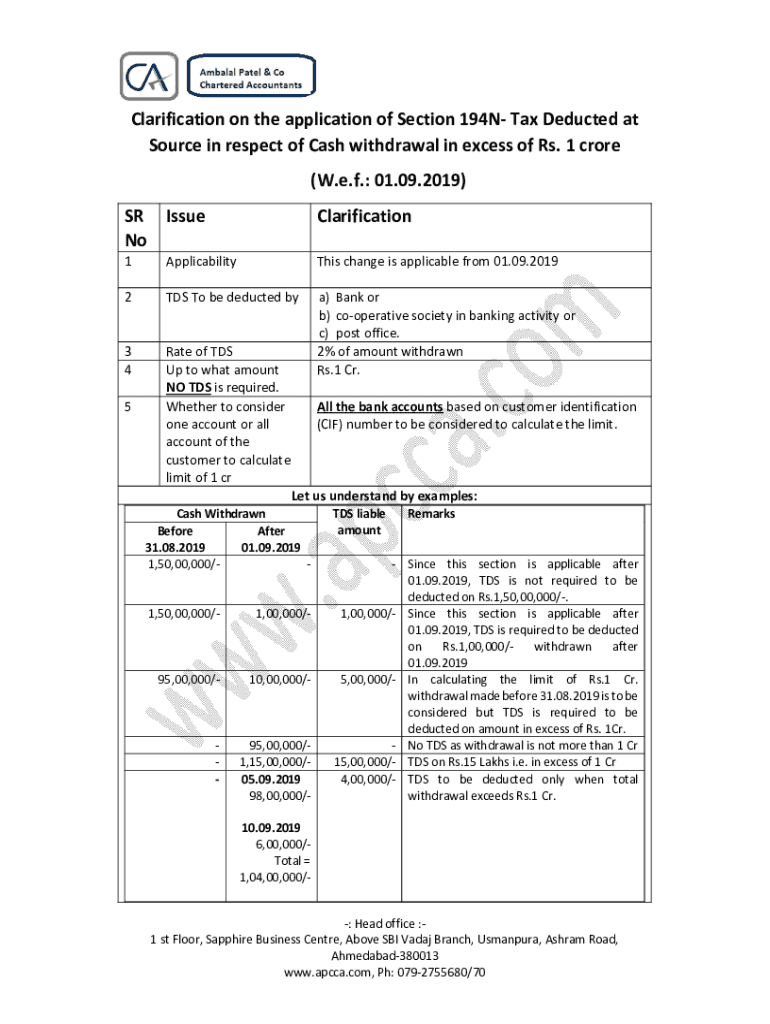

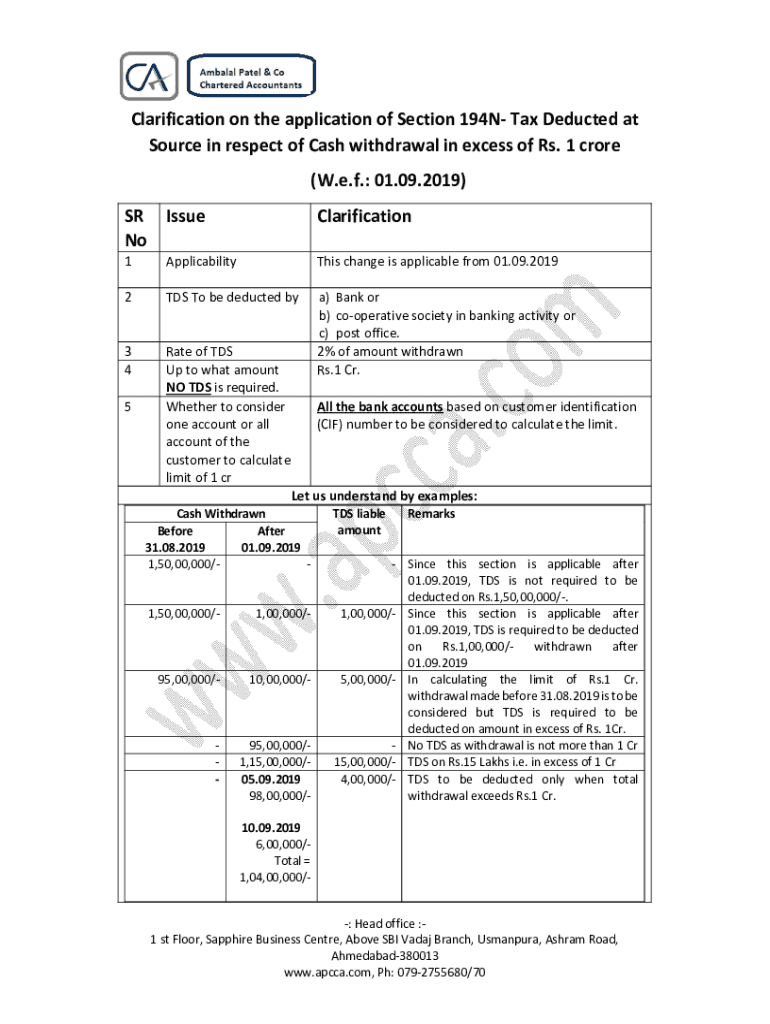

Clarification on the application of Section 194 N Tax Deducted at Source in respect of Cash withdrawal in excess of Rs. 1 crore (W.e.f.: 01.09.2019) SR NoIssueClarification1ApplicabilityThis change

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 194ntds on cash

Edit your section 194ntds on cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 194ntds on cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 194ntds on cash online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section 194ntds on cash. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 194ntds on cash

How to fill out section 194ntds on cash

01

To fill out section 194ntds on cash, follow these steps:

02

Start by identifying the payer and the payee.

03

Enter the relevant financial information, such as the amount of cash paid and the date of the transaction.

04

Include any necessary details, such as the reason for the payment or any additional information that may be required.

05

Make sure to double-check all the entered information for accuracy.

06

Once everything is filled out correctly, submit the form or provide the required documentation as per the guidelines.

07

Note: It is advisable to consult with a tax professional or refer to the official guidelines to ensure compliance with the specific requirements.

Who needs section 194ntds on cash?

01

Section 194ntds on cash may be required by individuals or businesses who are involved in certain cash transactions that need to be reported for tax purposes.

02

Examples of entities that may need to fill out section 194ntds on cash include:

03

- Employers who are making cash payments to employees or contractors

04

- Individuals or businesses who are receiving cash payments for goods or services

05

- Financial institutions or banks involved in cash transactions

06

The exact requirements may vary depending on the jurisdiction and specific circumstances, so it is essential to consult with a tax advisor or refer to the applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify section 194ntds on cash without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like section 194ntds on cash, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute section 194ntds on cash online?

pdfFiller has made filling out and eSigning section 194ntds on cash easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in section 194ntds on cash?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your section 194ntds on cash to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is section 194ntds on cash?

Section 194ntds on cash refers to the requirement of deducting tax at source on cash withdrawals of over a specified threshold limit from a bank account.

Who is required to file section 194ntds on cash?

Any person or entity making cash withdrawals exceeding the threshold limit specified in the section is required to deduct tax at source and file section 194ntds on cash.

How to fill out section 194ntds on cash?

To fill out section 194ntds on cash, the person must provide details of the cash withdrawals exceeding the threshold limit, calculate the tax to be deducted, and file the necessary forms with the tax authorities.

What is the purpose of section 194ntds on cash?

The purpose of section 194ntds on cash is to track and tax cash withdrawals above a certain limit in order to prevent tax evasion and ensure transparency in financial transactions.

What information must be reported on section 194ntds on cash?

The information to be reported on section 194ntds on cash includes details of the cash withdrawals, the amount exceeding the threshold limit, the tax deducted at source, and other relevant financial information.

Fill out your section 194ntds on cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 194ntds On Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.