Get the free T From Income Tax anization Exem Return of Or p g - Foundation bb

Show details

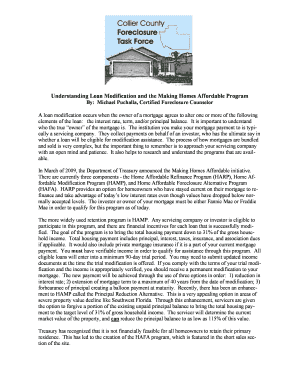

20070& 08/ 16/2010 For the 2008 calendar ear or tax y ear Bell inning B Check d applicable pie see u Amended return D Employer identification number E Telephone number 010515357 Number and street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t from income tax

Edit your t from income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t from income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t from income tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t from income tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t from income tax

How to fill out t from income tax?

01

Gather all necessary documents: Before starting to fill out the t form from income tax, make sure you have all the required documents at hand. These may include your W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial records.

02

Understand the form instructions: Familiarize yourself with the instructions provided with the t form. This will help you understand the purpose and proper completion of each section. The instructions will guide you through the process and provide clarity on any questions you may have.

03

Provide personal information: Begin by filling out your personal information accurately in the designated boxes of the t form. This usually includes your name, Social Security number, address, and filing status.

04

Report income: Move on to reporting your income on the t form. This is typically done by entering the relevant figures from your W-2 and 1099 forms into the appropriate sections on the form. Ensure that you report all income sources accurately and categorize them correctly.

05

Deductions and credits: Determine if you are eligible for any deductions or credits and include them in the appropriate sections of the t form. Examples of deductions may include student loan interest, mortgage interest, or medical expenses. Tax credits, on the other hand, can help reduce your tax liability directly.

06

Calculate tax liability: Use the provided instructions or consult a tax professional to help you calculate your tax liability accurately. This will involve applying the appropriate tax rates to your reported income and factoring in any deductions or credits you may have claimed.

07

Fill out payment or refund details: Depending on the result of your tax calculation, you will either owe taxes or be entitled to a refund. Fill out the payment or refund details on the t form accordingly. If you owe taxes, include your payment method and the amount you are paying. If you expect a refund, provide your bank account information for direct deposit.

Who needs t from income tax?

01

Individuals: Any individual who earns income throughout the year and meets the filing requirements set by the tax authorities will need to fill out a t form from income tax. This includes employees, self-employed individuals, and those with various sources of income.

02

Sole proprietors: If you run a business as a sole proprietor, you are required to report your business income and expenses on the t form. This ensures accurate assessment of your tax liability based on your business activities.

03

Investors and recipients of other income: Investors earning dividends, interest, or capital gains, as well as individuals receiving other forms of income such as rental income or royalties, are required to report and pay taxes on these earnings. Filling out the t form is necessary for them to comply with tax regulations.

Note: The exact eligibility criteria for filing a t form may vary based on jurisdiction and specific tax laws. It is always advisable to consult the tax authorities or a tax professional to determine your individual filing requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is t from income tax?

T from income tax refers to the form that taxpayers use to report their income and calculate the amount of tax they owe.

Who is required to file t from income tax?

Individuals and businesses with taxable income are required to file t from income tax.

How to fill out t from income tax?

To fill out t from income tax, taxpayers need to gather their income information, deductions, and credits, and enter them on the form accurately.

What is the purpose of t from income tax?

The purpose of t from income tax is to accurately report income and calculate the amount of tax owed to the government.

What information must be reported on t from income tax?

Income, deductions, credits, and tax owed must be reported on t from income tax.

How do I edit t from income tax online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your t from income tax to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the t from income tax electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your t from income tax in minutes.

How do I fill out t from income tax on an Android device?

Use the pdfFiller app for Android to finish your t from income tax. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your t from income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T From Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.