Get the free Paystubs for each wage earner totaling one current month of income

Show details

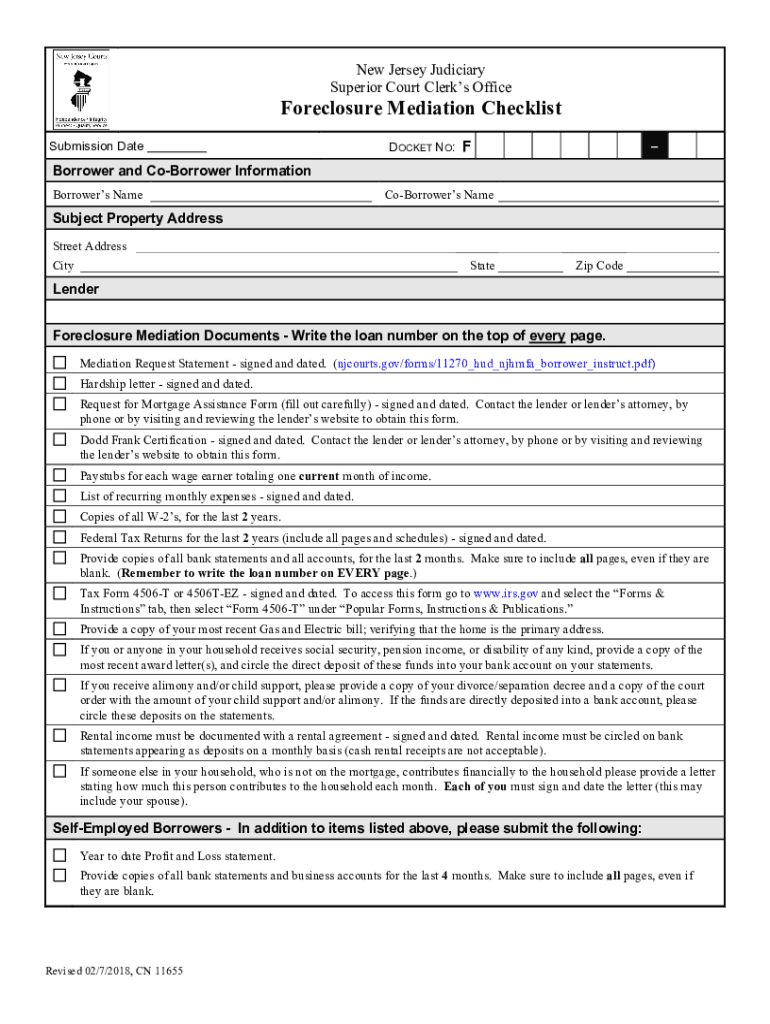

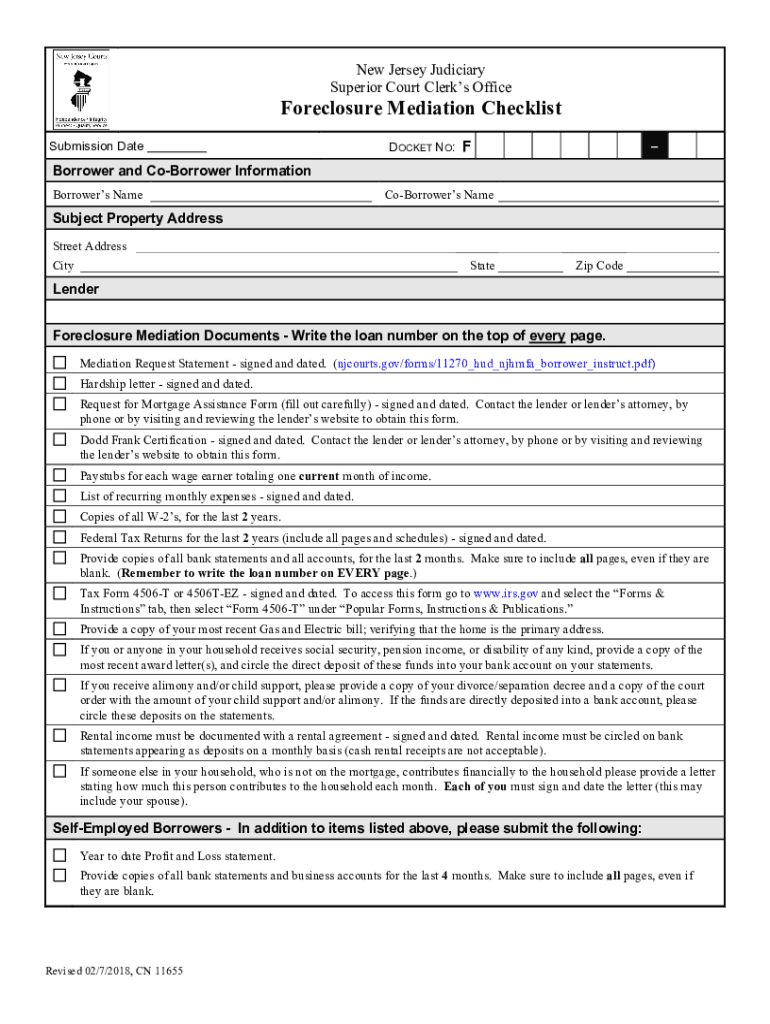

SavePrintClearNew Jersey Judiciary Superior Court Clerks OfficeForeclosure Mediation Checklist Submission DatesDOCKET NO:Borrower and Borrower Information Borrowers NameCoBorrowers NameSubject Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paystubs for each wage

Edit your paystubs for each wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paystubs for each wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paystubs for each wage online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit paystubs for each wage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paystubs for each wage

How to fill out paystubs for each wage

01

To fill out paystubs for each wage, follow these steps:

02

Gather the necessary information: You will need the employee's full name, address, and Social Security number. You will also need the employer's information, including the company name, address, and Employer Identification Number (EIN).

03

Record the pay period: Enter the start and end dates of the pay period for which you are generating the paystub.

04

Calculate gross wages: Determine the total amount the employee earned before any deductions or taxes.

05

Deduct withholdings: Subtract any deductions or taxes from the gross wages to calculate the net pay. Typical deductions include federal taxes, state taxes, Social Security, Medicare, and any voluntary deductions like retirement contributions or health insurance premiums.

06

Break down earnings: Provide a breakdown of the employee's earnings, including regular wages, overtime wages (if applicable), and any other forms of compensation such as bonuses or commissions.

07

Document hours worked: If the employee is paid hourly, include the number of hours worked during the pay period.

08

Include additional information: Consider including other relevant information on the paystub, such as the employee's job title, department, or any special notes.

09

Provide a YTD summary: Show a year-to-date summary of the employee's earnings and deductions to provide an overview of their financial history with the company.

10

Review and certify: Double-check all the information on the paystub for accuracy and ensure it adheres to legal requirements. Once verified, certify the paystub by signing and dating it.

11

Distribute the paystub: Give the paystub to the employee and keep a copy for your records.

12

Remember to consult with legal or accounting professionals to ensure compliance with local regulations and labor laws.

Who needs paystubs for each wage?

01

Paystubs for each wage are needed by multiple parties, including:

02

- Employees: Paystubs provide employees with detailed information about their earnings, deductions, and taxes. They serve as proof of income and are often required for various purposes like applying for loans, renting apartments, or filing taxes.

03

- Employers: Employers need paystubs to maintain proper records and comply with legal obligations. Paystubs help track employee payments, withholdings, and deductions, ensuring transparency and accuracy in payroll processes.

04

- Government Agencies: Government agencies may require paystubs as part of compliance audits or to verify income for benefits programs.

05

- Financial Institutions: Banks, lenders, and financial institutions often request paystubs when evaluating loan applications or assessing an individual's eligibility for credit.

06

- Landlords: Landlords may ask for paystubs to verify an applicant's income and ensure they can afford the rent.

07

- Tax Authorities: Paystubs play a role in verifying income reported on tax returns, and tax authorities may request them during tax audits or investigations.

08

It is important to provide accurate and complete paystubs to fulfill these various needs and ensure transparency in financial matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in paystubs for each wage?

With pdfFiller, it's easy to make changes. Open your paystubs for each wage in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit paystubs for each wage in Chrome?

Install the pdfFiller Google Chrome Extension to edit paystubs for each wage and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How can I fill out paystubs for each wage on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your paystubs for each wage. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is paystubs for each wage?

Paystubs for each wage are detailed documents provided by employers to employees which show the breakdown of earnings for a specific pay period.

Who is required to file paystubs for each wage?

Employers are required by law to provide paystubs for each wage to their employees.

How to fill out paystubs for each wage?

Paystubs for each wage can be filled out by including information such as the employee's name, pay period dates, hours worked, hourly rate, deductions, and net pay.

What is the purpose of paystubs for each wage?

The purpose of paystubs for each wage is to provide transparency and documentation of the employee's earnings and deductions for each pay period.

What information must be reported on paystubs for each wage?

Paystubs for each wage must report the employee's gross earnings, deductions for taxes, benefits, and any other withholdings, as well as the net pay.

Fill out your paystubs for each wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paystubs For Each Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.