Get the free BUSINESS CREDIT APPLICATION - 2

Show details

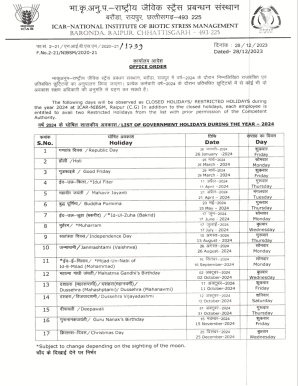

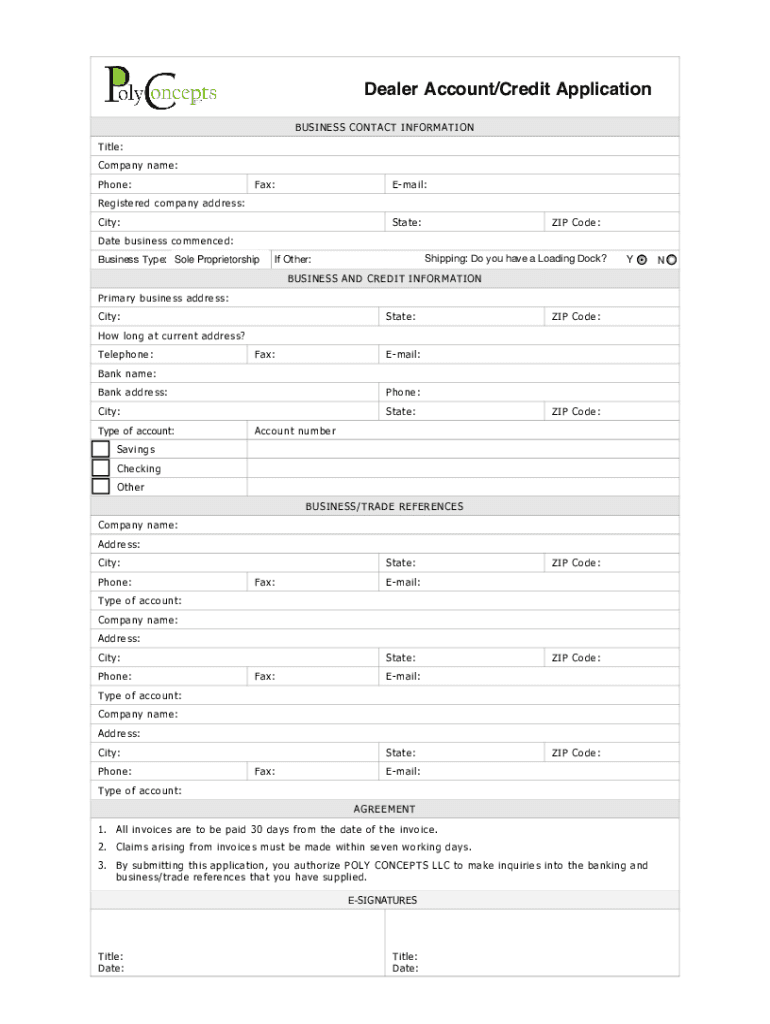

Dealer Account/Credit Application BUSINESS CONTACT INFORMATION Title: Company name: Phone:Fax:Email:Registered company address: City:State:ZIP Code:Date business commenced: Business Type: Sole ProprietorshipShipping:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business credit application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to fill out business credit application

01

To fill out a business credit application, follow these steps:

02

Gather all the necessary information and documentation needed for the application such as your business name, address, contact information, tax ID number, financial statements, and bank statements.

03

Research and choose the financial institution or lender where you want to submit your application.

04

Obtain a copy of the credit application form from the chosen financial institution or lender.

05

Read the instructions and requirements carefully before filling out the form.

06

Begin by entering your business information accurately, including your business name, address, and contact information.

07

Provide your tax ID number and other identifying information as required.

08

Complete the financial section of the application, including information about your business's annual revenue, assets, debts, and business banking details.

09

Attach the required financial statements and bank statements as specified by the lender.

10

Review the completed application form thoroughly for any errors or missing information.

11

Submit the application form to the financial institution or lender either through online submission or in person.

12

Keep a copy of the filled-out application for your records.

13

Wait for the financial institution or lender to review your application and provide a decision.

14

Follow up with the lender if necessary and provide any additional information or documentation requested.

15

Once approved, carefully review the terms and conditions of the business credit agreement before accepting or signing it.

16

Congratulations! You have successfully filled out a business credit application.

Who needs business credit application?

01

Business credit applications are needed by:

02

- Small business owners who want to establish a credit profile for their company.

03

- Business owners who wish to apply for a business loan or financing.

04

- Businesses that need to access trade credit from suppliers or vendors.

05

- Companies seeking business credit cards or lines of credit.

06

- Entrepreneurs starting a new business and requiring funding or credit support.

07

- Organizations looking to build a positive credit history for their business.

08

- Companies wanting to separate personal and business finances and establish credibility.

09

- Enterprises that want to qualify for favorable interest rates and better borrowing terms.

10

- Businesses that want to improve their cash flow management and payment flexibility.

11

- Any individual or entity aiming to establish a strong business credit profile.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business credit application?

The editing procedure is simple with pdfFiller. Open your business credit application in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the business credit application in Gmail?

Create your eSignature using pdfFiller and then eSign your business credit application immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out business credit application on an Android device?

Use the pdfFiller app for Android to finish your business credit application. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is business credit application?

A business credit application is a formal request made by a business to a lender or financial institution to establish credit or obtain a loan. It typically requires the business to provide detailed financial information and relevant documentation.

Who is required to file business credit application?

Businesses that seek to obtain credit or financing from lenders, suppliers, or vendors are typically required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, you generally need to provide information such as your business name, address, type of business entity, tax identification number, revenue, years in business, and references. It's important to ensure that all information is accurate and complete.

What is the purpose of business credit application?

The purpose of a business credit application is to assess the creditworthiness of a business and to determine whether to extend credit or financing. It helps lenders evaluate the risk associated with lending to that business.

What information must be reported on business credit application?

Typically, a business credit application must report information such as company name, address, tax ID number, business structure, financial statements, bank references, trade references, and an overview of the business's operational history.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.