EQT Authorization Agreement for Direct Deposits (ACH Credits) 2021-2026 free printable template

Show details

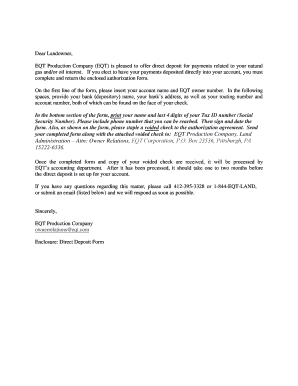

E Q TC O R P O R A T I O N625 Liberty Ave Pittsburgh, PA 15222 P: 1844EQTLand www.eqt.comDear Landowner, EAT Production Company (EAT) is pleased to offer direct deposit for payments related to your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign EQT Authorization Agreement for Direct Deposits ACH

Edit your EQT Authorization Agreement for Direct Deposits ACH form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your EQT Authorization Agreement for Direct Deposits ACH form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit EQT Authorization Agreement for Direct Deposits ACH online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit EQT Authorization Agreement for Direct Deposits ACH. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

EQT Authorization Agreement for Direct Deposits (ACH Credits) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out EQT Authorization Agreement for Direct Deposits ACH

How to fill out EQT Authorization Agreement for Direct Deposits (ACH Credits)

01

Obtain the EQT Authorization Agreement for Direct Deposits (ACH Credits) form from the EQT website or your HR department.

02

Fill in your personal information including your name, address, and contact details.

03

Provide your bank's name, address, and your account details including the account number and routing number.

04

Indicate the type of account (checking or savings) that you want your deposits to go into.

05

Review the terms and conditions stated in the agreement carefully.

06

Sign and date the form to authorize the direct deposit.

07

Submit the completed form to your employer or designated department responsible for payroll.

Who needs EQT Authorization Agreement for Direct Deposits (ACH Credits)?

01

Employees of EQT who wish to receive their salary via direct deposit.

02

Contractors or vendors associated with EQT that prefer ACH credits for payments.

03

Individuals who are receiving benefits or payments from EQT that can be processed through direct deposit.

Fill

form

: Try Risk Free

People Also Ask about

What is ACH payment authorization?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization. What you should know.

How do I write a direct deposit authorization form?

I hereby authorize {Enter Company Name} to directly deposit my pay in the bank account(s) listed below in the percentages specified. (If two accounts are designated, deposits are to be made in whole percentages of pay to total 100%.)

How do I authorize ACH payments?

Requirements of an ACH Authorization Form Payor's name and contact information. So that the payee can get in touch with the payor. Payee's name and contact information. Payment details. Authorization statement. Recourse statement. Payor's bank details. Date of agreement and signature. Sample of a Paper ACH Form.

Can I get an ACH form online?

You can complete the ACH Authorization Form manually on paper or online. Also, you can have a copy for the customers while the companies retain the signed form for at least two years.

Is an ACH transfer the same as a direct deposit?

What's the difference between ACH and direct deposit? A “direct deposit” is a type of payment made via the ACH network. It's an informal name for common ACH deposits where individuals receive payments directly into their bank accounts.

Is ACH and direct deposit the same thing?

A “direct deposit” is a type of payment made via the ACH network. It's an informal name for common ACH deposits where individuals receive payments directly into their bank accounts. The ACH-based payouts popularly referred to as direct deposits include: Salary and wages.

How do I enable ACH payments?

To receive an ACH payment, you need to provide your bank's routing number and the account number for the checking or savings account you want the money deposited into. With some companies, you may also need to sign an ACH authorization form; your client should provide that if it's required.

What does ACH mean for direct deposit?

ACH transfers are a popular kind of electronic transfer that is processed by the Automated Clearing House (ACH) Network. They are a safe, reliable way to move money between different bank accounts and financial institutions. ACH transfers take about 2 to 5 business days to deposit but are almost always free of charge.

How do I authorize a direct deposit?

How to set up direct deposit for your paycheck Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

What is the difference between direct deposit and ACH transfer?

Direct deposits are financial activities that put money into your bank account. For example, you can receive income from your employer or a payment from a friend. These electronic transactions count as direct deposits. ACH transfers are electronic financial transaction that changes your account balance.

Do I use my ACH number for direct deposit?

Do I use my ACH number for direct deposit? Yes, you need to provide your employer with your ACH number as well as your bank account number to set up direct deposit.

Do I need an ACH authorization form?

Direct digital payment options like ACH require that business owners fill in an ACH Authorization Form before consenting to any payment. It also needs a signature that helps safeguard the business if any legal disputes arise in the future.

What is a ACH direct deposit authorization?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

Why did I just get an ACH deposit?

An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. The most common types of ACH direct deposits include salary payment, tax returns, and government benefits. ACH transfers have made paper checks obsolete.

How long does it take to authorize a deposit?

This is the result of a temporary hold the bank places on your credit or debit card at the time of your deposit, and will clear itself in 1-3 business days.

How do I get an ACH authorization?

Requirements of an ACH Authorization Form Payor's name and contact information. So that the payee can get in touch with the payor. Payee's name and contact information. Payment details. Authorization statement. Recourse statement. Payor's bank details. Date of agreement and signature. Sample of a Paper ACH Form.

Should you accept ACH payments?

Accepting ACH payments is a great way to offer customers added convenience. If you already accept credit cards, you may be able to accept ACH payments easily. Accepting ACH payments offers customers an added level of convenience. Payments can be accepted through a bank or a third-party payment processor.

What is a pre authorized direct deposit form?

A Direct Deposit is when money is automatically deposited into your Advance Savings account on a regular basis. A Pre-authorized Payments is an automatic withdrawal from your Advance Savings account that is set up to pay bills or rent on a regular basis.

What is the difference between ACH and direct deposit?

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. Direct deposits are transfers into an account, such as payroll, benefits, and tax refund deposits.

Can someone else direct deposit into my account?

no. To set up direct deposit, you need to give your employer your bank account and routing number—and typically, you don't have the right to give out somebody else's bank account information.

Who is responsible for authorizing the ACH transaction?

ACH entries must be authorized by the owner of the account that is being debited or credited, though the type of authorization varies. The bank reserves the right to restrict types (i.e. Standard Entry Classes) available for processing and generally allows only consumer (“PPD”) and business (“CCD”, “CTX”) transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify EQT Authorization Agreement for Direct Deposits ACH without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like EQT Authorization Agreement for Direct Deposits ACH, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in EQT Authorization Agreement for Direct Deposits ACH without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing EQT Authorization Agreement for Direct Deposits ACH and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out EQT Authorization Agreement for Direct Deposits ACH on an Android device?

On Android, use the pdfFiller mobile app to finish your EQT Authorization Agreement for Direct Deposits ACH. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is EQT Authorization Agreement for Direct Deposits (ACH Credits)?

The EQT Authorization Agreement for Direct Deposits (ACH Credits) is a document that allows individuals or entities to authorize direct deposit of funds into their bank accounts via the ACH (Automated Clearing House) network. It provides the necessary authorization for a financial institution to process these transactions.

Who is required to file EQT Authorization Agreement for Direct Deposits (ACH Credits)?

Individuals or entities that wish to receive payments through direct deposit, such as employees, vendors, or beneficiaries, are required to file the EQT Authorization Agreement for Direct Deposits (ACH Credits).

How to fill out EQT Authorization Agreement for Direct Deposits (ACH Credits)?

To fill out the EQT Authorization Agreement for Direct Deposits (ACH Credits), one must provide personal or business information, including the name, address, bank account number, and routing number. Sign the form to authorize the specified party to initiate direct deposits.

What is the purpose of EQT Authorization Agreement for Direct Deposits (ACH Credits)?

The purpose of the EQT Authorization Agreement for Direct Deposits (ACH Credits) is to streamline the payment process by allowing for automatic deposits into an individual's or entity's bank account, thereby ensuring timely and secure transaction processing.

What information must be reported on EQT Authorization Agreement for Direct Deposits (ACH Credits)?

The EQT Authorization Agreement for Direct Deposits (ACH Credits) must report information such as the account holder's name, address, bank account number, routing number, and any specific instructions regarding the deposits.

Fill out your EQT Authorization Agreement for Direct Deposits ACH online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

EQT Authorization Agreement For Direct Deposits ACH is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.