Get the free Tax Increment Financial Reports - Illinois Comptroller's Office

Show details

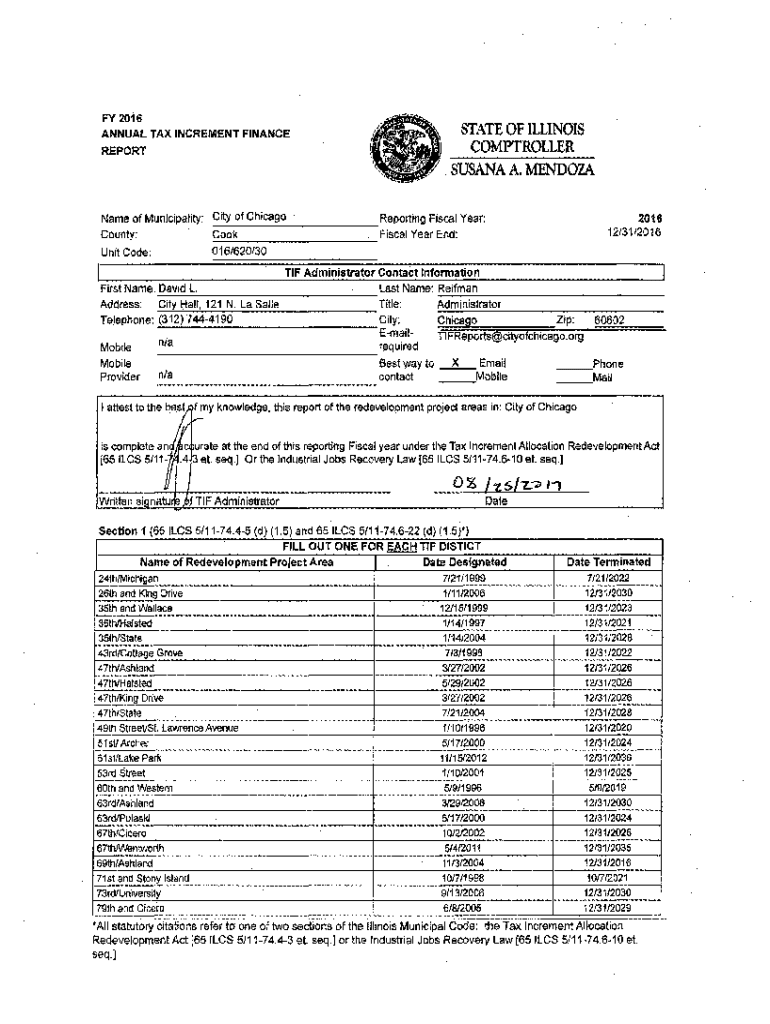

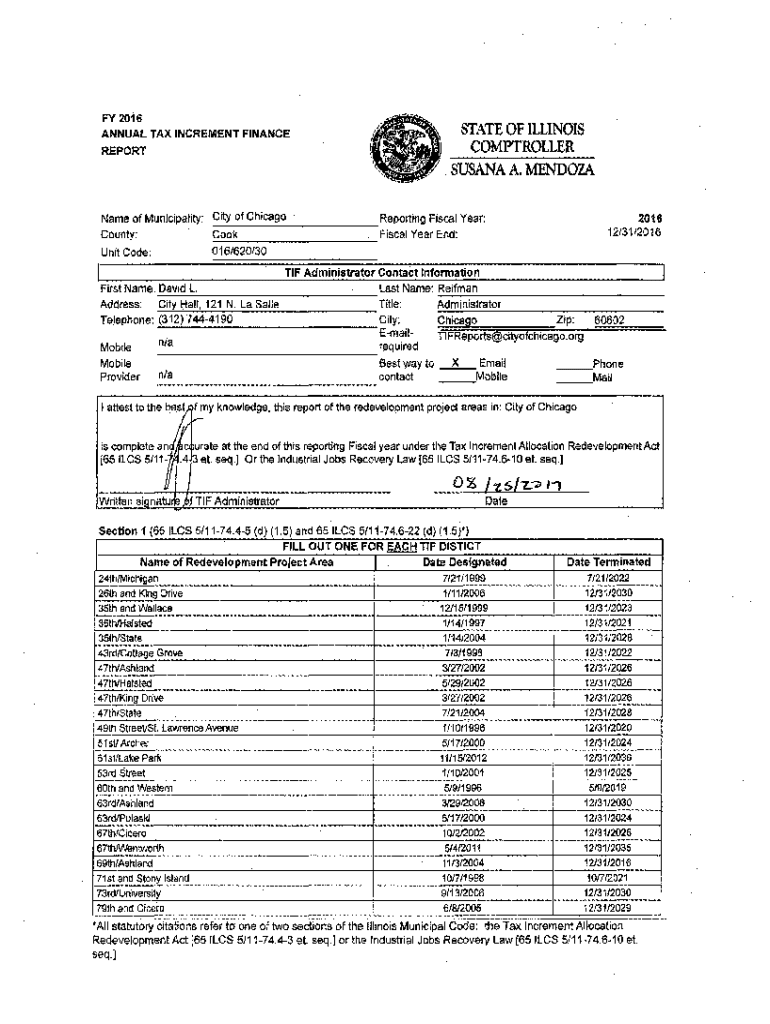

FY 2016 ANNUAL TAX INCREMENT FINANCE REPORTAGE OF ILLINOIS COMPTROLLER SUSANA A. MENDOZAName of Municipality: City of Chicago Reporting Fiscal Year: County: Cook Fiscal Year End: Unit Code:2016 12131/2016016/620130TIF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financial reports

Edit your tax increment financial reports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financial reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax increment financial reports online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment financial reports. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financial reports

How to fill out tax increment financial reports

01

To fill out tax increment financial reports, follow these steps:

02

Gather all relevant financial information, including income, expenses, and investments.

03

Organize the information according to the required categories in the report (e.g., revenue, expenditures, reserves).

04

Calculate the net change in each category by subtracting the beginning balance from the ending balance.

05

Compare the net changes with the previous reporting period to determine if there are any significant variations.

06

Summarize the findings and provide explanations for any notable differences or trends.

07

Double-check the calculations and ensure all numbers are accurate.

08

Fill out the report form or template provided by the tax authority, entering the calculated values in the appropriate fields.

09

Review the completed report for any errors or omissions before submitting it to the relevant tax authority.

10

Keep a copy of the report for your records and comply with any further reporting or filing requirements as necessary.

Who needs tax increment financial reports?

01

Various entities and individuals may need tax increment financial reports, including:

02

- Businesses and corporations that are subject to tax increment financing (TIF) agreements.

03

- Local government authorities that implement TIF programs and monitor the financial performance of TIF districts.

04

- Financial auditors and accountants responsible for ensuring compliance and accuracy in financial reporting.

05

- Investors and shareholders interested in evaluating the financial health and performance of a TIF project or district.

06

- Government agencies and regulatory bodies that oversee TIF programs and require reports for transparency and accountability.

07

- Economic development organizations that use tax increment financing as a tool for revitalizing blighted or underdeveloped areas.

08

- Researchers and analysts studying the impact and effectiveness of tax increment financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax increment financial reports on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing tax increment financial reports right away.

How do I fill out tax increment financial reports using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax increment financial reports on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out tax increment financial reports on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tax increment financial reports from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is tax increment financial reports?

Tax increment financial reports are financial documents that track the revenue and expenses of a tax increment financing (TIF) district.

Who is required to file tax increment financial reports?

Municipalities and other governmental entities that use tax increment financing (TIF) districts are required to file tax increment financial reports.

How to fill out tax increment financial reports?

Tax increment financial reports should be filled out carefully and accurately, including detailed revenue and expense information for the TIF district.

What is the purpose of tax increment financial reports?

The purpose of tax increment financial reports is to provide transparency and accountability for the financial activities of TIF districts, ensuring that funds are being used appropriately.

What information must be reported on tax increment financial reports?

Tax increment financial reports must include information on revenue sources, expenditures, fund balances, debt obligations, and any other relevant financial data related to the TIF district.

Fill out your tax increment financial reports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financial Reports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.