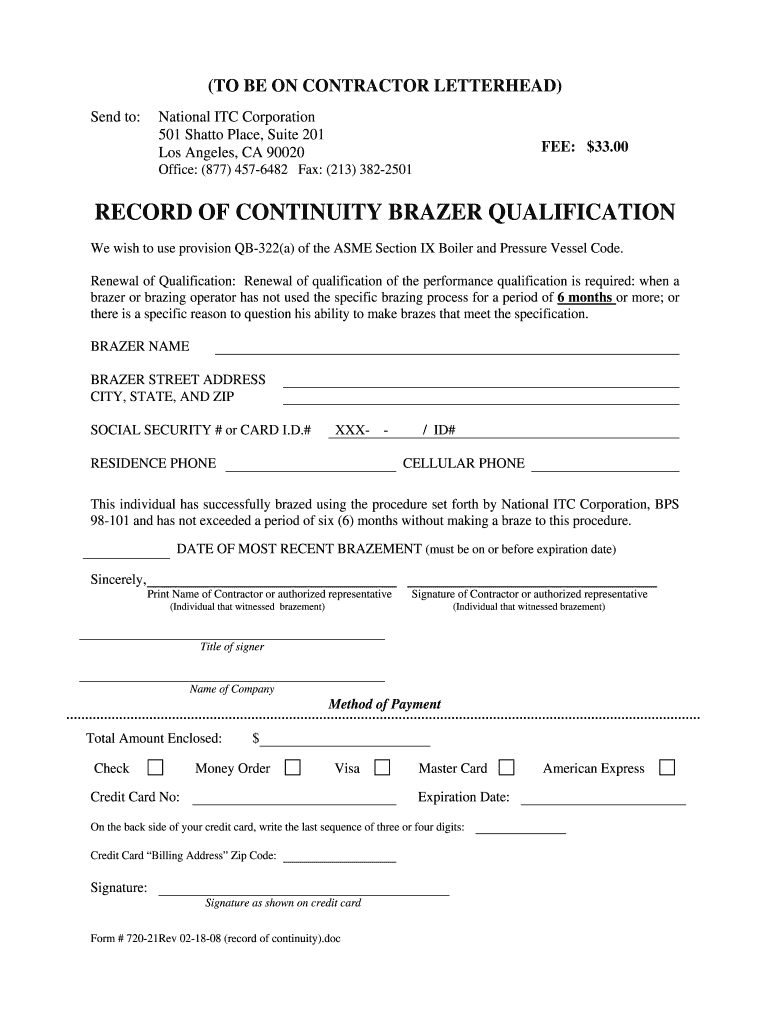

CA Form 720-21 2008 free printable template

Get, Create, Make and Sign CA Form 720-21

Editing CA Form 720-21 online

Uncompromising security for your PDF editing and eSignature needs

CA Form 720-21 Form Versions

How to fill out CA Form 720-21

How to fill out CA Form 720-21

Who needs CA Form 720-21?

Instructions and Help about CA Form 720-21

Welcome friends let us understand the procedure for filling the examination form for the CPT online on the ISIS website first you should log into the IC as we have said with the respecting URL by typing it in your web browser it is www.hyken.com I go to that particular website if in case you don't reach it directly can search it on Google and reach up to that website now I am done this particular website before you proceed ahead you should have your WHO number, but that is registration number with you number two you should have date of birth with you number three you should have the tenth passing percentage or not twelfth passing percentage and number four you should have a rule number four 1200 examination in which you appeared recently, or you might have passed it whatever the case maybe I need to create a new user first, and then I can go on to fill up the examination from, so first I click on this particular new user you can say to below the login there is a new user, so I click on the new user it asks me for examination I go for the CPD it asks me the registration number which I will enter now to the keyboard, so that's the registration number that gets entered then you enter the data birth through the calendar box that is available on the website so in this particular case it is 23rd of June 1994, so I scored it down, and I select 23rd of June 1994 in case the student is already registered with the ICA it shows a green validation mark and the name of the student is displayed on the right side of the date of birth that is Irish Sanjay user in this particular case in case you are not registered it will not be reflected on is a will ask you to proceed with the provisional registration those students who are not registered to register number so far they can proceed with the provisional registration option available on the website this video is about the student who is already registered you provide the email in this case I am providing my email ID, so I type the email ID Abhishek at the rate z2 PAP l dot in again I enter the email ID secondary mail you may give it you may not give it, so I am giving it just for the reference this email ID will be used for sending the password let me enter the mobile number now this mobile number should be your own mobile number, but it should be preferably not registered in the DND because you may not receive the SMS in that particular case if it is registered in the DND please that is done not disturb don't give that particular number let me give my number, and then you click on I do confirm that derails are correct, and you submit this particular information once you submit then SMS will be sent to you by email or by way of an SMS once you receive the SMS you will have the password with you and once you have that particular password you click on registered successfully click here to login, so I click here to login please understand very importantly at the same point of time you should not have the two...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA Form 720-21 directly from Gmail?

How do I edit CA Form 720-21 online?

Can I create an electronic signature for signing my CA Form 720-21 in Gmail?

What is CA Form 720-21?

Who is required to file CA Form 720-21?

How to fill out CA Form 720-21?

What is the purpose of CA Form 720-21?

What information must be reported on CA Form 720-21?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.