Get the free FBDC SBA 504 LOAN DEFERMENT REQUEST

Show details

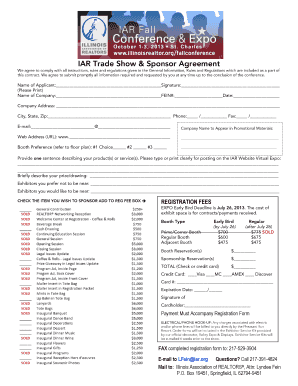

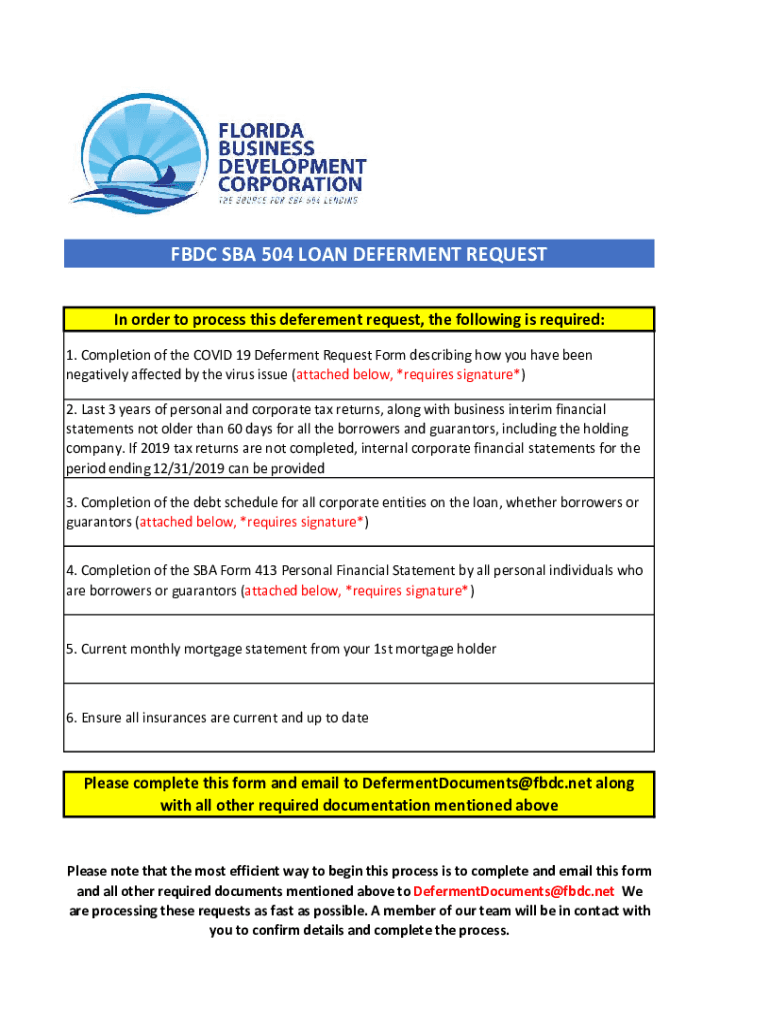

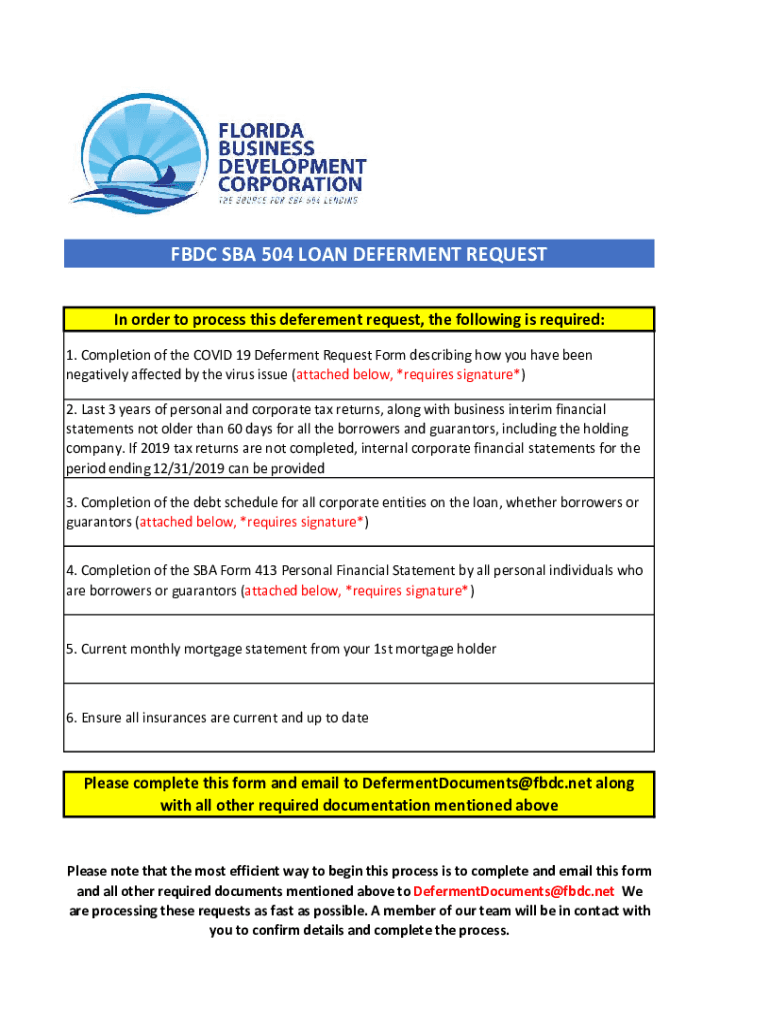

FBDCSBA504LOANDEFERMENTREQUEST Inordertoprocessthisdeferementrequest, thefollowingisrequired: 1. CompletionoftheCOVID19DefermentRequestFormdescribinghowyouhavebeen negativelyaffectedbythevirusissue(attached

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fbdc sba 504 loan

Edit your fbdc sba 504 loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fbdc sba 504 loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fbdc sba 504 loan online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fbdc sba 504 loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fbdc sba 504 loan

How to fill out fbdc sba 504 loan

01

Step 1: Gather all the necessary documents required for the FBDC SBA 504 loan application.

02

Step 2: Complete the loan application form by filling in the required details such as personal and business information.

03

Step 3: Provide financial statements, tax returns, and other financial documents to support your loan application.

04

Step 4: Prepare a detailed business plan outlining the purpose of the loan, the proposed use of funds, and the projected financials.

05

Step 5: Submit the completed application along with all the supporting documents to the FBDC SBA 504 loan department.

06

Step 6: Wait for the loan approval decision from FBDC. This process may take some time as the application undergoes a thorough review.

07

Step 7: Once the loan is approved, carefully review the terms and conditions of the loan agreement and sign the necessary documents.

08

Step 8: Follow any additional instructions provided by FBDC, such as attending loan closing meetings or providing additional documentation if requested.

09

Step 9: Start using the funds for the approved purpose and make payments according to the loan repayment schedule.

10

Step 10: Keep track of your loan payments, stay in touch with FBDC for any inquiries or assistance needed, and fulfill all obligations as per the loan agreement.

Who needs fbdc sba 504 loan?

01

Small business owners looking to fund long-term fixed assets, such as purchasing commercial real estate, acquiring heavy machinery or equipment, or making building improvements.

02

Entrepreneurs who want to expand their existing business operations and need capital for growth and development.

03

Startups or established businesses unable to secure traditional bank loans due to limited collateral or credit history.

04

Businesses seeking lower down payments and long-term fixed-rate financing options compared to conventional loans.

05

Companies in industries like manufacturing, wholesale, retail, accommodation, and food services that qualify for FBDC SBA 504 loan program guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fbdc sba 504 loan directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your fbdc sba 504 loan and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the fbdc sba 504 loan in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit fbdc sba 504 loan on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fbdc sba 504 loan, you can start right away.

What is fbdc sba 504 loan?

FBDC SBA 504 loan is a type of small business loan provided by the U.S. Small Business Administration to help small businesses purchase real estate or equipment.

Who is required to file fbdc sba 504 loan?

Small businesses looking to finance the purchase of fixed assets such as real estate or equipment are required to file for an FBDC SBA 504 loan.

How to fill out fbdc sba 504 loan?

To fill out an FBDC SBA 504 loan, small businesses must provide detailed information about the purpose of the loan, the business assets being financed, and the financial health of the business.

What is the purpose of fbdc sba 504 loan?

The purpose of an FBDC SBA 504 loan is to provide small businesses with long-term, fixed-rate financing for the acquisition of fixed assets such as real estate or equipment.

What information must be reported on fbdc sba 504 loan?

Information such as the purpose of the loan, the cost of the fixed assets being financed, the financial statements of the business, and the business owner's personal information must be reported on an FBDC SBA 504 loan.

Fill out your fbdc sba 504 loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fbdc Sba 504 Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.