Get the free wisconsin form 804 2021

Show details

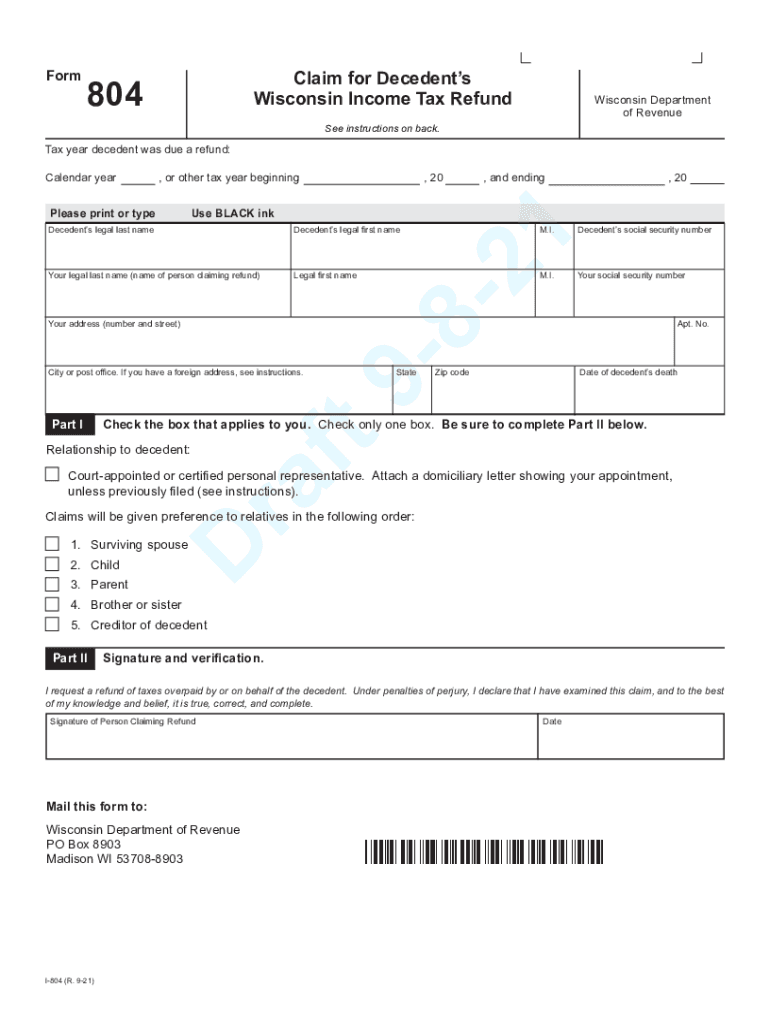

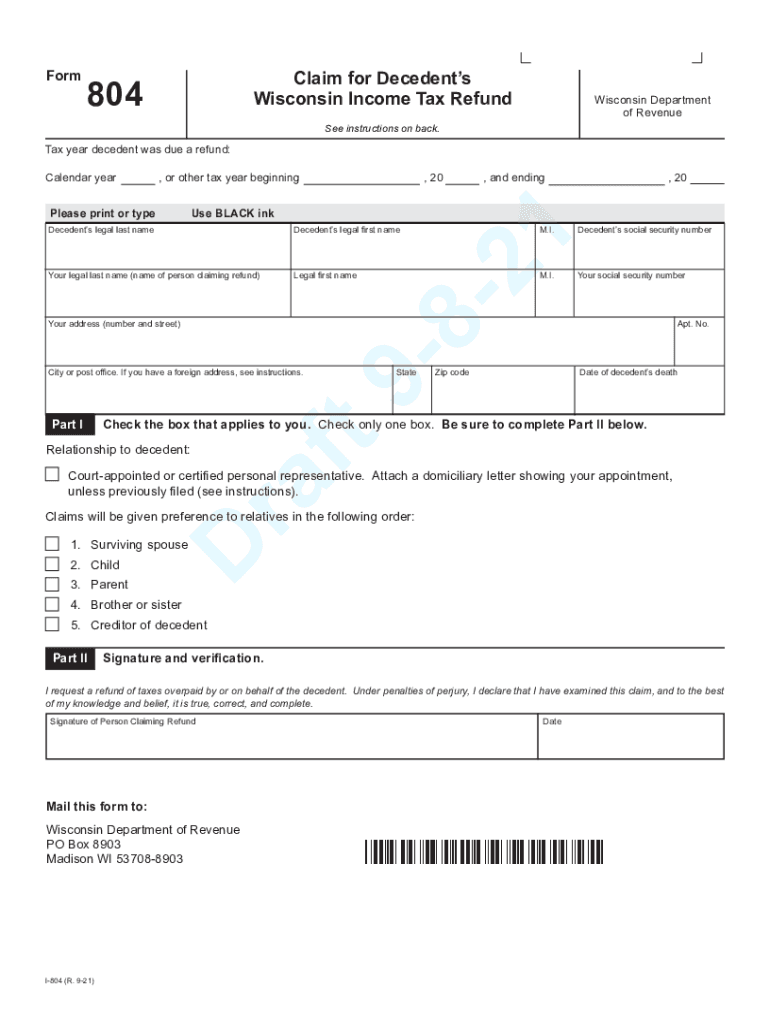

Formulaic for Decedents Wisconsin Income Tax Refund804Wisconsin Department of Revenues instructions on back. Tax year decedent was due a refund:, or other tax year beginningPlease print or type, 20,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wisconsin form 804 2021

Edit your wisconsin form 804 2021 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin form 804 2021 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wisconsin form 804 2021 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wisconsin form 804 2021. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wisconsin form 804 2021

How to fill out wisconsin form 804 2021

01

To fill out Wisconsin form 804 for the year 2021, follow these steps:

02

Download the form from the official Wisconsin Department of Revenue website.

03

Open the form using a compatible PDF reader on your computer.

04

Begin by filling out your personal information, including your name, address, and Social Security number.

05

Provide your filing status and any dependents you may have.

06

Proceed to the income section and enter the relevant information from your W-2 or other income sources.

07

If you have any deductions or credits, fill them out in the appropriate sections.

08

Double-check all the entered information for accuracy and completeness.

09

Sign and date the form.

10

Make a copy for your records and submit the form by mail or electronically as directed by the Wisconsin Department of Revenue.

11

If you have any questions or need further assistance, consult the official instructions or contact the Wisconsin Department of Revenue.

Who needs wisconsin form 804 2021?

01

Wisconsin form 804 for the year 2021 is needed by individuals who are required to file a Wisconsin income tax return.

02

This form is specifically for reporting any additional taxes owed under the Alternative Minimum Tax (AMT) system.

03

If you meet the criteria for AMT, you will need to fill out form 804 along with your regular tax return.

04

It is important to determine your eligibility for AMT before determining if you need to complete form 804.

05

If you are unsure whether you need to file this form, it is recommended to consult a tax professional or the Wisconsin Department of Revenue for guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is the 804 tax form for Wisconsin?

Use Form 804 to claim a refund on behalf of a decedent (deceased taxpayer). If you are filing the decedent's income tax return, submit Form 804 with the return.

What is Wisconsin Personal Exemption 2021?

The personal exemptions are $700 for individuals, their spouses, and dependents, and an additional $250 for taxpayers and their spouses (if filing a joint return) who have reached the age of 65 before the close of the taxable year.

Do I need to include my federal return with my Wisconsin state return?

In addition to your federal return, you may attach other forms, schedules, and explanations to support your Wisconsin return. If claiming the homestead credit, we require you to attach your property tax bill or proof of rent paid, along with proof of your income. How do I make a file suitable for attachment?

Who is required to file a Wisconsin tax return?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

What is the Wisconsin non resident tax form?

If you are a nonresident or part-year resident of Wisconsin and your Wisconsin gross income (or the combined gross income of you and your spouse) is $2,000 or more, you must file a Form 1NPR, Nonresident and Part-Year Resident Income Tax Return. The Form 1NPR and instructions can be downloaded from our website.

Does Wisconsin tax pensions and Social Security?

Wisconsin does not tax social security benefits. As a retired person, do I qualify for homestead credit? Retirees age 62 years of age or older who are full-year legal residents of Wisconsin may qualify for homestead credit if they meet certain conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in wisconsin form 804 2021?

With pdfFiller, it's easy to make changes. Open your wisconsin form 804 2021 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in wisconsin form 804 2021 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit wisconsin form 804 2021 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the wisconsin form 804 2021 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is wisconsin form 804?

Wisconsin form 804 is a form used for reporting Wisconsin withholding tax on real estate sales.

Who is required to file wisconsin form 804?

Individuals or entities who are involved in real estate transactions in Wisconsin and have withholding tax obligations are required to file Wisconsin form 804.

How to fill out wisconsin form 804?

Wisconsin form 804 should be filled out with information about the real estate transaction, seller, buyer, and amount of withholding tax. It is important to provide accurate information to avoid any penalties.

What is the purpose of wisconsin form 804?

The purpose of Wisconsin form 804 is to report and remit withholding tax on real estate sales in Wisconsin.

What information must be reported on wisconsin form 804?

Information such as the seller's name, buyer's name, property address, sales price, and amount of withholding tax must be reported on Wisconsin form 804.

Fill out your wisconsin form 804 2021 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin Form 804 2021 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.