Get the free Application for Term Life Insurance for Alumni

Show details

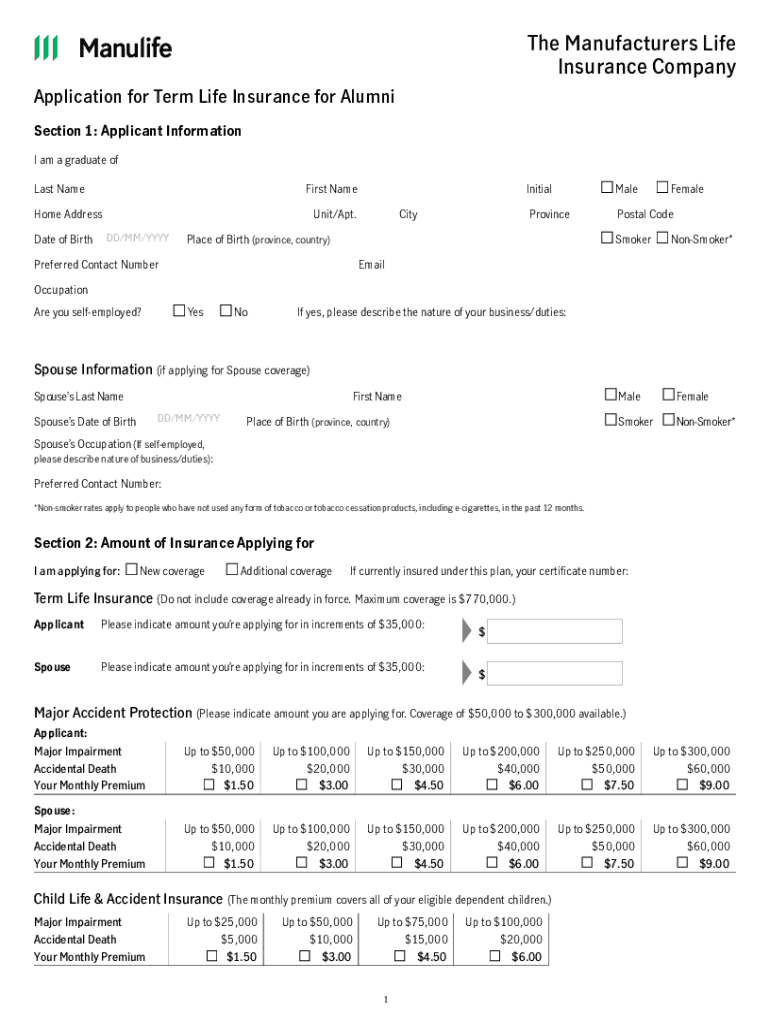

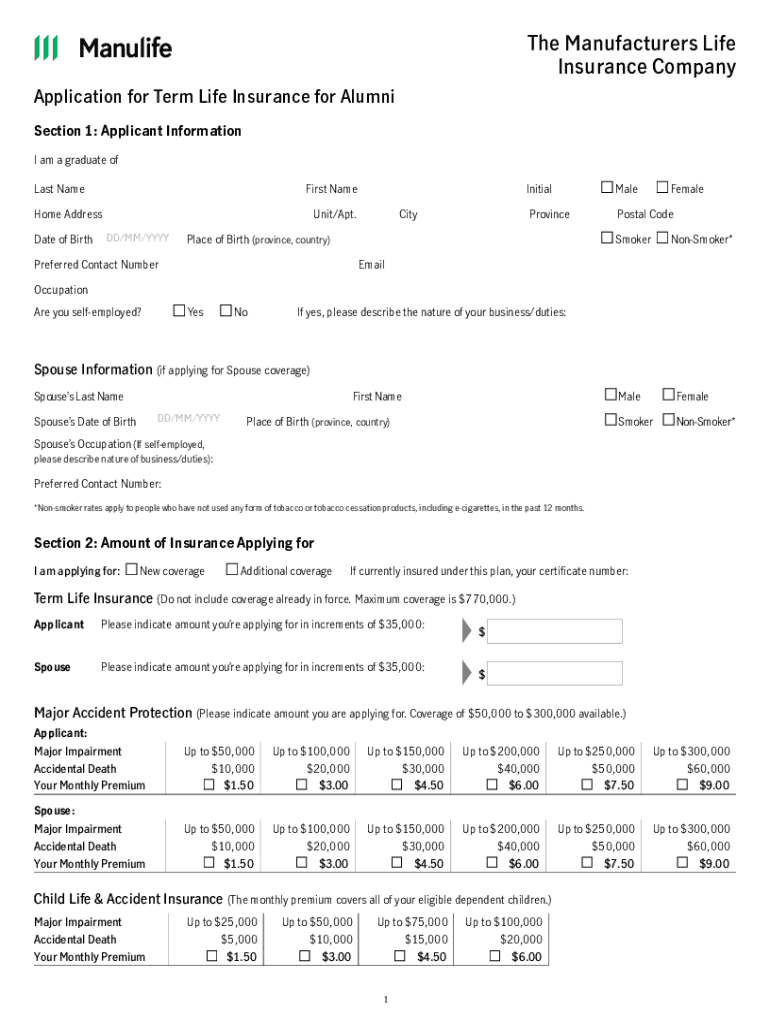

The Manufacturers Life Insurance Company Application for Term Life Insurance for Alumni Section 1: Applicant Information I am a graduate of Last NameFirst Namesake Address Date of BirthInitialUnit/Apt.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for term life

Edit your application for term life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for term life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for term life online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for term life. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for term life

How to fill out application for term life

01

Step 1: Gather necessary documents, such as identification, proof of income, and medical history.

02

Step 2: Research and choose a reputable life insurance provider.

03

Step 3: Complete the application form, providing accurate and detailed information.

04

Step 4: Attach any required supporting documents, such as medical records or consent forms.

05

Step 5: Review the application for any errors or omissions before submitting.

06

Step 6: Pay any required application fees or premiums.

07

Step 7: Submit the application either online, by mail, or in person, as per the provider's instructions.

08

Step 8: Await the decision from the life insurance company, which may include further medical evaluations or underwriting.

09

Step 9: Once approved, carefully review the policy terms and conditions before accepting.

10

Step 10: Make the initial premium payment to activate the term life insurance policy.Keep a copy of the filled-out application for future reference.

Who needs application for term life?

01

Anyone who wants to provide financial protection for their loved ones in the event of their untimely death can benefit from applying for term life insurance.

02

Individuals with dependents, such as spouses, children, or aging parents, often opt for term life insurance to ensure their family's financial stability.

03

Business owners who want to protect their companies from potential financial losses or to secure loans may also require term life insurance.

04

People with substantial debts, such as mortgages, student loans, or credit card balances, can use term life insurance to cover these obligations if they pass away.

05

Individuals with specific financial goals, such as leaving an inheritance or funding a child's education, may find term life insurance suitable.

06

It is recommended to consult with a financial advisor to determine if applying for term life insurance fits your personal circumstances and financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application for term life without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like application for term life, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute application for term life online?

With pdfFiller, you may easily complete and sign application for term life online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete application for term life on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your application for term life. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is application for term life?

An application for term life is a form that an individual fills out to apply for a term life insurance policy.

Who is required to file application for term life?

Anyone who wants to apply for a term life insurance policy is required to file an application for term life.

How to fill out application for term life?

To fill out an application for term life, an individual must provide personal information, medical history, lifestyle habits, and beneficiary details.

What is the purpose of application for term life?

The purpose of the application for term life is for the insurance company to assess the risk of insuring the individual and determine the premium rates.

What information must be reported on application for term life?

Information such as name, address, date of birth, medical history, occupation, income, lifestyle habits, and beneficiary details must be reported on the application for term life.

Fill out your application for term life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Term Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.